05 Sep ’23 Post Mortem on Nifty & BankNifty | Momentum not enough for break out + FinNifty Expiry

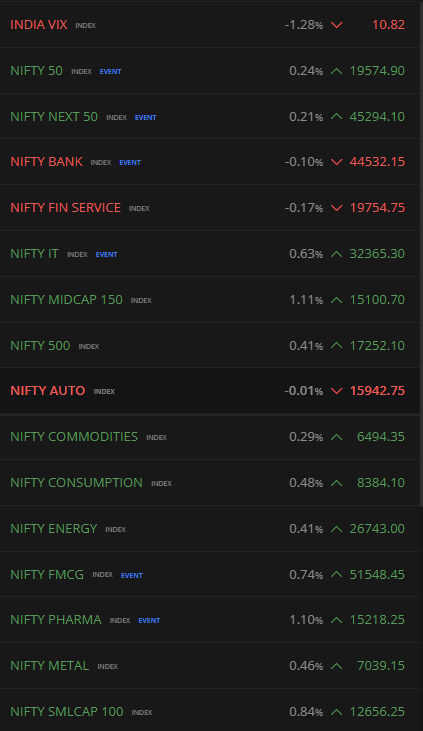

Nifty Analysis

Recap from yesterday: I wish to go with a full bullish stance tomorrow wherein 19584 has to be taken out in the first 2 hours and the final close should be above 19600. Although the price action looked as a continuation from yesterday — it did not have enough firepower to break the recent swing high of 19584 nor cross the 19600 threshold.

NiftyIT again provided good support to Nifty today along with Pharma, FMCG and Energy. Positionally Nifty50 is in good shape to go higher, but for that this momentum wont be enough. During a strong uptrend, all the sub sectors also have to be in green.

On the 1hr TF, Nifty has made a W pattern which indicates bullishness. As long as the 19450 level is intact this pattern will remain bullish. The moment Nifty breaks 19450 and goes near 19310 the W pattern will change shape and become like an M pattern.

We also would like to wait and watch how the first banknifty expiry on wednesdays will impact the trajectory. For tomorrow I continue to maintain the bullish stance unless 19450 is broken.

If you are enjoying this free content, consider subscribing to my free newsletter — click here

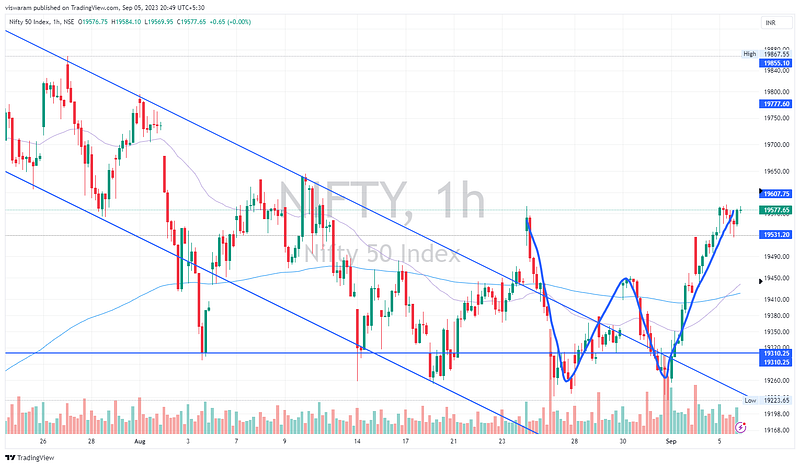

BankNifty Analysis

Although having all the conditions in its favor, BankNifty did not rally today. The 5mts candle at 10.15 which took out 115pts was trying to tell a story. In fact we dropped a total of 267pts from the high to the low of the day.

From the lows BN managed to climb back 140+ points but I am still unable to decode the directional intent. That is mainly because on the 1hr TF, Banknifty has almost made a triple top kind of pattern on a descending line. I wish to maintain my neutral stance for tomorrow and wish to go bullish if 44900 is getting taken out tomorrow.

If we drop to 44068 levels, I would prefer to wear the bearish shorts again.

· Free charts made with ❤️ on TradingView

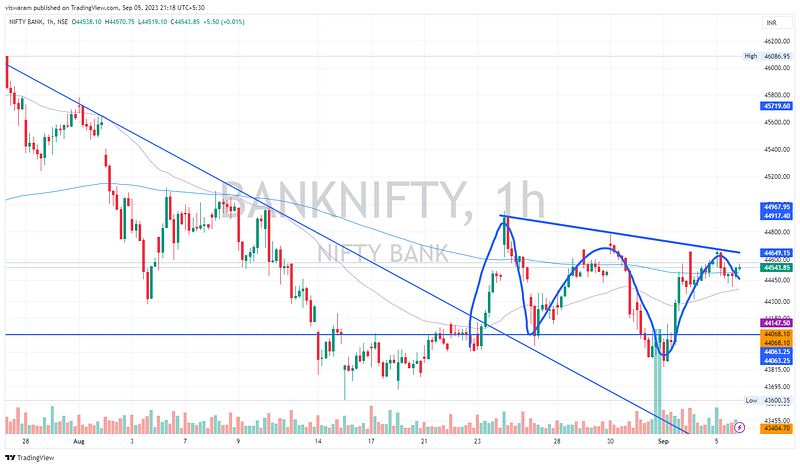

FinNifty Weekly Expiry Analysis

Between the last expiry and today, Finnifty has only fallen 0.21% ~ 41pts. From a headline level the fall of 1.83% ~ 365 pts and its recovery is not obvious. Moreover FinNifty has respected the support level of 19421 and is trading at a safe distance from it.

As it stands Finnifty is not showing any directional sentiment, this was the reason the options premium were very less today. In fact Nifty50 and BankNifty far OTM options had good juice today, I am assuming it would be because the liquidity was sucked out by the FinNifty expiry traders.