08 Sep ’23 Post Mortem on Nifty & BankNifty | The real cause for the rally — discontinuation of…

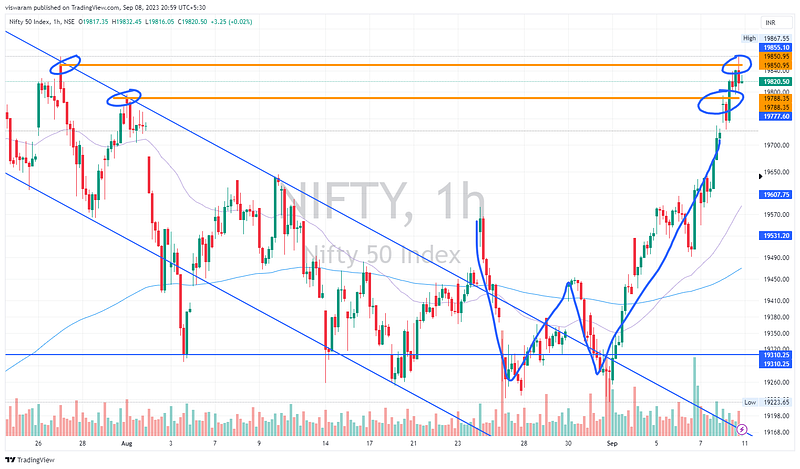

Nifty Analysis

Let the chart not deceive you, we really went up 142pts ~ 0.72% from the low to the high and today’s low was still above yesterday’s close. Since the chart was set to “Auto” resolution on “Log” scale — the up move may not look that much.

What an impressive rally today, I assume most of the analysts would have switched their bias to the long side after yesterday’s show. Today’s outperformance was quite predictable still the near ATM call options had a humongous price swing. Option premiums usually rise when the uncertainty goes up — and seeing the rally today the price jumps in 20100, 20200, 20300 & 20500 were more than unusual. 20100 CE which closed for 5.45 yesterday opened at 6.5 and rallied upto 13.5 ~ 248% before closing at 9.35.

We took out the first resistance point by 11.15 today and touched the 2nd resistance point by 14.15 to only close lower. The 2 resistance points are highlighted in orange horizontal lines.

I was feeling quite carried away that the technical analysis was working exactly as in the script. Nifty falling in a bearish channel from 21st July and then breaking out from 1st Sep. Just today I realized the real reason behind this is the I-CRR news flow — read here. Remember the fall started when the RBI Governor announced the 10% increment in CRR in his last MPC address. Now there is news that 75% of it might be removed immediately. This was the reason the banks started rallying all of a sudden from 2pm on 6th Sep. Do you recollect the article I wrote about HDFCBK being the lone wolf fighting for banknifty?

Now you might have understood how a 41% weightage on BankNifty can make a lot of difference.

For Monday I wish to change the status from bullish to 50% bullish & 50% neutral — that’s because I would like to wait for this news flow to get priced in. The euphoria and FOMO alone should drive Nifty50 to new ATHs, however I do not wish to get into new bullish positions till then.

If you are enjoying this free content, consider subscribing to my free newsletter — click here

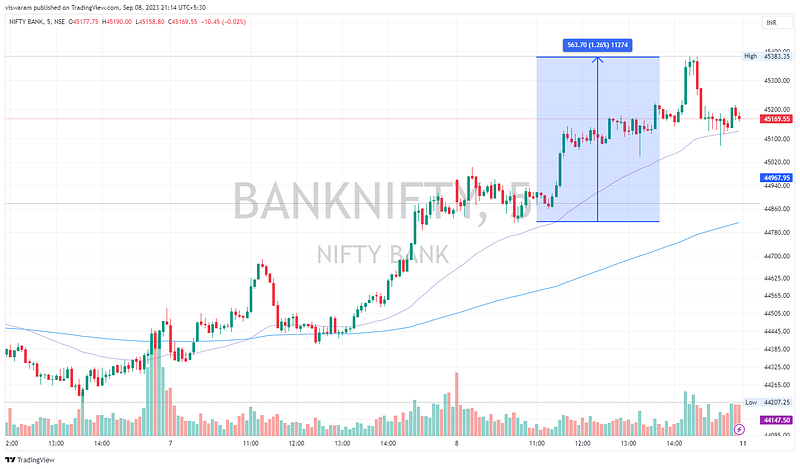

BankNifty Analysis

Banknifty was also continuing from the momentum it got from the last hours of 6th Sep. We had an intraday rally of 563pts ~ 1.26% to hit a new swing high of 45383. Again the bulk of the contribution came from HDFCBK.

The candles at 14.30 & 14.35 took out some steam or else the 45400 levels may have been breached today. Those 2 candles are the reason why I am a bit cautious for Monday — as I said in the Nifty analysis above, I need to wait and watch how the market reacts to the I-CRR partial withdrawal news.

The important levels have been highlighted in orange horizontal lines. 44967 is already taken out today, the next resistance is 45398 and then 45719. BankNifty has a bit more ground to gain with respect to Nifty to take out the ATHs. Any positive news on the I-CRR will give it more wings, whereas negative news might create a huge fall. Since we are dependent on fundamentals on Monday — it is best advised to stay out.

Technically I wish to maintain the bullish bias and hoping for a close between 45398 and 45719 on Monday.