08 Aug ’23 Post Mortem on Nifty & BankNifty | FinNifty Weekly Expiry Special

FinNifty Weekly Analysis

Between the last expiry and today, CNXFINANCE has fallen 219pts ~ 1.08%. The majority of the fall came on 02 and 03 Aug after which we have seen a recovery of 1.9% from the lows.

FinNifty Today Analysis

If you look at today’s 5mts chart, it was a steady upward moving market with a healthy pullback. Even when the index was falling from 10.55 to 11.30 — there was no visible threat in the short term upward bias. Shortly after this fall we had a rally of 104 pts to hit an intraday high of 20120 by 14.25.

The short term stance continues to be neutral with a slight bullish bias because we just cut through a bearish trend line.

Nifty Analysis

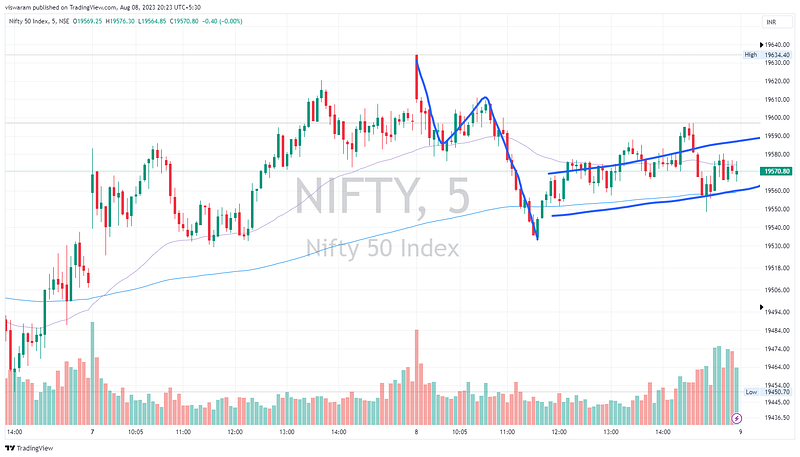

Nifty made an interesting opening 2 hour price action today. With a good gap up opening and then a strong rejection at 19640 levels to hit an intraday low of 19533 by 11.35. The selling pressure was strong, but the financial sector did not lend support. NiftyIT was falling — but that got arrested and hence the reversal post 11.35.

Currently we have a situation where Nifty50 did not break through the descending trend line. I had revised my bias from neutral to bullish yesterday with the assumption that we will have a breakout today.

Instead what has formed currently is more or less like a bearish trend continuation pattern if Nifty does not cut through 19680 by tomorrow. My personal conviction is 60% neutral and 40% bearish tomorrow. Few sectors like Nifty Metal, Nifty Energy, Nifty FMCG, Nifty Commodities, Nifty Auto, Nifty Consumption were in red today which is building a case for a bearish event. Guess it’s safe to monitor the trades tomorrow and update if we have a change in stance.

BankNifty Analysis

The major reason Nifty50 stayed strong without falling much is banknifty. It did show an attempt to break free from the bearish trend, the opening rush of 279pts till 10.40 is proof for that. From there was loss of steam and a pull back of 204pts. Once this inverted V shape was completed — there was lack of direction or momentum. Options data also indicated a non-directional trend post 11.30.

The change in stance from bearish to neutral worked well for banknifty today. We have marginally closed above the trendline. But for a bullish breakout we need to take back the 45400–45600 levels soon — I am not sure if there is enough momentum for that right now.

If the trades taken on Finnifty today were positional in nature due to expiry, we may have an unwinding tomorrow. This could also pull back banknifty back to the bearish zone — so currently the best idea would be to wait for tomorrow’s price action.