26 Feb ’24 — Except Energy, all the other sectors down? — Nifty & BankNifty PostMortem Analysis

Nifty Analysis — Stance Bullish ⬆️

Almost all the sectors looked weak today, NiftyIT was the main villain — at a point, it was like 1.7% down. The energy sector ended the day with some meaningful gains, excluding that then everything was either in RED or flat. Interestingly, Nifty did not touch or break the 22051 support level today and due to that we do not think a status change is required.

The near ATM CALLs side had exorbitant premiums last week, most analysts would have even extrapolated to have a 22500+ close this expiry. Today’s price action ensured normalcy returned to these CALL premiums. Meanwhile, the PUT premiums are not elevated as well, so we do not expect a major breakout or breakdown soon.

On the higher timeframe, the flag pattern seems to have played out as per script. Ideally, we should expect the leg2 to start soon, but the premiums are not indicative. Also, we have the monthly expiry this week and things could get a bit volatile before we find a clear trend. We wish to stay bullish and as soon as the 22051 support gets broken — we wish to change our stance to neutral. If 21913 is getting broken in 1 to 2 days — we would even go bearish as the flag pattern will be totally negated.

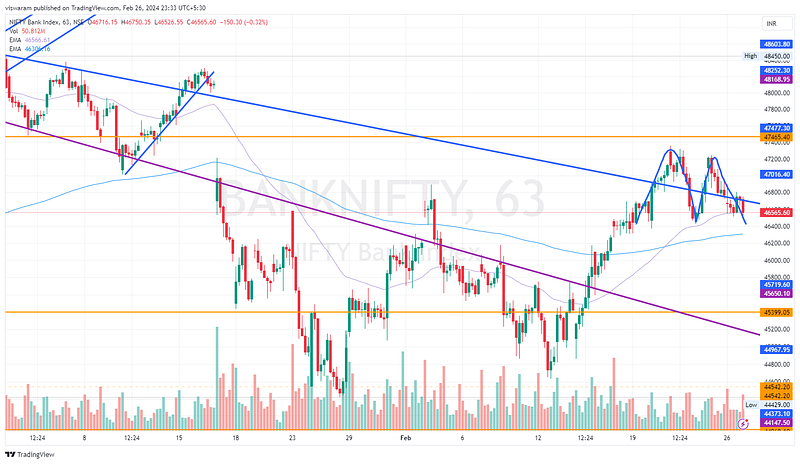

BankNifty Analysis — Stance Neutral ➡️

BankNifty on the other hand was looking weaker. Technically BN only lost 0.5% vs Nifty 0.41% — but the price action & visual impact showed the Banks ceding their bullish control. If you look at the sloping bearish trend line, we opened below that went up for a brief time and then fell back below water. We rejected the resistance twice today showing some signs of the steam cooling off.

On the higher timeframe, we have not yet broken away from the bearish resistance line. But the double top formation also leaves a visual clue. If the bulls had more control of the situation, they should have knocked out the 47465 resistance by now. It all depends on how BN will trade tomorrow and Wednesday. This time around, the torch bearer for Nifty50’s directional trend was all NiftyIT. BankNifty was the laggard and with 37% of weightage, it is quite impossible to rule out the strength of the banks. The first thing we would like to do tomorrow is to find some non-directional trades if BN stays in the bearish channel. To go bullish, BN will have to take out the peak of the double top formation i.e. 47250+ levels.

Algo Trading

Our algo trades ended today with a gain of Rs19367 today, we manually squared off the trades by 14.45 to protect the profits.

· Intraday Algos run via AlgoTest on Kotak

· Webhooks automation run via TradingView on Dhan