01 Mar ’24 — Nifty beats the double-top & goes GREEN — Nifty & BankNifty PostMortem Analysis

Nifty Analysis — Stance Bullish ⬆️

Was the Nifty’s price action predictable in the last 2 days? What do you think after reading our post-mortem reports? Yesterday we had a rally from the support 21913 to the resistance 22051. And today we briefly touched 22051 support and then surged upwards. Today’s price action was 100% Bull dominated — we did not even have a retracement. Nifty ended the day with a gain of 355 points ~ 1.62%. The odd man out today was NiftyIT, which did not want to participate in the rally and instead went the other way. It ended the day with a loss of 204 points.

BankNifty played a pivotal role today in helping Nifty50 take out its ATH, it is official — the new highs are 22353.3. And we may also have followthrough momentum tomorrow during the special trading session.

On the higher time frame chart, 2 things happened today. Firstly, we broke past the 22051 support/resistance zone which meant we did not have any more resistance. Secondly, N50 went above the double-top pattern — negating that, so from the next day’s report it will get removed. Our stance is now bullish and agrees with what we had in mind yesterday. We were just waiting for the double-top pattern to be negated.

BankNifty Analysis — Stance Neutral ➡️

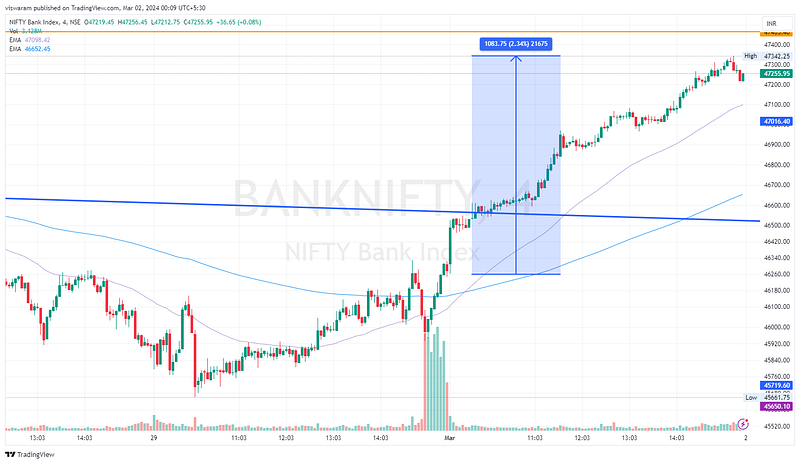

BankNifty also gets a stance change today i.e. from bearish to neutral. All that is pending is to take out the 47465 resistance to go bullish. Most likely that should happen tomorrow and we are eagerly waiting to trade on another Saturday. BN closed the day with a gain of 1166 points ~ 2.53%. But unlike Nifty, BN is not near its ATH. We have some more distance to cover.

Look at the number of green candles in the higher time frame. 11 consecutive 63mts candles i.e. 693 hours of unchecked bull run. We are very sure if the same had happened yesterday — a lot of option traders would have tripled their capital. Expiries usually attract hero-zero traders and most of them prefer to load on BankNifty CEs and PEs. BN is safely out of the bearish channel and that is why the stance has been revised from bearish to neutral.

Algo Trading

Our algo trades ended today with a loss of Rs39177. It was on the expected lines as the algo is based on option selling and for strong directional move days like today — it will run into deep cuts. In a way, we are happy that the loss was not 63891.

Intraday Algos run via AlgoTest on Kotak

Webhooks automation run via TradingView on Dhan