14 Mar ’24 — Nifty may be forming a lower high, stance neutral — Nifty & BankNifty PostMortem…

Nifty Analysis — Stance Neutral ➡️

The day did not go as planned, firstly the selling pressure came to a full stop. Secondly, the short covering helped Nifty breach the resistance of 22051. Nifty had a swing range of 287 points today and because it took out a crucial SR, we are switching the stance from bearish to neutral. I was totally not in agreement with the trades on NiftyIT, that sector alone ended up +1.98% today. The impact of Adani stocks was standing out today, a variance of 0.22% with Sensex should prove a point.

We are back to the same situation where the weak hands are holding the shorts. The first blink of green they run for cover creating a fake momentum. And then they re-enter the shorts at a lower level losing more points.

If you look at the higher time frame, today’s price moves might be between 38.2 to 50% Fibonacci retracement levels and what might have formed could be a lower high. Again we are not quite sure if the technical analysis will work tomorrow as the markets will be keenly watching for the electoral bonds data. We would like to re-enter the bearish position below 22051 and the bullish position above 22295.

BankNifty Analysis — Stance Neutral ➡️

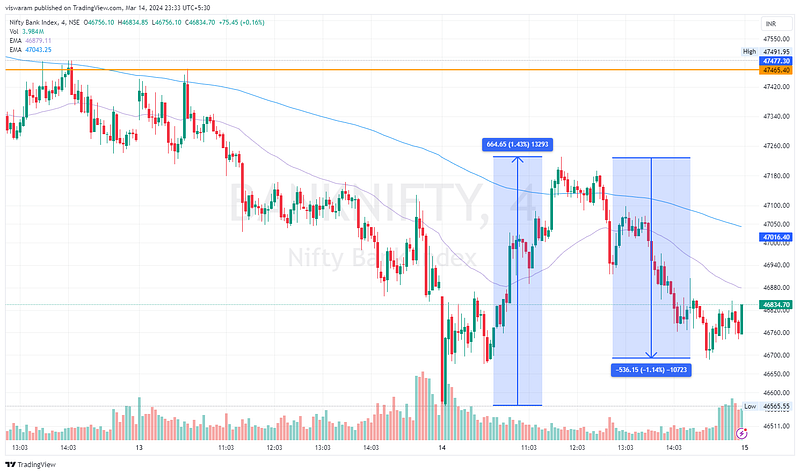

Banks were performing as expected today, even though we had a neutral view we ended up losing 0.41% for the day. The stance for tomorrow also continues to be neutral as BN did not breach support or resistance today. The starting candle was perfect as per the script, from there we rose 666pts ~ 1.43% to reach the HOD of 47231 by 11.43. The staling was obvious as there were no special triggers to take up even near the resistance level of 47465.

The fall of 536pts ~ 1.14% from the day’s high also made perfect sense. Unfortunately, Nifty50 does not convey the real truth that happened with the banks as that index was overshadowed by stocks like Adani and NiftyIT components.

On the 63mts time frame, the lower high formation looks much better than N50. Our stance continues to be neutral and would go short if we enter the bearish channel and would go long if the 47465 resistance is breached.

Algo Trading

Our algo trades ended today with a gain of Rs21565. Even though we had a quick dip in profits by 10.37, the system recovered and closed in green.

Webhooks automation run via TradingView on Dhan