21 Aug ’23 Post Mortem on Nifty & BankNifty | Change in Stance for Nifty, but not on BankNifty

Nifty Analysis

On our last day’s report we discussed the possibility of Nifty staying above the 19309 levels. It was with great difficulty that we got a closing below 19309 on Friday, today we opened right there and then had a good rally till 19370 levels.

Immediately we started reversing and fell below water by 10.10. The price action is similar to the 14.00 to 15.00 period. The change in stance did not come in the opening 1hr candle, thats because we did not have a perfect candle outside of the resistance line.

From 10.15 — the path that Nifty took was magical, we rose 129pts ~ 0.67% from the day’s low to high with no real pullback till 15.00. The 2nd hourly candle gave the change in stance signal i.e from bearish to neutral.

On the 1hr TF, Nifty is back in the falling wedge pattern (which is a bullish case). We need to wait for a perfect bullish signal — once we reach the convergence of the descending trendline and the horizontal support, it should break out.

Bears have a case if they can bring down the prices below 19309 again and keep it there for another 1 to 2 days. My stance for tomorrow stands corrected to neutral from bearish.

Today was another milestone when JIOFIN got listed, a demerged entity from RELIANCE — click here for my views on the same.

If you are enjoying this free content, consider subscribing to my free newsletter — click here

BankNifty Analysis

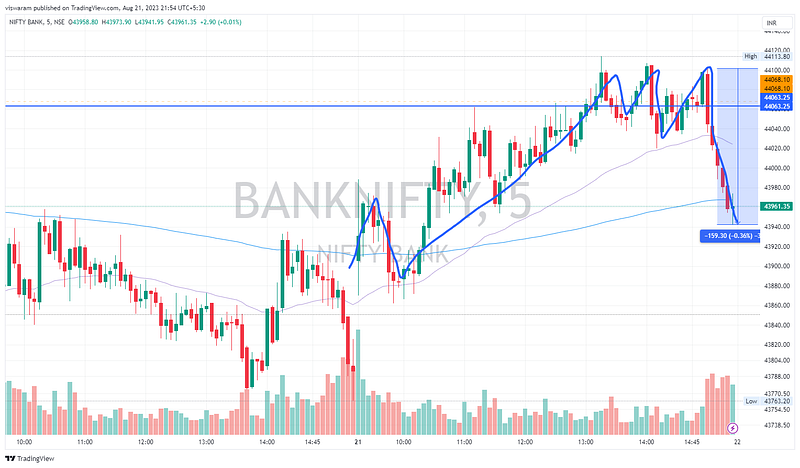

Looking at the way Nifty performed in the morning session, I was quite worried that the stance on BankNifty might also have to be changed. The level that we were looking for was 44068 which is the first resistance zone.

At 13.15 we broke that in the 5mts candle, and then we broke it again at 13.55 — but the momentum was not strong enough. There was a strong fall of 159pts in the last 30mts which would have given some respite for the bears. Basically it was this move that helped me decide to not change the stance.

The moves today were as bullish as Nifty, the only reason was the failure of resistance breach. The foundation of my tech analysis is based on support and resistance — so if we do not get a clear break, then I still consider it as a continuation pattern. This is the case even if the price action is strongly opposing it.

On the 1hr TF, the pattern is quite similar to Nifty — the only difference is that the price is below the SR line whereas its above for Nifty. As long as we are below the resistance in a falling wedge pattern — its still a bearish signal. Meanwhile the convergence is coming up real soon and an upward thrust could shift the momentum in bullish favor. The reason for faster convergence is because the slope is steeper for banknifty. For tomorrow I would prefer to retain my bearish stance until we have an hourly closing above the 44068 zone.