11th Oct 2024 — Stance is still bearish even though we fell only 81pts + BankNifty Algos no longer…

Nifty Stance Bearish ️⬇️

On a week-to-week basis, Nifty only dropped 81 points, but the real reason I am still bearish is because the pullback we had on the 9th was not powerful enough to take out the last swing low.

You can also notice the 50 EMA crossing the 200 EMA from top to bottom. I am using a 63mts custom time frame, but this must be true even for the hourly TF.

All this happened even when the global markets were rallying. By the way, the US markets’ SPX hit new all-time highs. This shrug-off in our markets may have to do with the new SEBI FnO rules. As a surprise to many, the BankNifty weekly index is getting removed and we will have only one Monthly expiry from December 2024. Has this spooked the markets, I think so. We will discuss that in a while.

For the week of 14th to 18th Oct, I wish to start with a bearish stance and then go neutral if 25230 is taken out decisively.

BankNifty Stance Bearish ️⬇️

For the week of 7th to 11th October, BankNifty fell 382pts ~ -0.74%, the price action looked stable and sideways but the only reason I am bearish is because of the preceding week’s price action. If BN reverses and takes out 51713 decisively, I will change my stance to neutral next week.

Two major decisions happened on BankNifty this week.

- RBI MPC decided to keep the repo rates unchanged but they removed the “withdrawal of liquidity” ~ meaning, the money supply will not be restricted.

- NSE decided to remove the BankNifty weekly expiries as SEBI demanded that an exchange have only 1 weekly expiry per week.

In the earlier discussions also, I had pointed out that NSE would always prefer to keep Nifty as the weekly expiry as it had everything to do with hedging. This happened despite BankNifty being the darling index for options traders.

Personally, the algo that I am using will no longer work if BankNifty’s weekly expiry is removed. I guess I tried out 50+ combinations to see if something could be worked out. The biggest challenge is the fees and charges for the monthly series as its premiums are higher. Definitely the lower theta is also working against it.

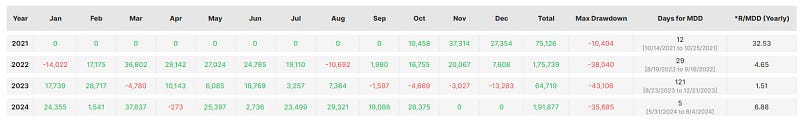

It took me over 3.5 years to develop, iterate and perfect the Algo. You can notice how the profits have dropped when the monthly is chosen over the weekly. Both the screenshots are without the exchange charges, the moment that is included, monthly’s PnL almost goes to RED.

I am quite sure, many other traders would be impacted if their strategy is quite similar to mine. Guess there is no way out, but to decommission the program and think of something new. After all, when a door closes, 4 others should open.

Intraday Algos run via AlgoTest on Kotak

Webhooks automation run via TradingView on Dhan