16 Aug ’23 Post Mortem on Nifty & BankNifty | How many bears are still alive?

Nifty50 Analysis

Last session we discussed the support level of 19311, this came into play today and proved quite hard to breach. Today’s intraday low 19317 was hit in the first candle itself after a gap down opening.

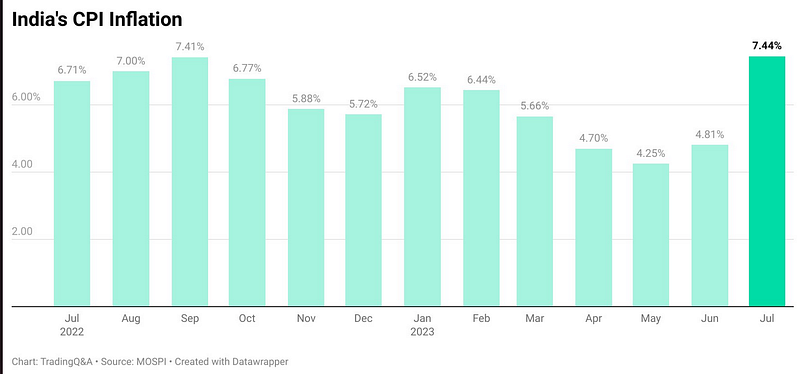

The biggest negative news to start the day was the higher than expected 7.44% CPI inflation that came after market hours on 14th Aug.

Also the SPX and NDQ also closed lower than 1.16 to 1.1% — this also should have influenced the gap down today. The data that came from China — was bad and a leading indicator to what a deflationary, illiquid & rising unemployment looks like. I personally felt we might breach the support and close lower than 19146 today. But the resilience and perseverance shown by the dip buyers (bulls) were phenomenal.

We rallied back 163pts ~ 0.85% to close the day in green. Pretty much frustrating if you are a bear. This market is quite hard to crack. The rally also ensured we went above the swing high of last session showing further positiveness.

If we look at the 1hr TF — the double bottom @ 19311 stands strong, and the bearish trend line is converging. Till date the tops Nifty has made has respected the trend line — this could also mean the falling wedge pattern could hold true. If yes — its a bullish pattern and we could have a trend reversal soon.

The only way bears can regain control is to break the support of 19311 immediately, preferably tomorrow 17th Aug. Seriously I was screening the news to find out why Nifty rallied even in spite of bad news — one event I saw was the “CABINET APPROVES 63000 CR RUPEES FOR EV BUSES SCHEME” tweet from redboxglobal. But seriously building an industry on subsidy & incentive is syphoning out tax payer money & destructive to existing industries. I am revising my stance from bearish to neutral, will shift to bearish if 19311 breaks tomorrow for good.

If you are enjoying this free content, consider subscribing to my free newsletter — click here

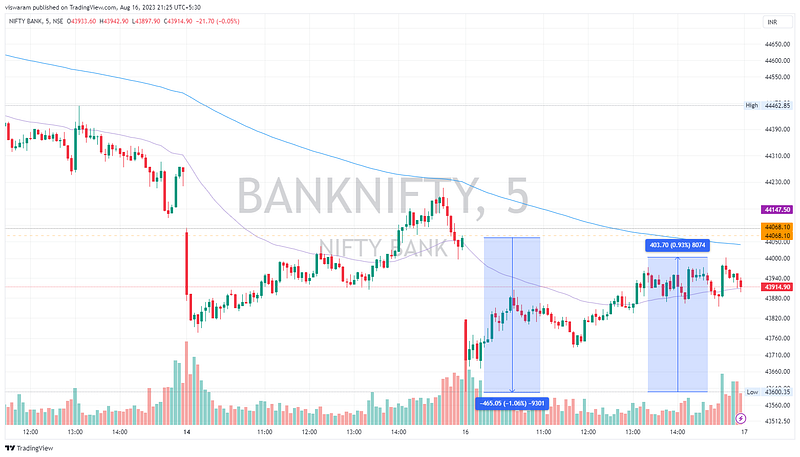

BankNifty Analysis

From the moment we started today, Banknifty looked and stayed bearish for the entire day today. In the opening minutes we dropped 1.06% ~ 465pts and then there was a decent recovery of 403pts ~ 0.93 by 15.05

Last session we discussed the support/resistance zone of 44068. We have broken that today and the close ensured we have conclusively breached it.

HDFCBK made a decent recovery today which was the primary reason banknifty cut its losses to just 0.3% ~ 144pts today. HDCBK was carrying on the bad news that its NII will be impacted after the merger.

Banknifty does not require a stance change and we continue to remain bearish. The first support level is 43404 and the first resistance is 44068 (marked on the chart yellow horizontal lines). From an options premium perspective, even after the strong moves today — the OTM premiums were not surging — suggesting no more wild swings for the day. I was really hoping to see some action today, but ended the day on a disappointing note.