09 Aug ’23 Post Mortem on Nifty & BankNifty | Technical Analysis Blown to Pieces Today !

Nifty Analysis

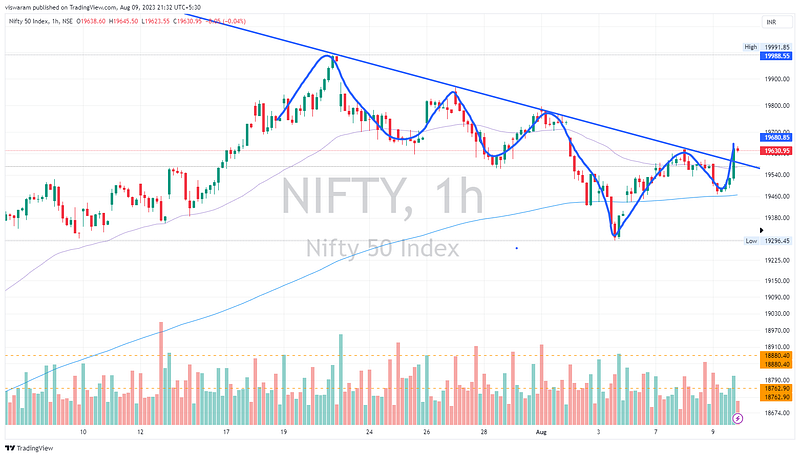

Yesterday we went with a 60% Neutral and 40% bearish stance for today. What happened from open till 13.15 — was in perfect harmony & as per the script. But the intraday rally of 177pts ~ 0.91% was totally shocking!

I was unprepared, unplanned and must say ran into losses today because of my bias. I should say with 100% honesty — my research failed me today. I had gone short once we broke the 19500 level — the rationale being Nifty is staying below the descending trend line. The short position held above water till the 19470 levels from where the reversals started hurting. Above 19590 even my neutral bias was taken for a ride. On the losses part — I dont feel that bad, because I have seen RED MTM before. But its been a while since my homework has proven me dead wrong.

Even now I am not entirely sure why we rallied like that, was it due to the RBI interest rate decision planned for tomorrow? (we will discuss in detail in the banknifty analysis section).

The 14.15 hourly candle that added 111pts ~ 0.57% has changed the game for Nifty. It ensured the final close is above the bearish trend line. The options premium of both PE and CE were abnormally low in spite of strong swing. This also limited my fire-fighting capabilities. For tomorrow I wish to stay neutral to start with, go long if 19700 levels are taken out and go short if we fall to 19550 levels.

BankNifty Analysis

Banknifty had a perfect W like pattern formed in the 5mts TF. Even though the rally from 13.50 to close was inspiring, it was not as fierce as on Nifty50. The fall of 441pts ~ 0.98% steals the limelight today.

Now was the 380+ pts reversal from the intraday low to close due to the RBI MPC outcome expectation tomorrow?

Some facts to consider.

- The vegetable, fruits, cereal, and rice prices right now are totally overheated. A middle class family of four will outrun their budget. Even a household income of Rs50000 will fall short. More pain if they have 2 school going kids or ageing parents who need medical attention.

- The sad thing is, even if RBI hikes the interest rate to control the inflation (which would have resurrected now) — it seldom goes into the control of Vegetable prices.

- RBI’s rate hike will only reduce liquidity to the formal sector. The guy who owns a super speciality air conditioned hypermarket that sells tomatoes = YES!. The guy on the roadside selling tomatoes = NO. The small farmer who harvests 20 bags of tomatoes = NO.

- I personally feel a hike of 25bps is overdue, mainly because fuel prices are rising and banks have reported decent quarter results — their balance sheet does not look that stressed out right now. Liquidity is not getting reduced that much and Inflation may hover around the upper band of 6% by the end of this festive season.

I guess the current product & service prices are unaffordable for the lower range of middle-class. The ultra poor get DBT, cash benefits and ration benefits from the Govt. — but the inflation hits them the most. I seriously think the poor people will opt-out from buying vegetables at these prices. The best solution they can pray for right now is a full blown depression.

On the hourly chart, banknifty has managed to stay out of the bearish territory in the 14.15 hourly candle. But the bears have not really lost control — a change in the status quo of RBI will tip the scale in their favor tomorrow. I am going with a 55% neutral and 45% bearish stance for tomorrow.

- Read my latest book “Expiry Day FireFighting Strategies on Nifty50: 4 commonly used option strategies on Nifty50 and expiry day firefighting techniques to limit the max losses + 2 bonus strategies” just for Rs99

- PS: The trades taken are no recommendation, blindly following them may cause more harm than good — read full disclaimer here

- Free charts made with ❤️ on TradingView