20 Sep ’23 Post Mortem on Nifty & BankNifty | Finally a reversal day

Nifty Analysis

We opened gap-down and well below 20070 which prompted me to go short. The 2nd 5mts candle showed some strength, but that faded away in the next 3 to 4 candles. Firstly I am not quite sure if the change in sentiment was technical or fundamental in nature. There was news about Canada rescheduling the FTA deal, Travel restriction to India, Expelling the Diplomat, NSA flying to London.

Before today most analysts were bullish in India and almost 95% of them did not have a reversal call. Now that Nifty50 has broken some levels — I assume few of them would have changed the plates.

We just fell 1.15% — it is not a big deal. Ideally we should have fallen more than 2%. Secondly the follow through and avalanche effect was missing — meaning the participants have not panicked yet. Our VIX is still 11.12% — up just 2.7%.

On the 1hr TF — the encircled region is the gap formed between 8th and 11th Sep 2023. And today’s prices just stopped right at the top level i.e 19895. For further down move we need that gap to be taken out on the downside just like how it was taken out on the upside. Only then the bears can bring the panic in the markets. Which translates into a 70pts+ gap down opening tomorrow.

My stance has been changed from neutral to bearish with the first target 19815 and then 19747. If Nifty50 is unable to fall below 19895 in the morning session — I will have to change my stance back to neutral.

If you are enjoying this free content, consider subscribing to my free newsletter — click here

BankNifty Weekly Analysis

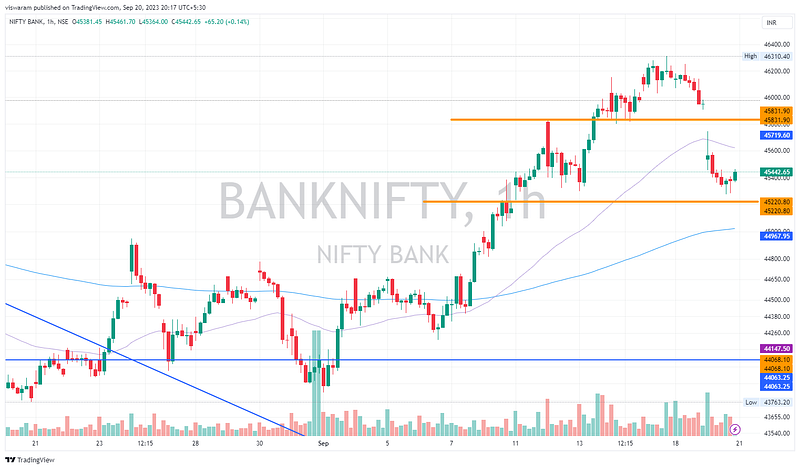

Between the last expiry and today, banknifty has fallen only 0.98% ~ 451pts. Today’s fall was much higher than that ~ 595pts. Most importantly we had a top like formation that got completed this week. And since Banks turn first — we can always consider it as a leading indicator during trend reversals.

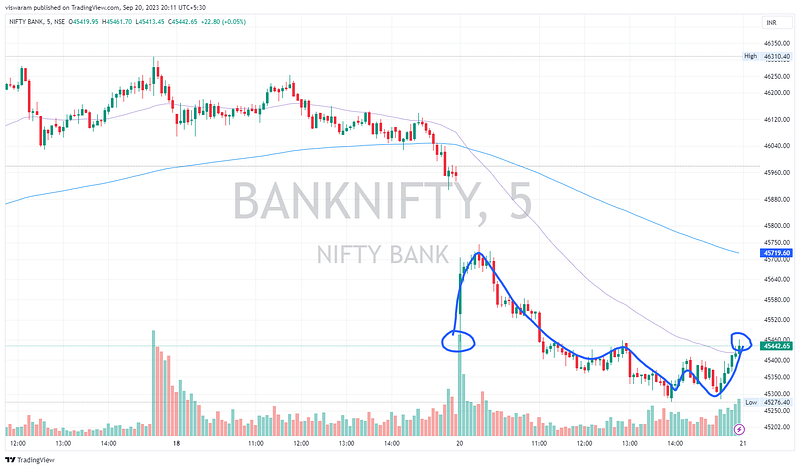

BankNifty Today Analysis

The opening 5mts candle low and the final candle wick high is at the same level. I was trading banknifty more today since it was expiry and the jumps in OTM premiums were more than unusual. Only CALL options had a jump in premiums, PUT options premium did not swing that much.

Even though we had a down day, a fall of 595pts is not at all that severe. If its a dress rehearsal for the events to come — then I totally agree. A look at the PE prices today told me the market participants are not that fearful — if yes we should have seen huge premium spikes.

The 1hr chart is quite interesting. The gap down has created an island day right in between 45220 and 45831. For further downward move we need that support to be taken out in tomorrow’s morning session. I wish to go with a bearish stance and change it to neutral only if banknifty is unable to breach 45220 tomorrow. Also if 45220 is taken out — then 44906 support level will be in play and I assume an avalanche can start.

· Free charts made with ❤️ on TradingView

· You can reach me via email at balu@viswaram.com