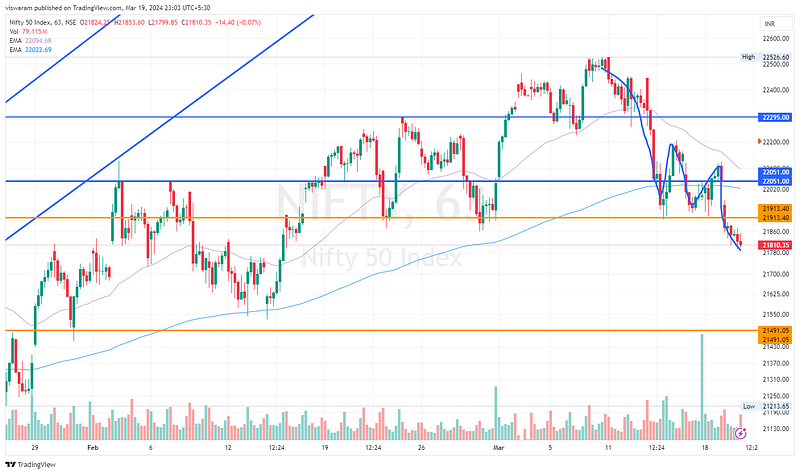

19 Mar ’24 — Another Support Broken — 21913, more downside? — Nifty & BankNifty PostMortem Analysis

Nifty Analysis — Stance Bearish⬇️

Recap from yesterday: “The only thing that could override this W pattern is the lower high, lower low formation. LH, LL will take precedence over a short-duration pattern all the time.“

I can say With 70% confidence that Nifty50’s Lower Low, Lower High (LL, LH) wave formation has taken precedence over the W (double bottom) pattern. If not, we would not have broken the 21913 support. Take a look at the 09.55 and 09.59 candlesticks, both are RED and with considerable depth. Once we breached the support, there was no attempt to retrace. One thing is missing though — momentum. The weak hands still hold the shorts, I am guessing it is the right time for the big boys to enter as the conditions are much more favorable right now. There is one problem though — BankNifty!

Nifty’s next major support comes at 21491, but before we go there we have some 2 months of data to be analyzed and processed. Reminding you once again that Nifty spent time from Dec 15th to Feb 15th between 21491 and 21913. So a flash crash could be ruled out per se. If that happens, then it is going to be some serious trouble for the current election structure. Always a greenish market is favorable for the current incumbent Govt. If the investors price the chances of re-election being troublesome, then the market has only one direction to go.

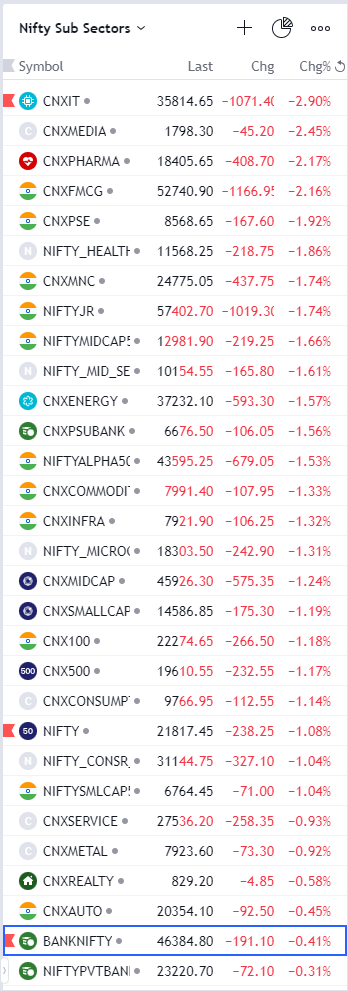

BankNifty Analysis — Stance Neutral ➡️

The level of reluctance BankNifty shows to crack is really intense. Usually, Banks react badly to any situation. We now have a peculiar case wherein Nifty has been downward facing for the last 3 consecutive sessions whereas BankNifty has stayed neutral. BankNifty has been losing points steadily, eg: it lost 191pts today but the bearish intent is not there. And you know pretty well we cannot change the status to bearish unless the “Bears” actually push down the index with momentum. We would need a breach of support or a re-entry to the bearish channel for that.

Even though BN lost a few points today, it was nothing comparable to Nifty (-1.08%) and NiftyIT (-2.9%). None of the Nifty subsectors were in Green today. The main sector fighting for the bulls was the Financials. My eyes were totally glued on ICICI Bank and HDFC Bank today, despite N50 falling both these banks held their ground pretty strongly. On many instances both were trading against the current.

On the higher time frame, BN has less than 300pts to enter the bearish channel. Tomorrow being the weekly expiry, we are pinning the hopes for a classic bear attack. We would prefer to start the day neutral and go short only if the conditions are met. A rising VIX would be the 2nd clue we might be watching for.

Algo Trading

Our algo trades ended today with a gain of Rs27216. I wound up the trades at 12.48 as almost 95% of the target was done and did not want to lose out to a possible directional trend.

Webhooks automation run via TradingView on Dhan