18 Aug ’23 Post Mortem on Nifty & BankNifty | Bears managed to close below 19309 today

Nifty Analysis

There was only 1 goal for the bears today, to close the markets below 19309. Somehow they got it done today which means we are in for a bear ride next week. Let me try to explain.

We opened right at the 19309 level and then fell to 19258 levels by 10.45 in a show of strength by the bears. From there there was a reversal till 12.00 where we re-touched the 19309 SR zone.

Leg 2 of fall was from 12.00 to 13.40 where we managed to re-test the 19258 levels. I was monitoring very closely to see if we will break this swing low and fall towards the 19186 levels. Instead we had a surprise rally of 111pts ~ 0.58% between 13.45 to 14.15. The news about RELIANCE-JIO shares getting listed on 21 Aug would have led to short covering. A move of +2.5% in RELIANCE is more than enough to spoil the technical analysis patterns & levels.

Nifty ended up making a double bottom today at the 19258 levels and the surge of 111pts to go green would have worried many bears. I sure got rattled, I even thought a close below 19309 may not be possible. However the bears finally got their act together and ensured to push down the prices below 19309 levels.

The fall below 19309 has just managed to negate a falling wedge or a descending triangle pattern. This is good for the bears as the mainline support is breached, which will open up the downside possibilities. The next goal is to take out the break-away gap that was created on 30th June. I wish to maintain my bearish stance for 21 Aug 2023, If we have a gap-up opening or a strong rally to take out the 19309 resistance — I might be forced to change the stance from bearish to neutral.

If you are enjoying this free content, consider subscribing to my free newsletter — click here

BankNifty Analysis

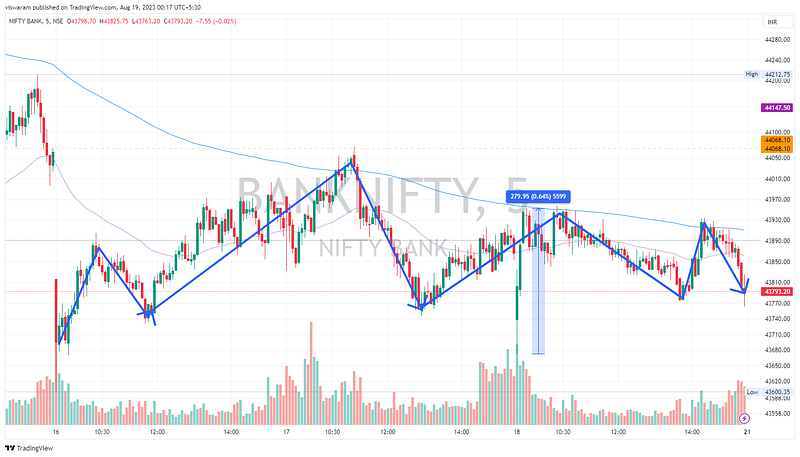

Banknifty is showing unusual resilience to breakdown, instead its chopping around. The intraday swing range has narrowed in the last 2 days which means we could expect a massive move pretty soon. I am not very sure what is restricting banknifty from falling.

For example we had a good gap down today and hit the swing low of 16 Aug, but the recovery was so decent that it made the gap-down seem like a blip. By 10.15 banknifty was in green and from there the fall to 43776 levels was gradual with no momentum. It took till 13.40 for a fall of 170pts ~ 0.39% which is not a great deal.

Just when Nifty50 started roaring (Reliance-Jio news), banknifty also started covering the shorts and rose till 43933 levels by 14.15. From there we kept drifting lower till close. Finally we just lost 40pts ~ 0.09%.

The momentum has fallen in the last 2 days, it could even be a rest period wherein banknifty is catching some breath. The closing prices and the distance to the trend line is wide enough to change a stance, so I wish to stay bearish till 44068 resistance is safe. If its getting crossed via a gap-up or strong trading moves — I may have to change the stance to neutral on 21 Aug.