15 Jan ’24 — Bullish reinforcements are on the way! — Nifty & BankNifty PostMortem Analysis

Nifty Analysis — Stance Bullish ⬆️

Recap from yesterday: “Till yesterday, we were looking for neutral trades with a possibility of going down. See how the tables have turned today. For Monday — we need to look out for bullish opportunities now.”

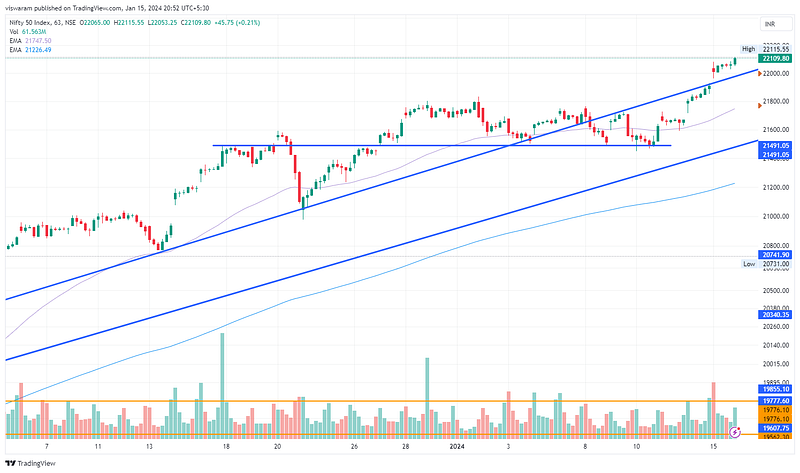

Another gap-up of 131pts ~ 0.6% today! It was required to break the channel resistance line. There was a minor fall, but the 22000 level provided early support and we kept the gap unclosed. Once Nifty50 found its balance, it rallied steadily for the day and closed near the highs. The new ATH is 22111.

The break away from the channel is evident in the 63mts chart. See the points Nifty is climbing every time it gets a stance upgrade from neutral to bullish. Remember how things were looking weak on the 8th and 10th of Jan and how Nifty turned from there? For tomorrow, the bullish stance continues and the first support will be the ascending channel top-line ~ 22050 levels.

BankNifty Analysis — Stance Bullish ⬆️

BankNifty also gets a stance upgrade from neutral to bullish today. After we crossed the 47539 resistance, its level as support never got tested. Today’s gap-up was not so visible for the banks — but the price action was more healthy.

The stance change came only in the last 15 minutes or so when BankNifty started to shift the gears. 48250 was a level I was watching for. Even though we did not breach it today, the momentum banknifty showed in the last 1 hour was more than satisfactory to change the stance.

The last candle made all the difference today, that is the secret ingredient for the change of stance. For tomorrow, the first thing BN has to do is take out the 48422 levels and if possible get a new ATH. The quarterly results from the component stocks will have a huge role to play. Look what the results of TCS, INFY, WIPRO, HCLTECH did to the NiftyIT sector — it almost went up 9% in the last 2 sessions.