02 Aug ’23 Post Mortem on Nifty & BankNifty + Start of a new TREND today

Nifty Analysis

Maybe it was the news that Fitch cut the US rating from AAA to AA+ (news report here) that sparked the reversals in Asian markets. Our market too started to fall but had a decent recovery in the last 1 hr (just as usual).

The global markets were staying at elevated levels for quite some time now. Our market is at the APEX with the outperformance unchecked. Even with such a strong news flow — the downward impact was not that much, but we did take out some important levels which shows the down-ward rally may be just starting.

Nifty opened gap down and then fell till 11.35 with no signs of slowing down or pull back. We lost 218pts ~ 1.1% in the process which I think is the greatest loss in a 2hr window in recent times.

From 11.35 to 12.45 we traded sideways before the 2nd leg of fall started, we fell 132pts ~ 0.68% in leg2

And just as usual we had a dip-buying or maybe a profit taking from the shorts in the last 1hr, where we recovered 90pts ~ 0.47%. The total fall was just 1.05% ~ 207pts which is in no measure a major impact.

In yesterday’s report we mentioned a bias shift to neutral from bullish. When the main support level got taken out, it made sense to go short. And then in round2 the next pivot level was taken out which prompted another round of selling. The failure to take out the 19400 level and a 90pts pullback did take out some confidence of mine.

India VIX although went up 10% today, staying at 11% does not show any fear. For mass participation we need a strong rising VIX above 16 within the next week. Nifty has made a triple top on a descending channel — till the channel holds the bias is now changed to bearish!

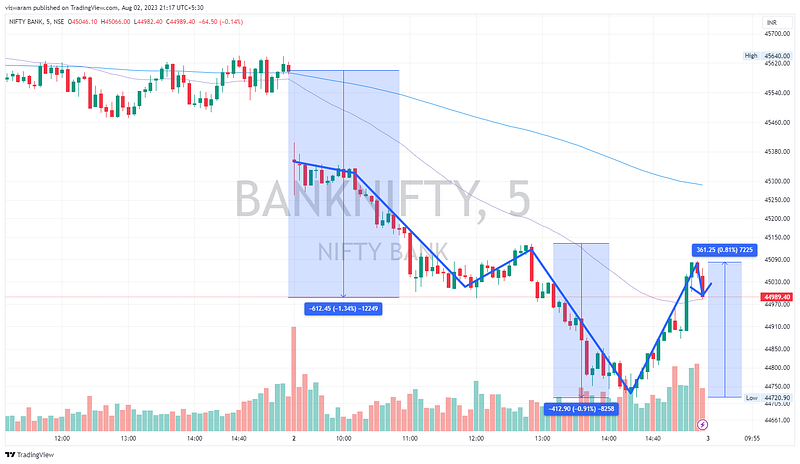

BankNifty Analysis

From yesterday we were bearish, so the moves in the forenoon session gave us some validation. But it was nothing like Nifty, the cuts in banknifty were not aggressive even though we lost similar points. The options flow was not indicating that deep a fall till afternoon — the premiums on nifty was far superior than banknifty (which has been unusual lately). Sometimes cannot really differentiate which has a higher beta — nifty or banknifty.

Banknifty fell 612pts by 12.00, then 412pts between 12.50 to 14.20 and the final recovery of 361pts in the last hour ensured the final loss was only 1.31% ~ 596pts which is not bad at all. If we stay like this, then banknifty will have to take leadership in the bearish trend. Since it has a 38% weightage — the institutions may target the financial sector to drive down the prices on Nifty too.

The 2 horizontal lines is a safe zone for banknifty, a strong break of 44598 will give bears total control and the double top would have given some bulls to take a breather. We will continue to have a bearish bias till proven wrong.

https://amzn.to/43Rhrqthttps://amzn.to/43Rhrqthttps://amzn.to/43Rhrqt