13th Oct ’23 — Unseen Double V shape — PostMortem on Nifty & BankNifty

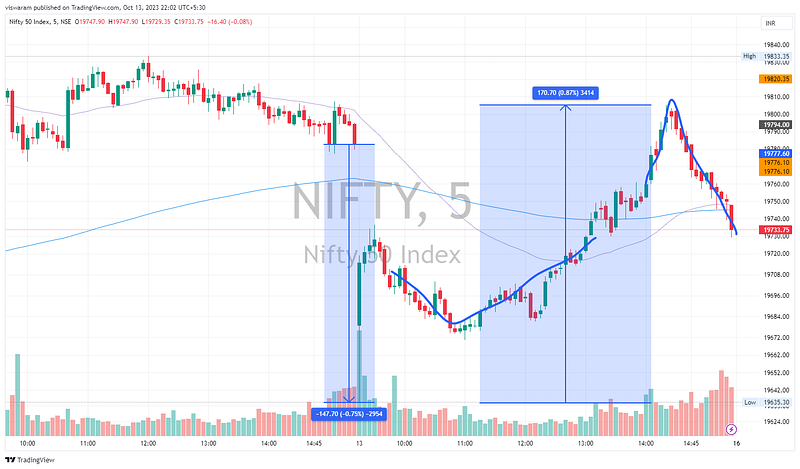

Nifty Analysis

Yes, you guessed it right by reading the title — I lost money both ways today. Firstly I went short because 19671 was broken. The short trade did not do well as we stopped falling. Secondly, we had a massive reversal — a total of 170pts intraday swing that really made my short position look like a sitting duck.

To start with, I did not expect we would have an opening candle swing of negative 147pts ~ 0.75%. Agreed that US markets were weak yesterday and INFY results disappointed. Guess what? Infy ended the day with just -2.34% loss. The rates pre-open showed was negative 4% opening on INFY would have really put the pressure on Nifty to have that deep-cut opening. But levels are levels and we traders respect that — I had no other option but to go short. The only mistake I made was not having a safe long position on the CALL side as protection. There again I never thought we would be rallying back to go-green and then fall back.

We had 2 V shapes today. The first reversal at 10.50 and the 2nd one at 14.25. I might have to test and find out what kind of trader made money today — A double V shape is normally not a Nifty50 phenomenon.

On the 1hr pattern, the first thing I would like to do is change my stance from bullish to neutral. We have broken the 19776 support today and well above the 19446 zone. For Monday I wish to go with the neutral trades only and go short if we fall below 19614 in the forenoon session. Till then I am eagerly watching how SPX will close the day today.

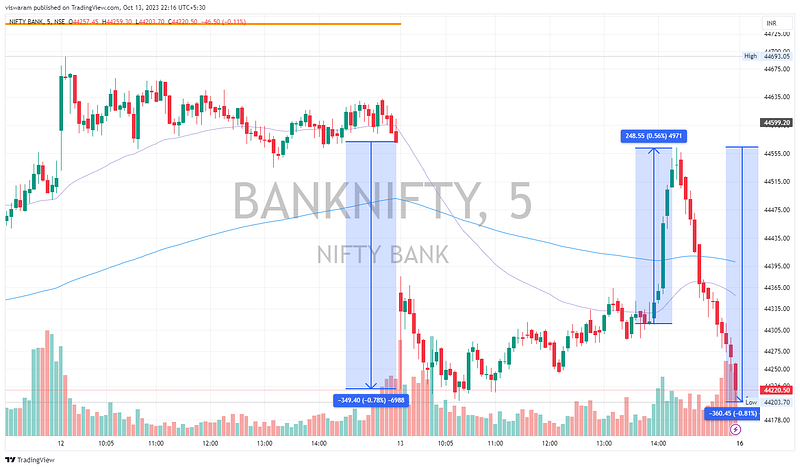

BankNifty Analysis

BankNifty was crazier than Nifty today, but because the options premium were not juicy enough, I refrained from taking positions (glad that I did).

Open we fell 349pts and never really recovered from it. Till 13.30 BankNifty was showing more intent to fall than Nifty. Then came a quick surge of 248pts ~ 0.56% in 30mts. We closed the gap with this. More importantly, we fell back 360pts from that day’s top. A 0.81% fall in the closing hour has to do something with the results on HDFCBK.

Yesterday I went with a neutral view for BankNifty and clearly said would prefer to go bearish if the 44380 level is broken. 44380 from the chart above shows the minor support level on which the double top lands. For Monday, it looks like the technical analysis may not work as news-flow, the results declaration on HDFCBK will mess it up. Still, with respect to the support/resistance levels, I wish to go with a short position if the 44068 gets broken.