22 Sep ’23 Post Mortem on Nifty & BankNifty — Nifty still shows weakness, BankNifty gets a hope

Nifty Analysis

I would say we had a flattish day today and a tight range. Nifty showed the tendency to fall but was eclipsed by BankNifty. There were 2 news events that took priority over the technical moves

- JP Morgan adding India to emerging market’s bond market (GBI-EM Global Diversified)

- Ministry of Finance — saying removal of I-CRR will give ample liquidity for banks

We will discuss both of them below in our BankNifty analysis. But most importantly — when there are news flows — it will always take precedence over the technical analysis. Thats because stock markets are mainly news driven — the element of greed/fear is amplified when news breaks out.

We discussed yesterday that the first target would be 19672, that was hit by 10.00 and things were looking quite promising for the bears. The pullback that started from there went on till 12.50 and would have given some respite for the bulls. However this did not last long and we came back to where it all started.

Nifty closed the day with a loss of 0.34% ~ 68pts on what should have been a strong down day.

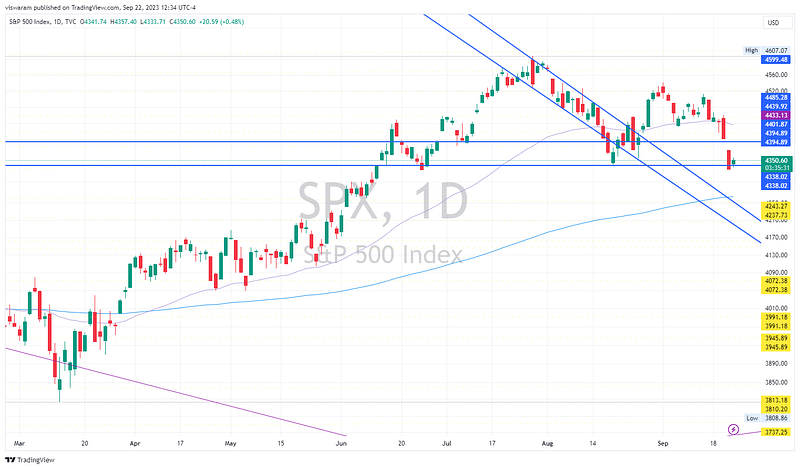

Yesterday SPX closed at -1.64% loss and fell below the 2nd support line into a strong bearish territory. Compare that with India’s stock markets — we are still not there on the bearish scene. The major support is at 19310 which is another 1.8% away. Bears can still go into the weekend party seeing 3 red candles on the daily time frame.

For Monday I wish to continue my bearish stance with the first target being 19563 and second 19484. If the momentum fades and we are unable to pick a direction in the opening 2 hours — I wish to change my stance to neutral to a wait and watch mode.

If you are enjoying this free content, consider subscribing to my free newsletter — click here

BankNifty Analysis

BankNifty was trying to recover from the fall yesterday and it got lucky with 2 news events. Firstly JP Morgan announced its adding India to its Emerging markets bond index — source. Catch the discussion in TradingQNA.

Secondly the news broke out that Govt’s commentary that I-CRR withdrawal will give ample liquidity with the banks — source

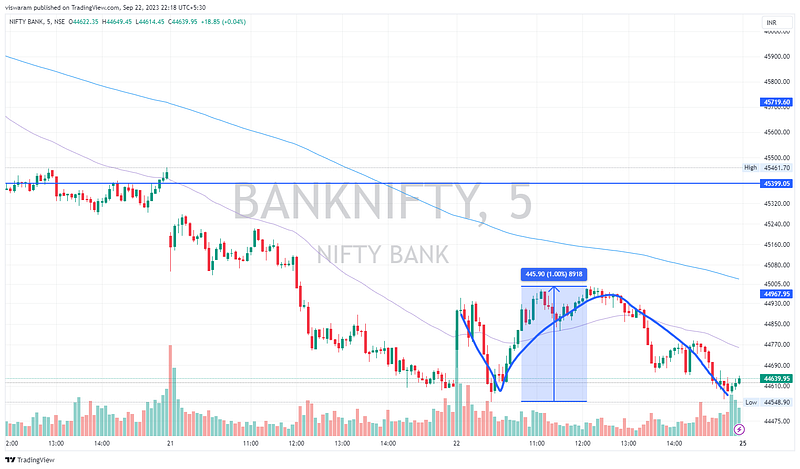

Both the news gave some thrust to Banknifty and thereby Nifty in the forenoon session and helped it avoid a big fall (according to me). BN rallied exactly 1% from the lows hit at 10.00 to a comfortable position by 12.05.

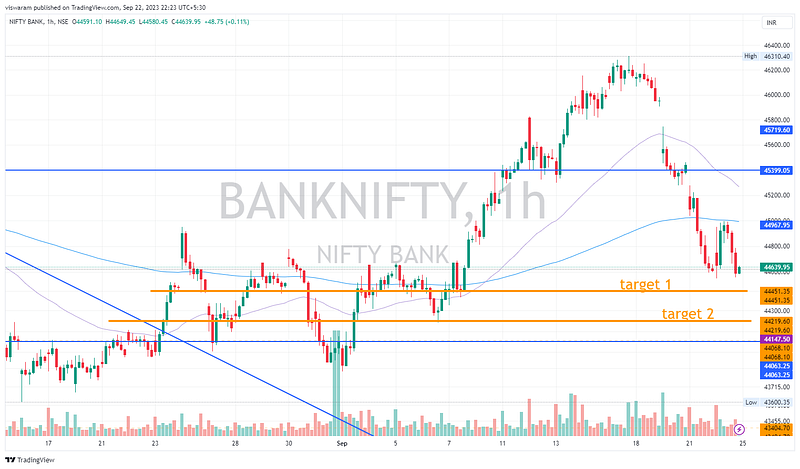

Both the news logically does not make sense for the bank nifty to rally. India’s bond markets meaning GOI bonds are serviced by RBI and the banks may choose to serve its debt — but not directly. Secondly the I-CRR withdrawal news was made on 1st Sep and the ATH hit by Nifty50 was due to this (Please refer to the post-mortems from 01 Sep to 15 Sep for more details).

My targets for BankNifty did not work out today, but I am still continuing the bearish stance for Monday. The first target being 44451 and the second — 44219. In case BankNifty is not breaking the current low in the opening 2 hours — I would prefer to change my stance to neutral.

· Free charts made with ❤️ on TradingView

· You can reach me via email at balu@viswaram.com