18 Sep ’23 Post Mortem on Nifty & BankNifty + FinNifty weekly expiry analysis

Nifty Analysis

Recap from yesterday: “For Monday I wish to maintain the same 50% neutral 50% bullish stance. And wish to go short if 20100 level is getting taken out.”. Nifty was not neutral today, had a negative bias, but did not fall below 20100 to go short.

On Friday SPX closed -1.22% down sending a strong negative message, but it seems like our markets were not afraid. The pre-open today showed a -0.23% probable open — but the real open was just 0.04% down. The first candle swung to a low of 20121 which was respected till 15.15. Just imagine — a market that doesnt get bothered by what is happening globally. Even though over-valued, over-extended rally — still no fear of a fall or correction. There is something special about Indian stock markets.

I was almost out of words for this tweet — not just small and midcaps but even the large caps are overbought.

On the 1hr TF, I will be quite happy if this turns out to be the new top formation. Since the 20100 level was not taken out today, I was not able to take new short positions. We have a holiday tomorrow, but when we resume on Wednesday — I would really prefer if 20070 is taken out, till then I would prefer to stay neutral.

If you are enjoying this free content, consider subscribing to my free newsletter — click here

BankNifty Analysis

Banknifty showed more negative sentiment than Nifty. In Fact it is hard to digest that Nifty was staying strong when BankNifty, NiftyIT and Reliance were down. Quite a rare day.

Recap from Friday: “For monday I wish to maintain the bullish stance and would like to reverse and go short only if the 45910 levels are getting taken out.”. Not only this prediction went wrong, but the reversal level of 45910 was not taken out conclusively. So from a trading standpoint — had a non-performing day today.

BankNifty has made a smooth curved top like formation on the 1hr chart. If the next day’s trades are getting punched below 45900 levels — then the interim top can be confirmed for sure. I wish to go short below 45855 on Wednesday — and it is going to be the expiry day, so expect turbulence. Till the short level is not taken out — I wish to stay neutral.

If you are enjoying this free content, consider subscribing to my free newsletter — click here

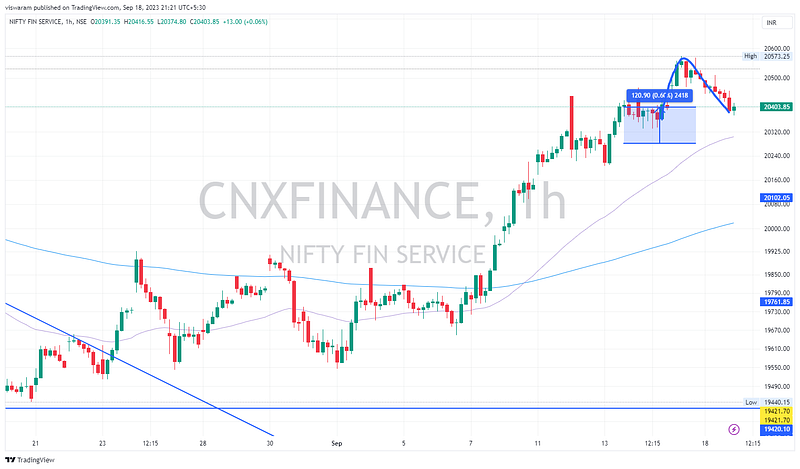

FinNifty Weekly Analysis

We had the expiry today instead of Tuesday because of a scheduled holiday in exchanges on 19th Sep 2023. So in the current expiry week, FinNifty got only 4 trading days.

Between the last expiry day and today, FinNifty has gone up 120pts ~ 0.6%. And in this period we looked strong, but not strong enough to take out the all time highs. Unlike banknifty, the top-like formation is not rounded or curved — its like a straight line.

Since its not rounded — I have my doubts. It could even not be a top too. 20666 is the ATH and to take that out we need just 264pts ~ 1.3%. And if you noticed today the major components of today’s 0.6% negative run were banks and not BAJAJ twins. Are the banks seeing something that’s hidden in plain sight?

· Free charts made with ❤️ on TradingView

· You can reach me via email at balu@viswaram.com