21st Dec ’23 — Nifty50 Retraces 50% of Yesterday’s Fall — PostMortem on Nifty & BankNifty

Nifty Weekly Expiry Analysis

Between the last expiry and today, N50 has gained 94pts ~ 0.45%. Most importantly we hit a new ATH of 21593 this week and also saw a massive RED candle yesterday. However, N50 was able to defend its fall quite well today. The next week should be full of action as lower liquidity due to holidays may cause higher swings.

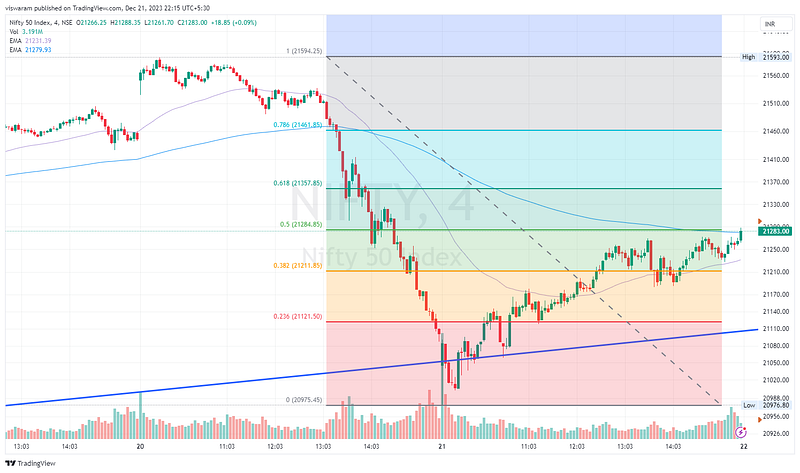

Nifty Today Analysis

Recap from yesterday: “The price action on the 63mts TF does not look bearish per se. But notice the weight of the RED candles — we retraced right up to the ascending channel top envelope.”

4mts chart link — click here

Nifty started the day on a negative note fell to 20976 and then started recovering. The recovery was so strong and convincing that there was no level of hesitation or indecision in between. When the day ended and the price actions were recorded on the chat — it seemed like the domestic institutions came ready with their chest to pump in new buy orders.

From a technical analysis perspective, we cannot hope that dip buyers will step in and do the needful. The best I could do was to draw a Fibonacci retracement level. The final close stands at the exact 50% retracement level. The right setting for a bearish continuation should have been below 21211 ~ 38.2% retracement. The main sector that spoiled the bear’s party today was BankNifty.

63mts chart link — click here

Nifty50 takes support right at the ascending channel showing the inability of bears to overpower the bulls. I am inclined to change my stance to neutral with the developments of today. Giving the bears one more opportunity to prove their mettle, hence going with the bearish stance for tomorrow as well. All they have to do is keep Nifty50 below 21200 in the opening 2hrs for the momentum to kick in — that may require a gap down of 50+ points. Seeing how the US markets have reacted to their GDP report (strong green) — the only thing that could put them in RED would be some pointers by FED saying “…no rate cuts in 2024”

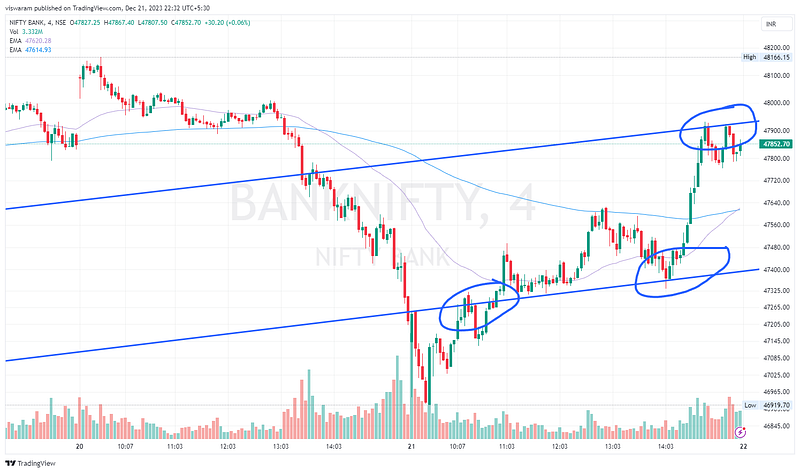

BankNifty Analysis

I initially thought the wolf in the sheep’s costume was NiftyIT today spoiling the fun of the Bears. The real culprit was BankNifty — the way it defended its turf today was more than amazing. Even though we had a lower opening, HDFCBANK was staying strong at one end. You know pretty well that HDFCBK alone can drive up/down the index as its weight on the index is manipulatively sizeable.

4mts chart link — click here

Just like a Tug-of-War, HDFCBK was at the rear end acting as the anchor. It bolted itself to the ground and ensured BN was not slipping. Somehow it worked. The first thing BN did was to retest the lower end of the ascending channel i.e. between 10.07 to 10.55. Once it broke out — it retested the same line from a support perspective i.e. b/w 13.55 to 14.11. The 2nd test was rejected which gave it massive momentum to break free (upside). The next stop was right at the top end of the channel i.e. b/w 14.47 to 15.19. You might have to see the encircled portion in the chart to know what I am referring to.

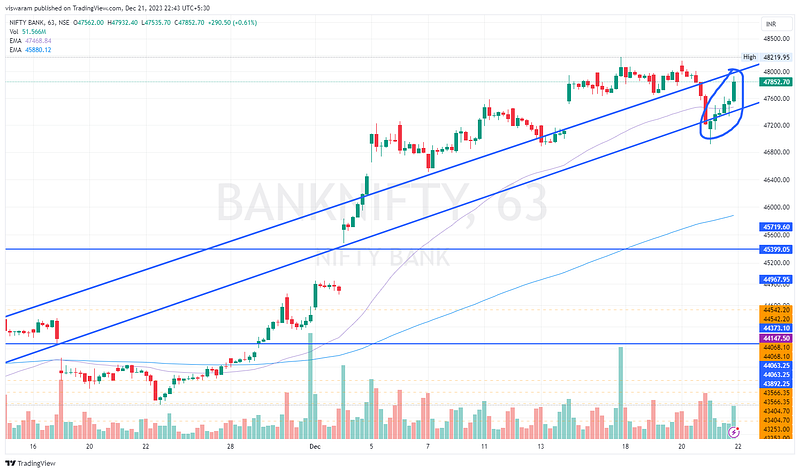

63mts chart link — click here

Can you believe — All the candles today were GREEN. We started at the lower end of the channel and ended at the top boundary stopped only by the bell. Today’s price action almost nullified yesterday’s move and seeing the way BN fought back, I wish to change my stance to neutral for tomorrow. Will go bearish once 47400 gives away and will go bullish if the ATM is taken out. The options premium did not have any excesses today indicating that a big move may not be expected — will update you via TV minds if I see something interesting tomorrow.