23 Aug ’23 Post Mortem on Nifty & BankNifty | BankNifty goes up like a rocket & India lands on Moon

India created history by landing Chandrayaan 3 on Moon. The 4th country to do so and the first to land near the south pole. — official source.

BankNifty Analysis

We will start with BankNifty today, because we had a reversal pattern today. According to me trend changes are first spotted on BankNifty and hence it works as a leading indicator.

This is what I said in yesterday’s report: Also note that the falling wedge will converge tomorrow, so a strong up move is more dangerous. The bulls will use that opportunity to drive the prices up and it could even take out the 44800 levels in one go. I am not quite sure which of these scenarios will work for tomorrow. I am inclined to go with the bearish stance as its still under the resistance of 44068.

What really happened today is Banknifty took out the resistance of 44068 by 11.05 and went all the way up to 44521. There was a swing of 567pts ~ 1.29% today. Literally BN became the rocket today. We did breakout from the falling wedge pattern and turned bullish.

The same is shown on the 1hr TF, notice we had 4 hourly candles above the bearish trend line. This indicates a breakout usually. Also the candles at 10.15 and 12.15 (before and after the break) were strong enough suggesting a change in sentiment.

Luckily we were prepared for such a scenario today and did not mess up with the existing short position. The reason I took up banknifty analysis before nifty is to show you that Nifty did not have a clean break today. Whereas BN did, the reason could also be due to the slope of the falling wedge. The convergence of the bearish trendline and the horizontal support happened today — so Banknifty had to either breakout or breakdown.

Though I dont exactly know what change in fundamentals caused the breakout, from the technical analysis angle — the move did not come as a surprise. I wish to change my stance from bearish to bullish for tomorrow. If we fall below 44068 in the morning session, I might have to go bearish again.

If you are enjoying this free content, consider subscribing to my free newsletter — click here

Nifty Analysis

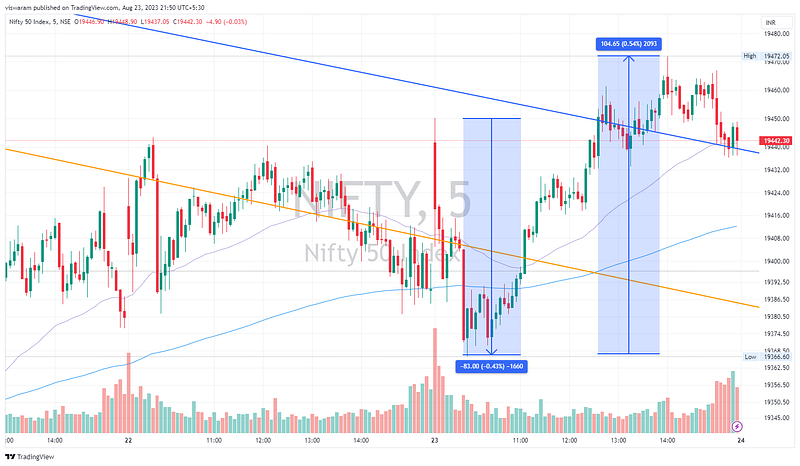

Nifty also closed in the green today but did not have as much momentum as BankNifty today. The first divergence happened in the opening 1 hr where Nifty gave up 0.43% ~ 83pts even after having a gap-up opening. The real reasons for a gap-up opening was not clear as the Global hand-out was not that positive.

Traders including me were looking for breakdown possibilities as the 5mts candles at 09.15, 09.25 and 09.50 had so much force. Since Banknifty started reversing the trend and was showing a breakout possibility, I did not adventure getting into shorts on Nifty50.

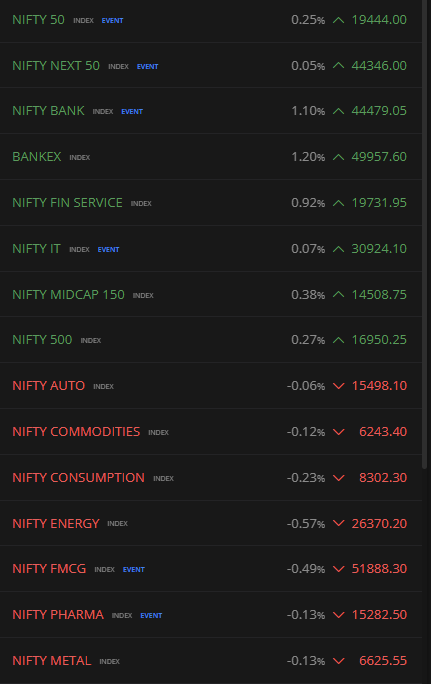

Once the momentum was set by the breakout on BN, Nifty also caught up to it. There were still many sectors in red — Auto, Commodities, Consumption, Energy, FMCG, Pharma & Metal. This indicated that the rally in Nifty will not be as powerful as BankNifty.

The reason I drew 2 bearish trend lines yesterday makes more sense today. If we go by the orange line — it means we already had a falling wedge breakout. If we go by the blue — we are yet to break it.

Tomorrow’s opening minutes will give us the exact answer to that question. Personally I feel we are yet to break out and the blue line is more accurate. To have a real breakout, almost all the sub-sectors also has to be in green.

Since Banknifty has already broken out, the probability has shifted into a similar trade direction for Nifty as well. I wish to change my stance from neutral to bullish for tomorrow. If the breakout fails or we hit the 19310 level tomorrow, I might have to fall back.