07 Sep ’23 Post Mortem on Nifty & BankNifty | Super rally in last 90 mts

Nifty Weekly Analysis

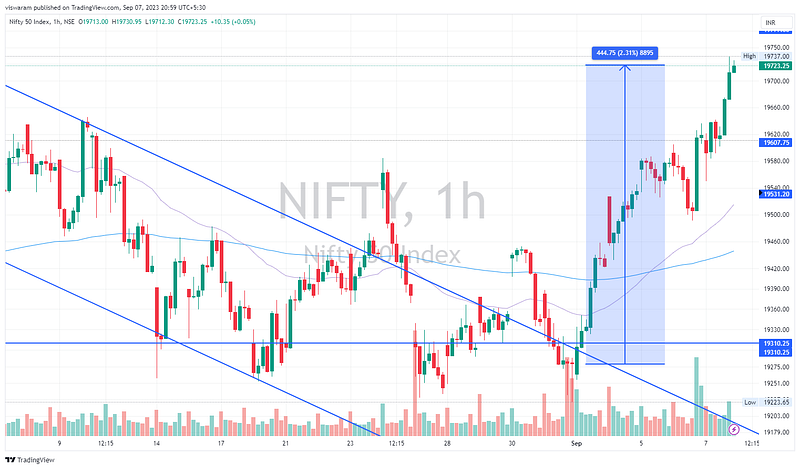

You may not believe that Nifty has added 444pts ~ 2.31% between the last expiry and today. The bulk of the moves came on 1st Sep and then today.

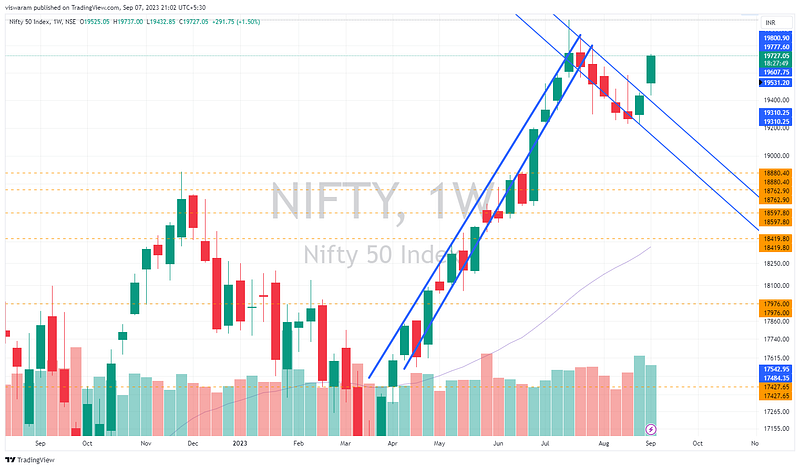

On the weekly timeframe Nifty just broke out from the bullish flag consolidation formation signaling further fire power ahead. Will the global markets play spoilsport is the only question here.

