22nd Nov ’23 — An Intraday W Pattern — PostMortem on Nifty & BankNifty

Nifty Analysis

5mts chart link — click here

My concept of having a neutral stance meant a day without volatility, not like a day today wherein we had sharp price movements with a flat closing. Nifty opened inline today, retested yesterday’s high, and then started falling. We fell approx 121pts ~ 0.61%. Once it broke the 19776 support line, the length of the red candles kept on increasing showing visible evidence of breakdown. At 12.25 we hit the low for the day and then started reversing.

Quite surprisingly the stop & reverse formed a W (double bottom-like pattern) on the 5mts TF and we took out the 19776 resistance with good-length green candles. Nifty retraced the entire fall and ended the day with a gain of 0.14% despite BankNifty staying down.

1hr chart link — click here

The 14.15 green candle is standing out today showing some evidence that Nifty has respected the 19776 support. No matter how hard Nifty50 tries, it cannot go up beyond a limit till BankNifty joins the rally. I wish to continue my neutral stance till 19875 is not broken out above which I would go bullish. For a bearish stance, Nifty will have to take out the 19562 support.

BankNifty Weekly Expiry Analysis

Between the last expiry and today, Banknifty has fallen 761pts ~ 1.72%. The bulk of that fall comes on just 1 day ie 17th Nov. BN has taken out 2 important supports this week.

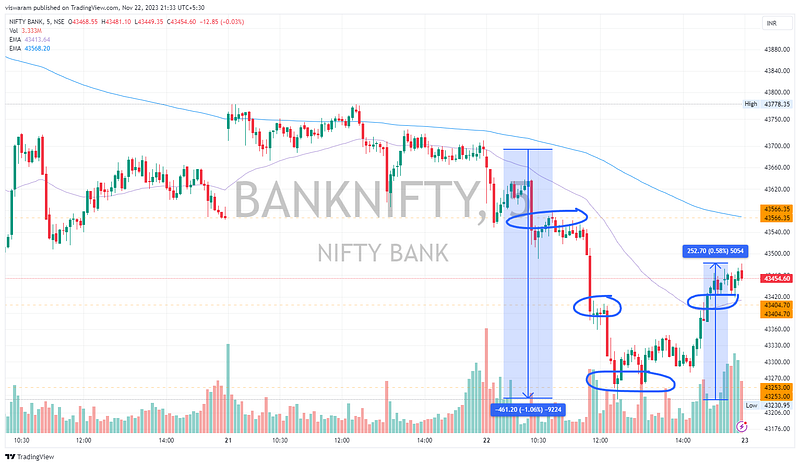

BankNifty Today Analysis

BankNifty was a total support and resistance play today. Unline Nifty, BankNifty did not retest yesterday’s swing high instead it started falling right from the open. We were at the 43566 support level till 10.20 after which it got broken. By 11.45 we broke the next support level at 43404 & that is when I changed my stance from neutral to bearish. I did update via the TradingView Minds on my stance change. TradingView minds is an excellent tool to inform everyone, if you are following me — you get an email instantly.

5mts chart link — click here

The best way to go short today was to sell the calls as it was expiry day. The only way your calls retain value is if BankNifty moved up. After BankNifty broke the 43404 support it went to the next support of 43253 and was rejected. The rejection took BN back above the 43404 level. Reiterating that there is no way Nifty can go up with BankNifty looking bearish.

1hr chart link — click here

BN is right at the 50% retracement from the recent run-up from 42105 to 44400. The 38.2% retracement level is at 43566 🙂, 61.8% retracement is at 43012. It is not quite usual that I get my support and resistance levels exactly in line with the Fibonacci retracement lines. My stance is currently bearish with the first target of 43012 and then 42576. In case we reverse course and go up, it has to take out 44063 before any bullish activity has to resume.