17th Nov ’23 — Nifty stays steady despite deep cuts on BankNifty — PostMortem on Nifty & BankNifty

Nifty Analysis

5mts chart link: click here

Nifty opened gap down and then closed that gap in the first candle itself. It continued to go up till 10.00 wherein the resistance of 19776 was briefly crossed on the 5mts TF. Unfortunately, these gains did not last that long and we started falling in a narrow range for the rest of the day.

Nifty has to be given some credit today, BankNifty was falling like a house of cards but Nifty held its ground quite well. As we discussed yesterday, I had to change my stance from bullish to neutral since the resistance of 19776 was not taken out.

1hr chart link: click here

On the 1hr TF, it kind of looks like Nifty has made an interim top at these levels. Primarily because this leg of the run was due to NiftyIT and not BankNifty. And now BankNifty is battling the news about Capital Adequacy Ratio and there could be some more selling due to that. At present, I wish to change my stance to neutral and wait for further clues. If we start dropping on Monday, I would prefer to go bearish with the first target of 19562 and then 19446.

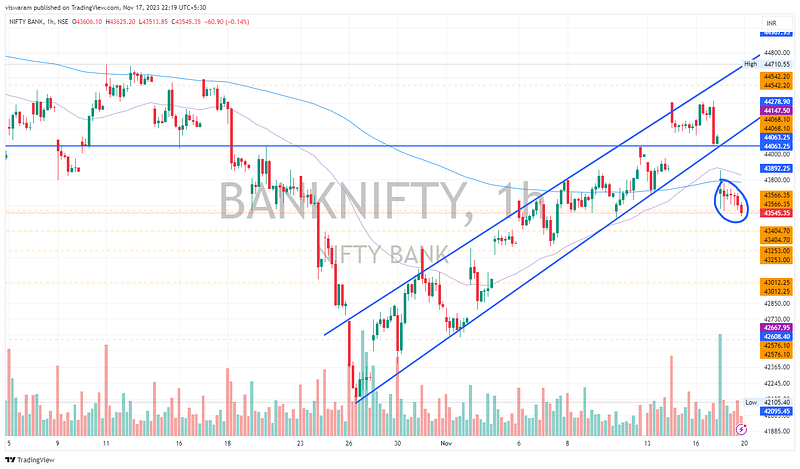

BankNifty Analysis

We will discuss the Capital Adequacy Ratio news in detail today as I was unable to find time yesterday due to an unscheduled hospital emergency. In yesterday’s postmortem, I mentioned that I would be changing the stance to bearish if the support of 44063 does not hold. Hope you would have got my tradingview minds update.

5mts TF chart link — click here

We opened gap down at 43694 well below the support level of 44063. In the opening candle itself, we tested the next support level of 43566. Unlike Nifty, there was no recovery in sight for BankNifty. By 10.15 we retested the 43566 support again. The price action was not at all aggressive, we were only falling gradually. Its just that the opening candle had a swing of 565pts and I guess that was the maximum target the big-boys had in mind today.

Towards close we broke the 43566 support and closed lower, which means we knocked out 2 support levels today.

What is the news from RBI that has spooked the financial sector?

- RBI’s tighter regulatory risk weight to hit banks’ capital adequacy by 60 bps: S&P

- Axis Bank shares fall 2% after RBI raises risk-weight on consumer loans, imposes penalty

- Bajaj Finance, HDFC Bank, ICICI Bank stocks tank as RBI’s risk-weight move hits tier-1 capital

- RBI’s New Guidelines To Have Capital Impact Of 55 Basis Points, Says SBI Chairperson

- SBI Card’s Capital Adequacy To Fall 400 Basis Points After RBI Raises Credit Risk Weights

- RBI Circular.

If time permits, request you to go through these news snippets to get a fair idea of what transpired. When RBI decided to up the risk weight for personal loans and credit-card loans by 25%, it means the lender has to maintain adequate capital to cover those risks. CAR is basically for the health of the lender.

From a macro perspective when Inflation goes up uncontrolled, people resort to personal loans and credit card EMIs to fund consumption. This is especially true for those segments of the population that did not have a proportionate rise in income. Think like this, if people start buying groceries using a credit card loan — it shows their inability to afford. It definitely is a red flag as the interest on these loans will catch up soon and the end-user could default if his income is staying as it is.

1hr TF chart link: click here

Most importantly we broke out from the ascending channel pattern and created an island day today. If you read that price action along with 2 supports getting clean-bowled, it may be true that the bears are making a comeback. For Monday, I wish to maintain my bearish stance, the next targets would be 43404, 43253 and 43012. If we reverse and go up, the first major resistance will be 44063 and if we are unable to get into the ascending channel by Monday, I will be happy to remove that.