23rd Nov ’23 — BN breaks out from a resistance — PostMortem on Nifty & BankNifty

Nifty Weekly Expiry Analysis

Between the last expiry and today, Nifty has just made +50.75pts ~ 0.26%. Some credit should be given to NiftyIT which helped Nifty to stay green when BankNifty was taking deep cuts. Looking at the chart, it is unable to make out even if we had a losing week on BankNifty index (lost 761pts in the weekly series).

Nifty Today Analysis

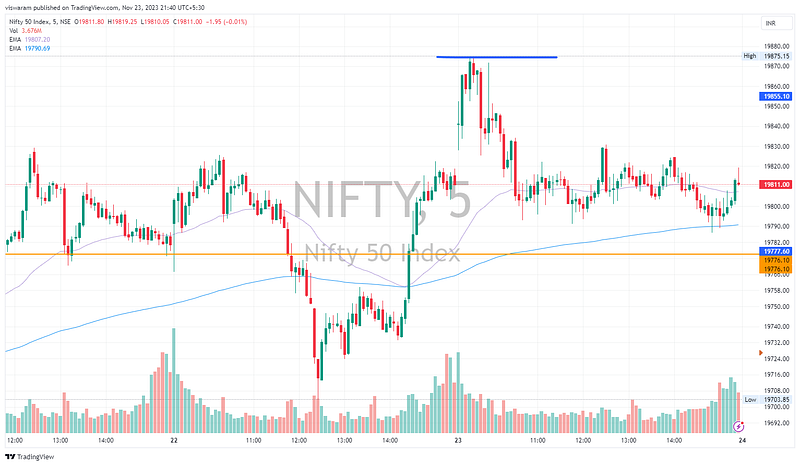

Recap from yesterday: “I wish to continue my neutral stance till 19875 is not broken out above which I would go bullish. For a bearish stance, Nifty will have to take out the 19562 support.”

5mts chart link — click here

The opening minutes gave the impression that 19875 would be broken for good, but that firepower did not last. By 10.00 Nifty made up its mind and started trading sideways. After that initial acceleration, we had a boring price action for the rest of the day. One good thing is that we did not retest the 19776 support level — which shows some indication that we are gearing up for an up-move.

1hr chart link — click here

On 16th Nov we hit the 19875 levels and broke down, today we broke through that same SR level of 19776 before retesting the 19875. Yesterday’s 14.15 strong green candle read along with the opening price action of Today shows some signs that the bulls are trying to get their mojo back. If you have read my previous post-mortem reports, I have been staying neutral since the 17th and it looks like that is going to change tomorrow. As soon as 19875 is broken on the 1hr TF, I would prefer to go bullish. I will update you guys via the tradingview minds section if that happens tomorrow.

BankNifty Analysis

BankNifty made some interesting strides today. After opening inline, it went to the resistance level of 43566 really quickly. By 10.00 we had a close above this level on the 5mts TF. I did update on the trading view minds that, I changed my stance from bearish to neutral because of this.

5mts chart link — click here

Even though we did not go much higher, BankNifty was able to retain the lead and hold the ground. The Final close was also above this level opening up opportunities for further up moves. Fundamentally I still don’t know if the banks have priced in the CAR and risk weight increment news perfectly, but from a technical chart perspective — it seems like the bearishness is almost over.

1hr chart link — click here

BankNifty has a lot of ground to cover to get back at the bullish trend line. The first target would be to take out the 44063 resistance level and give some food for the bulls to charge. Over the last few sessions, I had a bearish view on the 17th & 20th, a neutral view on the 21st, and then a bearish view on the 22nd. Today I have changed the stance to neutral again. At present Nifty and BankNifty are in a neutral stance. Logically the directional bias has to be in sync for both Nifty and BankNifty, that’s when the real magic happens. I am quite sure if BankNifty goes bullish tomorrow, Nifty will also get its stance changed.