Nifty Today Analysis

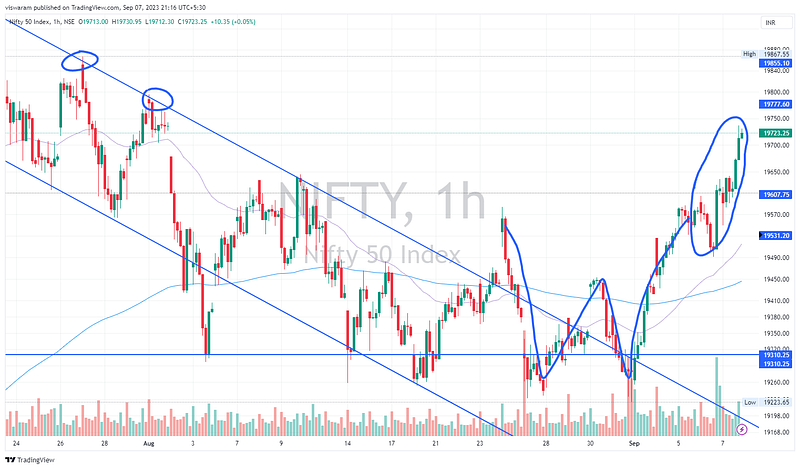

It was not a surprise that when I posted the bullish view on tradingview minds this morning, I got a -4 downvote. Almost all the analysts were looking for bearish opportunities on Nifty and BankNifty and the opening moves would have given the illusion of downfall. We fell 71pts ~ 0.36% by 09.35 enough for most to go short and that too on expiry day.

What happened after that was a reclamation of 19600 levels by Nifty, we even hit a new swing high of 19642 at 11.15. And honestly I thought thats it — we will consolidate sideways and end the day around those levels.

I was totally surprised when Nifty rallied 144pts ~ 0.74% between 11.40 to 14.35. In fact I had 2 bullish CE long positions that I exited prematurely at a small profit. If I knew Nifty had more firepower to take out the 19700 today — I would have hung on to it & made a fortune 🙂

From a weekly expiry standpoint — the options premium near ATM and far OTM were real pathetic. Something that I realized today is that when we had BankNifty & Nifty expiring together — we could jump in and out on strikes that gave max bang for bucks. Since BN is now set to expire on Wednesdays, there are no more arbitrage opportunities. If the conditions like today persist in the foreseeable future — then option selling wont be able to attract a fresh crowd.

On the 1hr TF the W pattern worked out quite good. The next 2 resistance points will be 19786 and 19852 if we are continuing the breakout rally. If we were to fall the first support will be the resistance we just broke i.e. 19678 followed by 19581. For tomorrow I wish to continue my bullish stance unless the first support of 19678 is taken out in the first 2 hours.

If you are enjoying this free content, consider subscribing to my free newsletter — click here

BankNifty Analysis

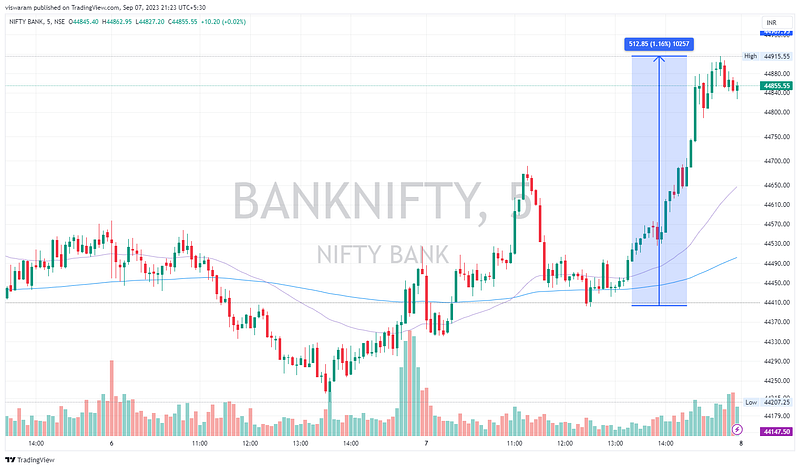

The real reason Nifty50 outperformed in the last 90 minutes was BankNifty. Even NiftyIT contributed, but since the weightage of banking stocks are higher — that made a real difference. BN rallied an impressive 512pts ~ 1.16% from the lows to the highs today.

You might remember the 1hr chart we discussed yesterday, as long as banknifty was staying beneath it — the sentiment would have been bearish. And the moment it broke-out from that trap — it got additional wings.

The reason 14.15 candle went up 221pts could be because of that. It is like the whistle from the pressure cooker — when the steam builds up ample pressure, it lifts the whistle and oozes out. The next resistance points are at 45353, 45727 & 46069. We will get to know tomorrow if the build of steam is good enough to cruise through. I wish to change my stance from neutral to bullish for tomorrow.