21 Sep ’23 Post Mortem on Nifty & BankNifty — Good follow through from yesterday’s price action

Nifty Weekly Analysis

Nifty has fallen 354pts ~ 1.76% between the last expiry and today. Interestingly the price action on 15th and 18th stands out as an isolated island. Almost 90% of the fall came in the last 2 days which has even changed the sentiment.

Nifty Today’s Analysis

Everyday I write down the next day’s levels, targeted open, close etc — but never have I got it 100% right in the last many years. We had gap-down open and the encircled regions shows how the gaps were recreated on the downside just like we had it on the upside.

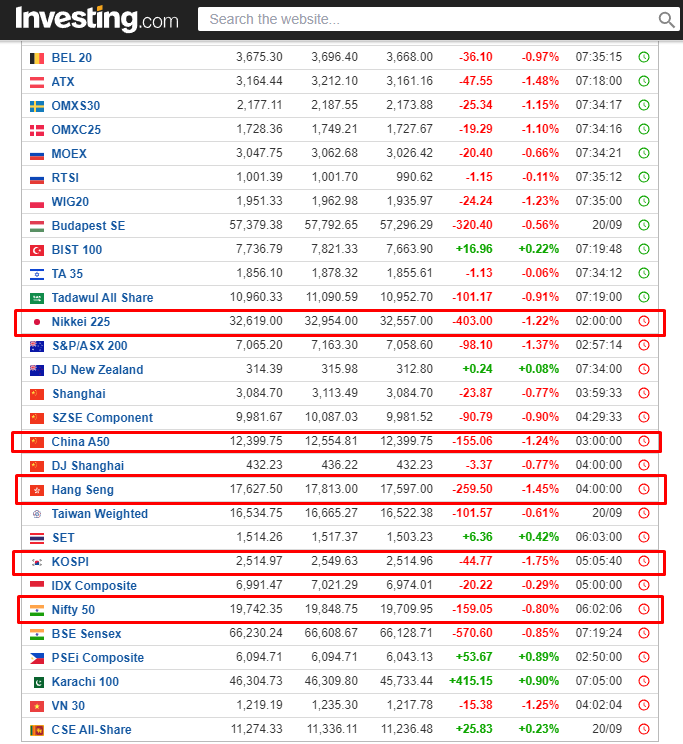

Isolated islands are usually created when there are changes in sentiments overnight. Yesterday we had the FOMC meeting in the US and they decided to keep the interest rate as it is — source. What really unnerved the markets is their decision not to cut the rates till they win the battle against inflation. Ideally that is a negative global macro — and guess what our markets performed better than asian peers in spite of these news.

You are already aware India — Canada tensions are rising and there was news about Halting Canadian Visa services. Still we fell only 0.8% ~ 159pts today.

Japan fell -1.22%, China fell -1.24%, Hong Kong fell -1.45%, South Korea fell -1.75%. Our markets are in a different orbit of its own.

On the 1hr chart — the weakness is visible — but the bears have not gained enough momentum. There is still no panic — VIX fell -2.79% @ 10.8175. Today’s price move is summarized in the first hourly candle — because the next 6 candles have not moved the needle by an inch. I am starting to doubt if the bulls have priced in all the information available?

For tomorrow, I wish to maintain the bearish stance with the first target at 19672 and the second but strong target at 19589. Ideally the bears should be able to close the day below 19589 tomorrow and take out the 19310 early next week. One thing to remember is Nifty50 is still not bearish on the daily time frame whereas SPX is.

If you are enjoying this free content, consider subscribing to my free newsletter — click here

BankNifty Analysis

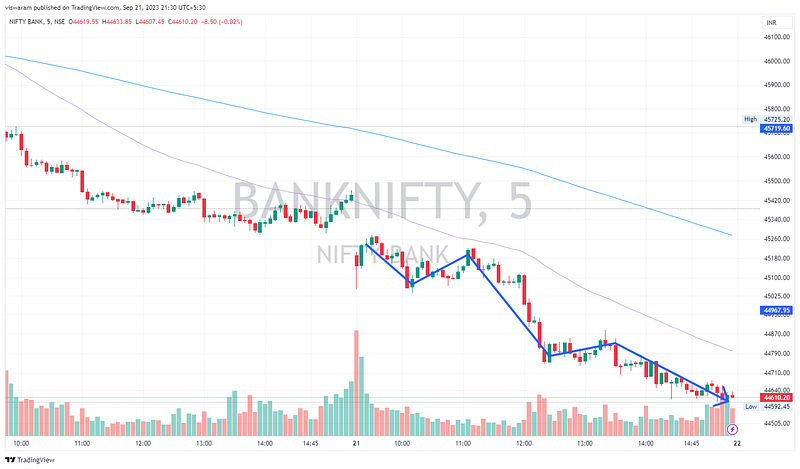

One thing that really gave me confidence in the bearish move was the build up of momentum in banknifty. I did not get this feedback from Nifty, but Banknifty’s pulse gave me hope that further down moves are highly possible.

Since I rely on options flow also to gauge the sentiment — the intensity of CE shorts were too good today especially in the last 1 hour of trade.

Nifty had a flattish day after the 1st hourly candle — but take a look at banknifty. The 3rd candle onwards everything was in RED. 567pts out of 760 came in this period — and the rest points actually came in gap-down. When the market falls in normal trading hours — it gives a boost of confidence vs fall via gap-downs. That is because traders prefer to see the sentiment changing hands.

For tomorrow I am continuing the bearish stance with the first target being 44429 and then 44236. If 44068 gets taken out in next 2 sessions — it is going to be a game changer.

· Free charts made with ❤️ on TradingView

· You can reach me via email at balu@viswaram.com