14th Dec ’23 — Markets break out yet again! — PostMortem on Nifty & BankNifty

Nifty Weekly Expiry Analysis

Between the last expiry and today, Nifty gains 1.36% ~ 285pts. 1.23% ie 90% of the weekly gains came today. Since we hit a new ATH, the Bulls might be partying hard — December has been a good month for them so far. I am still worried for the Bears who have been banished to hibernate this winter.

Nifty Today’s Analysis

4mts chart link — click here.

Guess what happened today? The CE short-sellers ran for cover as the pre-open indicated a mega gap up. Rightly so, we opened 182pts higher after FED announced plans to cut rates thrice in 2024. US markets were overjoyed and its spillover effects fell on Indian markets as well. Since the opening was above my target of 21037, I had to choose the bullish direction.

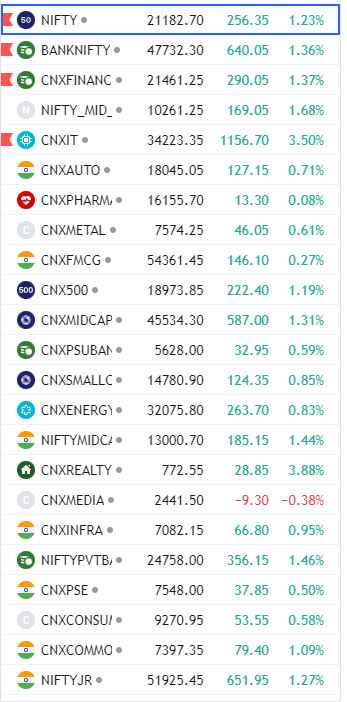

You won’t believe how hard NiftyIT rallied today, +3.5%. The main reason we had a retracement over the last 2 to 3 sessions was NiftyIT. And its reversal helped Nifty50 hit a new ATH of 21210.9 today.

63mts chart of NiftyIT — click here

See the chart of NiftyIT. Between 12th and 13th December we fell 3.25% ~ 1098pts. And from those lows, it rallied 4.89% ~ 1599pts including today’s gains of 1156pts. Not just IT, almost all the sectors were in green today except for maybe NiftyMedia.

63mts chart — click here

Nifty has shown it is stronger than thought by bouncing off the channel’s upper boundary. For tomorrow, my stance is revised to bullish. Since we are at ATH, I do not have an upper target, but my support level will be 21037.

BankNifty Analysis

If you read the postmortem report yesterday, you might have seen how the W pattern formed yesterday and BankNifty respecting the ascending trend line turned out. BankNifty had a different start today vs Nifty because we opened 0.95% gap-up and then rallied another 0.8% to hit the all time highs.

4mts chart — click here

The 2nd rally was equally intense as the first. And once we hit the ATH — BN turned flat and had a sideways trend till close. Remember we discussed how gap-up and gap-downs are the major weapon used by the big-boys to scare the s**t out of the option sellers? US markets rarely does the gap-ups or gap-downs, I mean the index. Whereas the majority of the gains/loss in our markets are done via gaps.

FED’s rate cuts promise in 2024 looks like more of a political play than an economic one. A rallying market and portfolios in green sounds pretty good for the incumbent leaders. Imagine trying to get re-elected when there is economic depression/recession?

63mts chart link — click here

The stance on BankNifty has been revised to bullish. I have no targets in mind as we are at the ATH. The first support to look at will be 47588. Meanwhile, the charts look perfectly like in the textbook.