25 Sep ’23 Post Mortem on Nifty & BankNifty | Another day of pause?

Nifty Analysis

Firstly my bearish call did not work out today — that disappointed me a bit.Since the momentum has faded — it also makes sense to move to a neutral stance today. Opening was inline and the first 2 hrs of price move were in alignment to the action from friday (notice the continuous blue line drawn).

What didnt make sense was the 133pts ~ 0.68% rally from the lows to 19734 levels by 13.00. Another 60 odd points — we would have gone into the bullish zone. One major news that broke today was NSE’s plan to extend the trading hours to 6 to 9pm as a separate session — source. Looking at the time slot, I guess its to include the office goers into this betting arena.

We are already overdone with daily expiries, adding extra trading hours to bring in more participation may not work in the best interest of everyone except maybe the exchanges. Professional traders will always prefer reform stability over flexibility. If we push it too hard — these people may abandon ship and move to US markets.

SEBI has already said 9 out of 10 people lose money in derivatives. 90% of full time traders are not able to go profitable — how likely is it that part time traders who jump in between 6 to 9pm expect to make money?

Trading itself is a stressful activity, its because we handle the frustration of going wrong along with losing money. 09.00 to 15.30 is usually a period where we remain absolutely focused, distraction free & dedicated. People like me even eat lunch at the trading desk. Just imagine if we have to dedicate 18.00 to 21.00 also with a similar intensity — wont the work life balance be affected?

On the 1hr TF, Nifty will have to break down below 19563 or break out above 19788 for a trend determination. I wish to change my stance to neutral as long as we remain between these 2 orange lines. Personally I prefer if Nifty breaks down and retests the August lows by this Thursday.

If you are enjoying this free content, consider subscribing to my free newsletter — click here

BankNifty Analysis

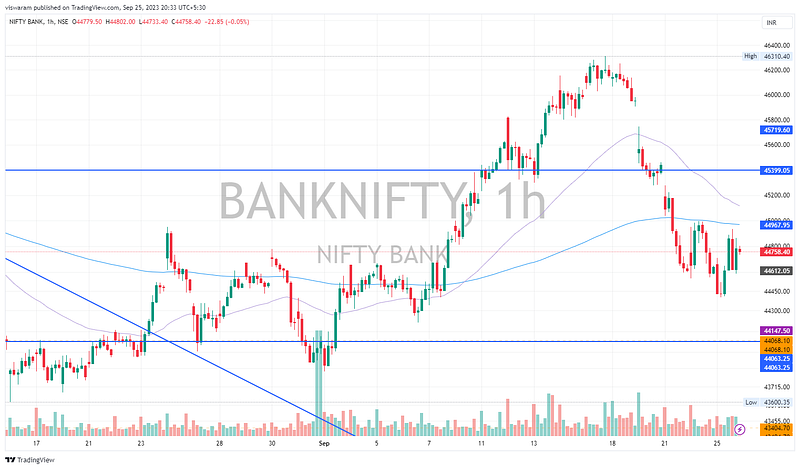

The real reason Nifty50 went sharply up from 11.00 to 13.30 was due to banknifty. In the same period BN added 534pts ~ 1.20%. The spikes in most banks did not have a natural rhythm to it. Most likely this may be due to some news event. I was not able to find any relevant trigger post market hours also.

The chart patterns were similar on ICICI, AXIS and SBIN whereas HDFCBK went in the opposite direction. KOTAK was immensely strong today. If you look at the 1hr chart it still shows weakness — the hourly candle at 13.15 is a strong evidence for that. Even though we had 2 good green candles prior to that — the bears managed to drive down the price @ 13.15.

14.15 the bulls managed to drive the prices back up, but did not get full strength. My first target of 44451 was hit — but it was not enough to build up momentum. As long as BN stays below 45399 I wish to maintain the bearish call. This is in spite of the day ending with a gain of 154pts. I would prefer to change my status to neutral only if we have a range bound trade tomorrow also.

· Free charts made with ❤️ on TradingView

· You can reach me via email at balu@viswaram.com