27 Mar ’24 — Scary opening minutes and broken support at close — Nifty & BankNifty PostMortem…

Nifty Analysis — Stance Neutral ➡️

Recap from yesterday: “The support of 22051 will be crucial and N50 has to defend it if we wish to go bullish.”

No one would really believe it if we said Nifty50 had an opening low of 21947 i.e. 133 points below the last session close. Well, it was just a blip and we quickly regained the 222051 support/resistance level. From 09.19 to 14.31 Nifty was hovering around this zone with no particular intent to go up or down. In the last hour, Nifty made a quick fall of 50+ points went to 22000, and then closed there. The good thing is that we did not retest the opening lows again and the bad thing is that the momentum we had on the last working day is almost gone.

We drew an inverse Head & Shoulders pattern on the 22nd. If that holds true, we should be getting some assistance tomorrow or the 28th. If N50 is unable to rally despite the IH&S pattern we will quickly change our priority to a small triple top that is forming and go bearish if 21913 support also fails. Tomorrow we wish to maintain our neutral stance.

BankNifty Analysis — Stance Neutral ➡️

BankNifty started the day weak and continued to stay weak. The rebound from the opening low was not as dramatic as N50, we broke the low at 10.03 indicating further weakness. Technically BN only closed 0.56% lower vs Nifty which closed -0.42%, but the visual impact shows more negativity on BN than N50. Firstly because the recovery was almost not there and secondly because we kept on losing the lows.

The chart pattern on BN is not bullish anyway. Even though the numbers look flat & neutral, the chart is screaming bearish. But you know we cannot go bearish until the support is broken or a new lower low is formed — so we might have to be contended with what we have. NiftyIT has made a decent reversal from the interim top, if BN also keeps falling then no way can N50 stay at these levels. Sector rotations do work for a limited period but if we have the financials and IT putting its weight on one side, all the other sectors combined cannot pull N50 back.

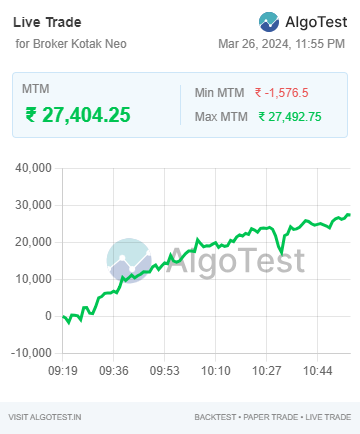

Algo Trading

Our algo trades ended today with a gain of 27404. Exited the trades @ 10.54 and did not want to test my luck after that.

Webhooks automation run via TradingView on Dhan