20 Jul ’23 Post Mortem on Nifty & BankNifty | Weekly Expiry Analysis | Nifty within kissing…

Nifty Weekly Analysis

Nifty is up an impressive 526pts ~ 2.71% between the last expiry & today. This is by far the most impressive breakout by Nifty. From the last known resistance level of 18880, nifty is up 6.07% ~ 1142pts in a span of 3 weeks.

Guess what? My analysis went deeply wrong this monday when I exited the long position, I had a neutral call for this week and was expecting a rally by month end. I am not sad that I lost the opportunity cost of unwinding a long position on Nifty, but because my analysis failed to see this possibility.

I was really hoping Nifty will consolidate this week, seeing through the RELIANCE demerger and make its play next week. As we are the apex point, there are no resistances & moving up was the easiest way!

Daily Analysis

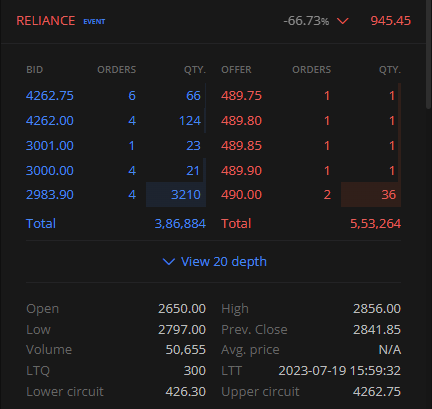

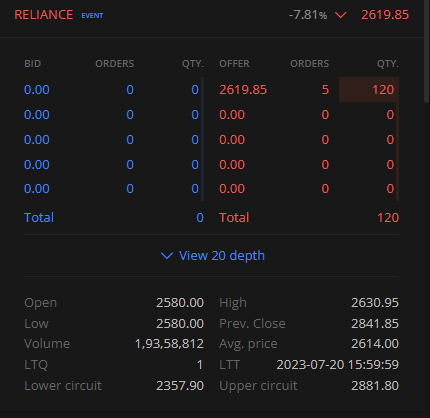

Nifty was looking weak in the opening minutes, maybe because of the RELIANCE demerger effect.

During the pre-open period till 09.15, Reliance settled for a price of 945 & we were all shocked. However the real pre-open for Reliance & Jio Financial price discovery was till 10.00 AM and it opened at a price of 2580 which was more or less what the participants were anticipating.

Let us not take the credit out of Nifty50, after 10.00 Nifty made up the lost ground in a quick rally by 10.30. That was only a start. Nifty made an intraday swing of 232pts ~ 1.18% and the momentum was building up!.

In fact it was banknifty that triggered this outperformance today, nifty was quick to catch up on this opportunity & take out its all time highs. The brand new ATH is 19991.85 just 8.15pts for the 20000 milestone.

I stopped my long call when nifty was at 19540, from there we have gone up 450 pts. This is the first time my own analysis went against me, probably I may not get over that anytime soon!

The expiry was a real jumping up and down game for the traders, multiple times the same OTM strikes swung between the highs to lows to highs. This created a beautiful arbitrage opportunity, to have captured that you should have timed the entry and exit carefully. When the day started I was so uncertain that we will have a high volatile expiry — but by afternoon all my doubts were answered with results!

Whats next?

Infosys declared its results and the signs of slowdown are quite evident. We have a situation where the banks are having good results overshadowing the rise in NPAs and ITs having lower than expected profit potential. Even the results from HUL was not looking good prima facie — but I am not quite sure if these factors will stop the bull run on Nifty! Remember markets can remain irrational till you are ….

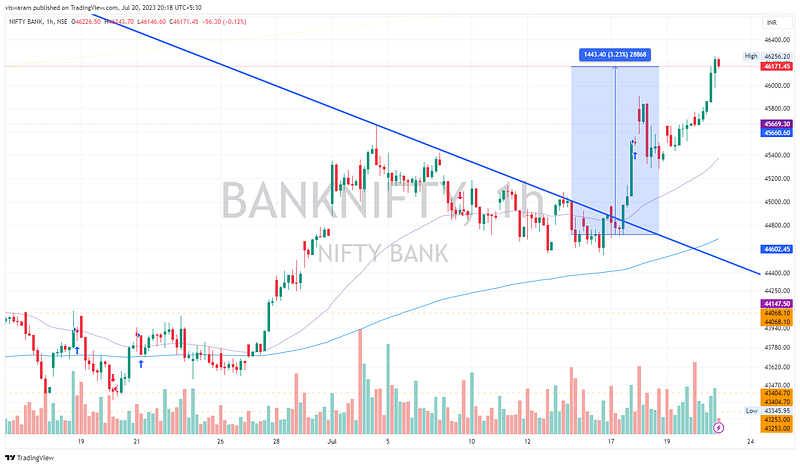

Banknifty Weekly Analysis

Banknifty also outperformed this week, between the last expiry & today it is up 1443pts ~ 3.23%.

Unlike Nifty50 my positional call on Banknifty did not go wrong, that was mainly because we negated a bearish trend line this week. Usually when the trendlines are broken the breakout momentum is so strong that it could take the index to an overbought level too.

Daily Analysis

Banknifty’s 5mts pattern has some story to tell, notice the period till 10.00 where nifty was falling, banknifty held its ground. In fact the real rally did not take off till 11.45. From there it went up 497pts ~ 1.09% by 14.30. This rally from a point of strength gave a steady grip for Nifty to play its natural game!

We made a new ATH of 46256 today, the weird thing is we had a retracement of 231pts ~ 0.5% between 14.30 to 14.50, the pullback to that was more weird — we gained back all those points in the next 20pts.

The expiry premiums for the PEs were quite unrealistic, the premiums were jumping so aggressively that it gave out a lot of easy money minting opportunities. Usually the volatility increases like this during market crashes. Probably this would be the first time where the PUT options were in deep green when the markets were going up.

PS: The trades taken are no recommendation, blindly following them may cause more harm than good — read full disclaimer here