1st Nov ’23 — Some weakness still persisting — PostMortem on Nifty & BankNifty

Nifty Analysis

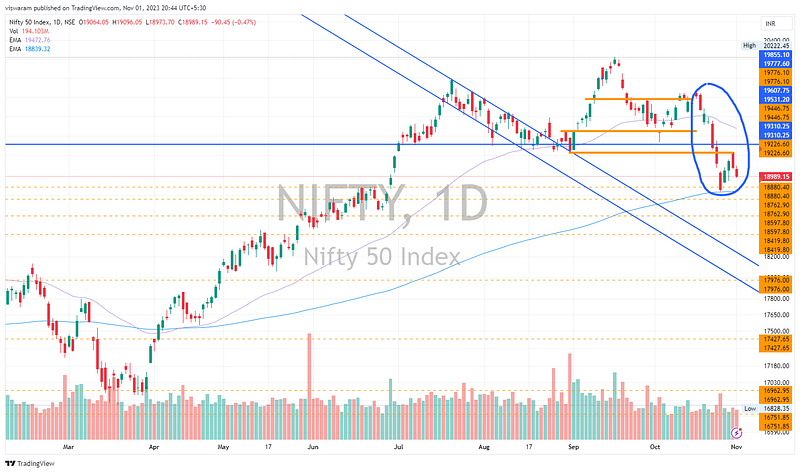

Recap from yesterday: “Since we retraced the 38.2% level of 19226 today and the reluctance to go up might be confidence-building for the bears. Also the 23.6% level forms a base for further movements. The issue is that we cannot go outright bearish now, we need further proof of that. Ideally, the 18880 support has to be taken out and that too pretty quickly. Till then I wish to maintain my neutral stance.”

There is some weakness still lingering around. Despite positive closing by US markets yesterday — we were reluctant to go green today. If you look at the 5mts chart above — the price action continues its journey from yesterday.

By 10.00 we hit 19019, but miraculously we gained back those points. From 12.30 to 13.15 we started falling again breaking the last swing low to 19006. Then from 13.45 to close we fell again to a new swing low of 18973. BankNifty was staying pretty strong due to which a big fall was avoided on Nifty. This also ensured that Nifty50 did not break the 18880 support level below which we had to go short.

Check out the daily time frame, does that not look bearish to you? Since we had a red candle today also, it seems like the bearish momentum could build up pretty quickly. We have the FOMC interest rate decision at 23.30 today and US FED comments may spook or lift the markets. Definitely, that will spill over to our markets tomorrow. As of now, SPX is in green trading with gains of 0.53%. Until 18880 is not broken, I wish to maintain my neutral stance.

BankNifty Weekly Expiry Analysis

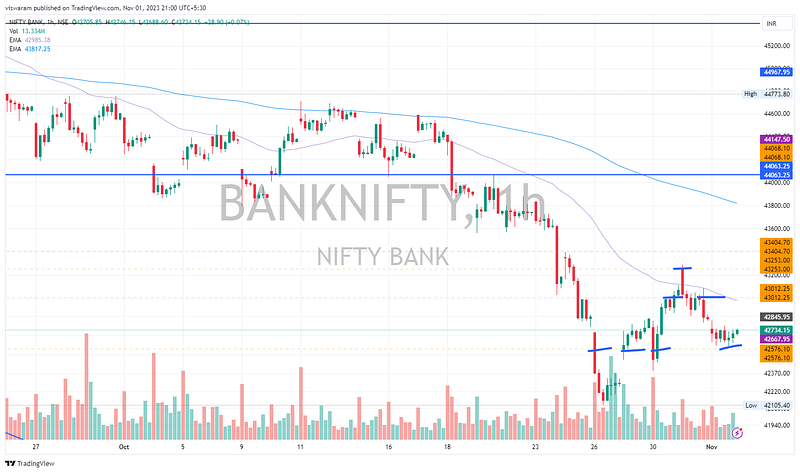

Between the last expiry and today, BankNifty has managed to climb 432pts ~ 1.02%. It has also managed to trade above the support/resistance of 42576. This retracement could be seen as a lower-high formation for continued selling pressure. For proof, we would need to see the 42576 getting knocked out in the upcoming sessions.

BankNifty Today Analysis

Unexpected, but Banknifty had a perfectly neutral price action today. Most of the trades were carried out between 42770 & 42643 today i.e. a swing range of 127pts. I can say with 70% confidence that the major reason Nifty50 did not take out its support was due to lack of participation from BankNifty today.

BN only fell 0.34% today vs Nifty which fell 0.47%. BankNifty had a gap down open and its close was almost at the same level. There were 2 attempts to fall, the best one was between 12.30 to 13.15 — but the support of 42576 was respected.

Being the expiry today — a flattish BankNifty would have filled the pocket of the straddlers. It is not that common to get textbook-like straddle conditions. My personal trades in BankNifty did not last long as the premiums were dropping pretty quickly. I switched back to Nifty50 when its OTM had juice left. Also, remember — when the index is perfectly flat with no volatility — the OTM premiums will be pretty low.

I have highlighted the support/resistance points that are crowded around the spot in blue color. Till 42576 is not broken, I cannot go bearish. Not just that, it has to take out the swing low of 42105 on the same day 42576 is taken out — just to ensure that the momentum is good enough.