14 Aug ’23 Post Mortem on Nifty & BankNifty | What started like a thunderstorm ended up as a…

Nifty Analysis

After the trades on Friday, I modified my stance to 100% bearish. What other boon could I ask for when we had the opening 5mts better than expected? “The first target to take out will be the recent swing low of 19296. The next support comes at 19190.’ As soon as 19300 was taken out in the 2nd candle, my conviction for a bear rally was growing.

But that did not last long enough, the bears were unable to push down the prices further and this hesitation gave the confidence for bulls to make their move. There were 2 news/events that should have tipped the scale to the bear’s favor

- Deloitte quitting Adani’s audits — read here

- Net Interest margin could take a hit, HDFC bank — read here

The first news was speculative, it does not give any indication of the health of Adani’s finances (at least for the general public). Auditors could resign for a number of reasons. Whereas the second news was more authoritative as it came from the CEO himself. The final impact ADANIENT down -3.29% and HDFCBK down -0.49% (not at all a big impact).

The bulk of the recovery was by RELIANCE, INFY and HUL and I am quite sure 99% of the traders would not have guessed Nifty will close in the green today. I had sights on 19500 CE at Rs19 levels which ended at Rs40 today. If I had any clue of the power of bulls, I would have grabbed on to this opportunity!

At the end of the day, what got formed is a classic double bottom at the support level of 19311 and a descending bearish trend line. If it goes like this — it becomes a falling wedge pattern which is not at all good for the bears.

Having said that, there is one piece of comforting news for the bears. The retail CPI inflation comes in at 7.44% a 15 month high — read here. Guessing RBI made a big mistake of not hiking the interest rate last thursday.

I continue to remain bearish as of now, if the support level is getting broken in the next session — it’s an advantage. If not the wedge (triangle) will catch up and it could even mean a reversal of trends.

If you are enjoying this free content, consider subscribing to my free newsletter — click here

BankNifty Analysis

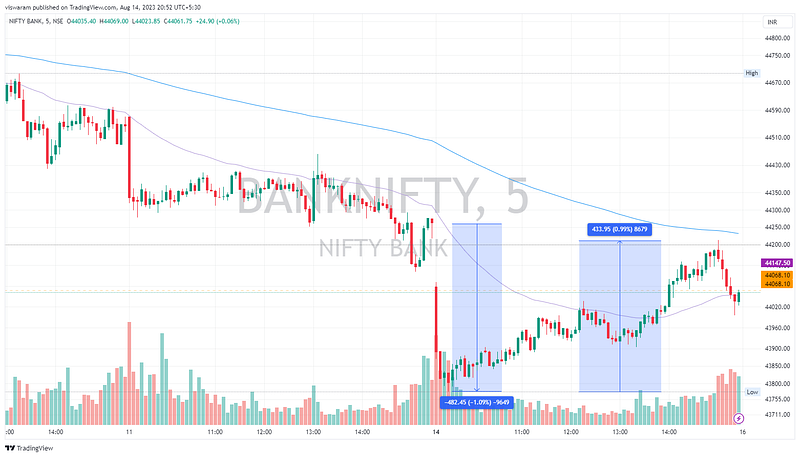

Banknifty also made a decent recovery after the 482pts ~ 1.09% fall in the opening 20mts. It retraced 433pts by 15.00. And then fell a little to close out with only 0.2% losses @ 44090.

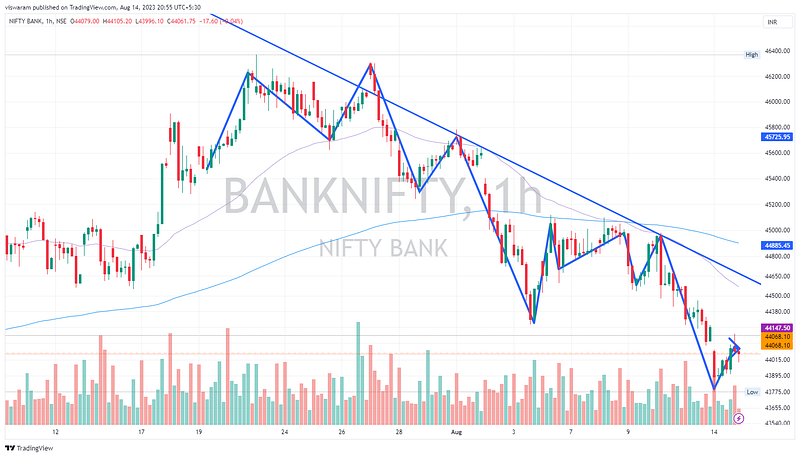

Even though the recovery was good, it was not as dramatic as Nifty50. And we are back at an important support/resistance level of 44068. So bank nifty has retested its old SR level before Nifty which still means the downtrend could continue a bit more. Earlier on I did mention in the last report that BankNifty is the leading indicator for trend in India vs NASDAQ in US.

Today’s close on the 1hr TF will give some proof for that. The final close is quite far away(below) the trend line and my 50 & 200 EMA is widening. The stance continues to be bearish with 44068 as the first SR and 43404 as the next SR.

If you are enjoying this free content, consider subscribing to my free newsletter — click here

FinNifty Weekly Analysis

We have fallen 2.31% ~ 464pts between the last expiry and today. This is definitely a good start for the bears. Unlike Nifty, Finnifty has managed to form a lower low on the 1hr TF. The first major support comes at 19421.

FinNifty Today Analysis

Due to HDFCBK’s weightage on Finnifty, we closed a 0.1% lower than banknifty today i.e at 0.3% ~ 66pts down.Chartwise today’s recovery was not as dramatic as Nifty50 and provides further room for bears to play.

From an expiry perspective, the options premiums were not at all exciting even during the opening minutes. Since we had a good gap down, the expectation was that PE strikes would explode in premiums — but that did not happen. Guess the big-boys came prepared not to drive down the prices further. Retail traders like you and me were in the dark and had to guess the direction.

Tomorrow will be a trading holiday as we are celebrating our 77th Independence Day — 15th Aug. This was the reason we had FinNifty expiry on Monday instead of Tuesday this week.