14 Sep ’23 Post Mortem on Nifty & BankNifty + Nifty weekly analysis

Nifty Weekly Analysis

Between the last expiry and today Nifty is up an impressive 378pts ~ 1.92%. We really did pick up some directional momentum this week. Almost all the sectors were assisting Nifty hit an all time high in this historic week and conquer 20000.

Nifty Daily Analysis

Recap from yesterday: “I expect the expiry to be above 19989 if we still have the bullish sentiment. I wish to stay 50% neutral and 50% bullish for tomorrow and would like to go 100% bullish once the swing high of 20110 is taken out.” Since we hit a new ATH by 09.40 today and because it was above my bullish level of 20110 I had to go long today. I rolled up my PUT positions from 19900 to 20000 for protection.

I am quite relieved that the 20000 PE expired out of the money otherwise my bullish bias would have been proven wrong. Meanwhile the CE long option was rolled over for the next week’s expiry.

The bullish momentum lasted only till 09.45 after which we were falling quite strongly. All the 5mts candles from 09.50 to 10.15 were in red. The 20000 PE option I had taken did appreciate more than 175% but I somehow decided not to exercise.

We closed at just 0.16% gains, so quite relieved that yesterday’s analysis played out okay. Regarding the option prices — the OTM premiums were not attractive for an expiry day options seller. This is the 2nd expiry we had after decoupling banknifty from nifty.

With the current VIX scenario — the only route to make money for OTM option sellers is to shuffle the positions between banknifty or nifty or finnifty depending on the abrupt jumps in premiums due to lack of liquidity. I will try to write out an article by this weekend explaining the concept with examples.

On the 1hr TF Nifty has made a healthy upward pattern and as discussed over the last 2 sessions — a consolidation at the current levels will give it some stability. Parallelly since we took the ATH — a part of it would want to break free as that is the path of least resistance. If you are a bear — the only way you could fight back in is to close Nifty below 19989 or get a quick swing below 19960.

I wish to stay with the moderately bullish stance for tomorrow as well. Since I am holding a long position my personal preference would be to close above 20167.

If you are enjoying this free content, consider subscribing to my free newsletter — click here

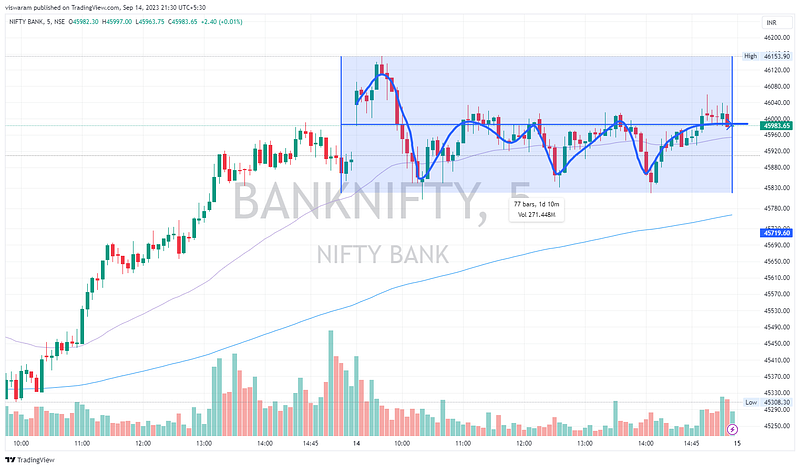

BankNifty Analysis

Banknifty had a decent range bound day today, but the options premium had some unusual jumps. I wasn’t prepared to take advantage of those — especially during the open period as I was scanning for Nifty strikes to sell. After a few minutes I still saw the exorbitantly high OTM premiums both for PE and CE — but still couldn’t capitalise as my margins were totally blocked.

This scenario has occurred due to the shifting of banknifty expiry to wednesdays. The lack of liquidity is shooting up options prices and I assume most credit spread writers may be dearly paying for this.

From a price action perspective, the sudden drop from 09.40 to 10.20 is still a mystery. Was it because we had a gap up opening and then the big-boys wanted a flattish closing so they had to sell a few heavyweights?

We are just 389pts ~ 0.84% below the ATH. With the momentum gained — it’s quite possible that we take this out over the next 2 sessions. I won’t even be surprised if we hit it tomorrow. I wish to go with a bullish bias for tomorrow with stop loss being 45725.

· Free charts made with ❤️ on TradingView

· You can reach me via email at balu@viswaram.com