18 Jul ’23 Post Mortem on Nifty & BankNifty + FinNifty Weekly Expiry Special

FinNifty Weekly Expiry

We had a gap up open and the high was formed the first swing i.e. 20476.25 by 09.25, from there the momentum was lost & we started falling.

There was a 1.19% fall between 11.15 to 12.20, then a brief recovery and then the selling continued. The options premium was elevated today, usually we do not have high premiums for Finnifty expiry. Most noticeably even the Nifty50 and BankNifty options premiums spiked today.

Between the last expiry & today, finnifty gained 1.4% ~ 279pts. Although we did not retest the ATH of 4th July, we came quite close today. The index is not looking weak though and we would require a sharp selling for a change in bullish bias.

Nifty50 Analysis

Nifty50 had a surprising comeback today, we opened gap up and then there was a strong rally till 11.05 where we set a new all time high of 19819.45. From 11.05 to 12.05 we had a decent fall of 129pts ~ 0.65%.

Surprisingly the falling stopped right there and we bounced back quite strong. NiftyIT took part in the rally post 13.30 which helped Nifty stay green. BankNifty was not that supportive though (we will discuss in detail below).

Today’s price action shows someone will come up to support nifty in its pursuit, if the banks fail, IT supports. If IT underperforms then RELIANCE or ITC will support. The last 800pts rally would have really sucked the soul out of the bears. No matter what they do, they cannot push down the prices.

I was waiting for Nifty to fall below the 19600 to go short, I did not want to go long because I was scared of heights 🙂. How Reliance demerger will plan out on 19th July is another question. The current stock value of Reliance is considered as the sum of reliance + jio financials. On 19th both the entities will be delisted and on 20th only reliance will be relisted. So whatever price difference between the closing price of 19th and pre open price of 20th is considered the share price & percentage of Jio financials.

In an ideal case Nifty50 index should take a big hit — I am yet to find out how they are hard coding to prevent this from happening. Thats because Jio Financials as a separate entity is not eligible to be part of Nifty50 & Reliance will have a reduced market cap & pricing which should create outflows.

The hourly chart is looking bullish and no worries so far. I am so inclined to be a contrarian and take a short position near the 19600 levels, not because I am bearish but because I am so shocked to see this rally. Believe a profit booking is overdue..

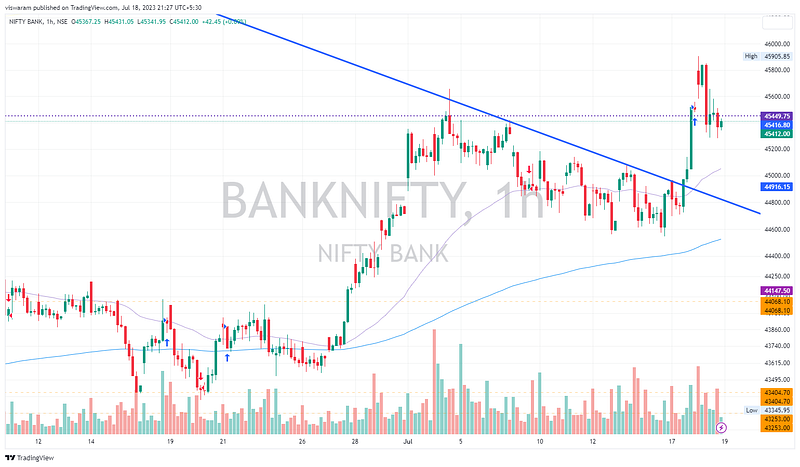

BankNfty Analysis

Banknifty saw some profit booking today & it seems healthy. Thats right after we broke the all time high by 09.25. Interestingly finnifty also hit the day’s high at the same timeline but it could not take out the previous ATH.

There was a fall of 557pts ~ 1.22% between 11.15 to 12.20 but even this did not take banknifty much below the prev. close of 45449.75. It also means the selling momentum was not picking up pace — another bad news for the bears.

Also the impact on Nifty50 was not heavy as NiftyIT started to support and rallied almost 1.6% afternoon.

Hitting a new ATH for banknifty was something special, this has to do with the impressive quarterly results. Seems like the other banks may have similar or better numbers to report than Hdfcbk, saw the IndusInd bank results post market hours — that looked good as well.

On an hourly time-frame banknifty is sill looking bullish — mostly because of its trend line break and the break-out momentum. Today’s fall was also arrested quickly which may be of interest to the bulls.

PS: The trades taken are no recommendation, blindly following them may cause more harm than good — read full disclaimer here