26 Sep ’23 Post Mortem on Nifty & BankNifty — Neutral with a bearish tint + FinNifty weekly expiry

Nifty Analysis

Recap from yesterday:”I wish to change my stance to neutral as long as we remain between these 2 orange lines. Personally I prefer if Nifty breaks down and retests the August lows by this Thursday.”.

The prediction came out exactly true, but the trading results today were not satisfactory. Nifty stayed in a very tight range today with no indication of a breakdown.

I assume most traders were looking out for bullish opportunities, the swift move from 11.30 to 13.00 yesterday would have given some hope to the bulls. As soon as the markets opened this bullish case was not that strong, so I was looking out for moderately bearish to range bound trade possibilities.

Since it was the FinNifty expiry today, I committed the margin to a few OTMs of that index. When the opportunity came, I was unable to exit and take positions in Nifty. The opportunity did not last that long because markets were range bound.

On the 1hr chart we are almost at the centre point of the orange lines (support and resistance) i.e. 19562 and 19786. Nifty has to either fall below or rise above one of these lines to make the big move. Personally I prefer if it breaks the support and falls to the 19470 levels by tomorrow. As long as Nifty does not do that — I wish to maintain my neutral stance.

If you are enjoying this free content, consider subscribing to my free newsletter — click here

BankNifty Analysis

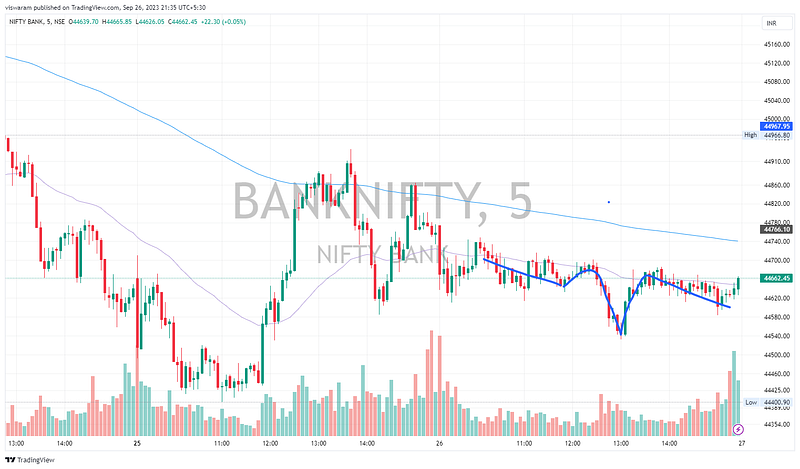

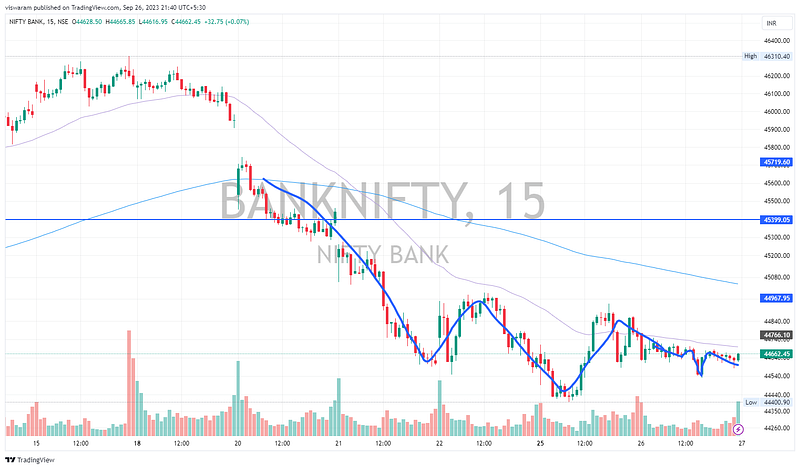

Yesterday I had a bearish call for banknifty, recap: “My first target of 44451 was hit — but it was not enough to build up momentum. As long as BN stays below 45399 I wish to maintain the bearish call. This is in spite of the day ending with a gain of 154pts.”

If you look at the 5mts chart pattern, its hard to notice the bearishness, but if you switch to a higher time frame — it will get more obvious. The only limitation being the lower low is still not taken out. The move yesterday has not taken out the last lower high.

I wish to continue the bearish sentiment as long as the lower high is not taken out on the 1hr TF. Totally accept the fact that this down move has not been an inspiration for the bears yet — but my advice to them would be to wait till 44068 is broken.

If you are enjoying this free content, consider subscribing to my free newsletter — click here

FinNifty Weekly Expiry Analysis

Between the last expiry (18th Sep) and today — FinNifty has fallen 585pts ~ 2.87%. 19th Sep was a holiday due to which the expiry was preponed to 18th. On 20th we had an island day with sharp cuts. 21st also we had an island day but that got faded out as the price move kind of stabilized around those levels.

Few of those points were looking quite interesting on the Fibonacci levels. The moves on 20th near the 61.8% levels. Highs of 25th on the 38.2% levels and the swing low near the 23.6% levels. Personally I would prefer the 0 level i.e. 19424 get taken out before the next expiry.

· Free charts made with ❤️ on TradingView

· You can reach me via email at balu@viswaram.com