11th Nov ’23 — US CPI plays spoilsport — PostMortem on Nifty & BankNifty

Nifty Analysis

It indeed became pretty complicated today, we directly jumped from below the resistance point to well over the support point i.e. below 19446 to above 19562. The gap-up was almost 212pts ~ 1.09%, the reason — Lesser than expected US CPI (Inflation data). In fact, the US CPI was only 10 basis points below the expectation, but it gave a feeling of “no more rate hikes” by FED. SPX ended yesterday with a gain of 1.91% and for the first time, I regret having a holiday in between.

When there is news, technical analysis will go for a spin and if you have a holiday in between — it will be a tailspin. I had to change my stance from neutral to bullish in the opening minutes itself as it went above the resistance of 19562. Even though we had a tail in the opening 5mts candle, it ended up holding its ground. Nifty picked up some more strength as time passed by and we closed toward the high point of the day.

On the 1hr chart, the next target to break will be 19776 which is just 100pts away. Something that is easily possible if SPX holds its ground today. Since most of the market participants are long-only, any upsurge will sweep in more market participants. To change my stance back to neutral, Nifty has to fall below 19562 and stay down tomorrow.

BankNifty Weekly Expiry Analysis

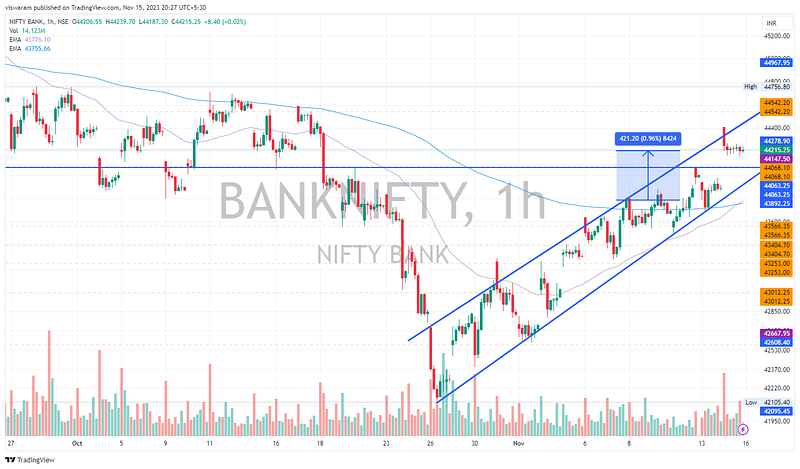

Between the last expiry and today, BankNifty has gone up by 421pts ~ 0.96%. Bulk of those gains came in from the gap-up today. The real good outcome in this week was to break out from the 44063 resistance level which was proving to be quite a nuisance for BN.

BankNifty Today Analysis

Dont get confused with the chart below, I will explain the sloping lines shortly. Notice the gap up of 519pts ~ 1.18% today took out the crucial resistance of 44063. A walk down the history will teach you how crucial was that. 44068 was the most important level in recent times and a breach means there is only 1 way to go — UP.

BankNifty after opening strongly started falling and it started to slow down only at 44200 levels. Of all the major sectors, BN proved to be the laggard in supporting Nifty50 today. NiftyIT on the other hand ended up with a whopping gain of 2.59%. All that is due to the SPX and Nasdaq closing yesterday.

And its time to explain the ascending channel that we started drawing from the last post-mortem. BankNifty has respected the channel — more proof visible after the 1st hourly candle today. If we consider the break out from the resistance level of 44063 along with the ascending channel — its a strong bullish signal for BankNifty. Today’s underperformance will get covered up soon as BN usually goes ahead of Nifty during strong trends. My next level comes up at 44542, support is at 44063.