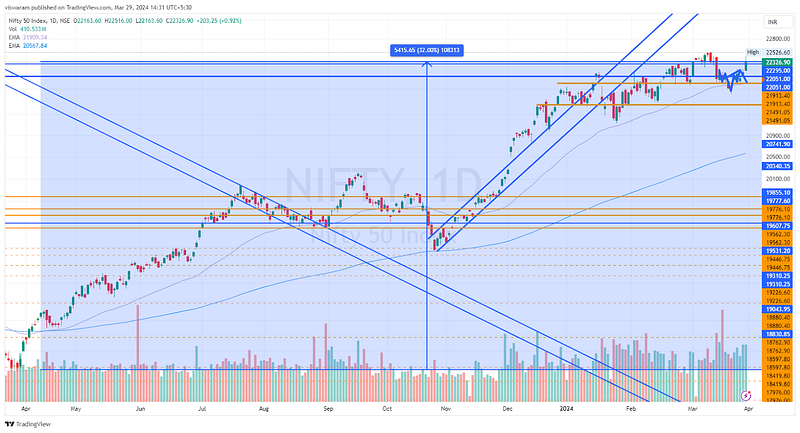

28 Mar ’24 — Nifty up 5415pts 32% this FY, Investors beat traders — Nifty & BankNifty PostMortem…

Nifty Analysis — Stance Bullish ⬆️

Recap from yesterday: “We are still hanging on to the inverse head and shoulders pattern and strongly hope we should have some movement to the 22295 levels by tomorrow.”

Unbelievable intraday price action by Nifty50 today. A rise of 369 points ~ 1.67% and then a sharp fall of 250 points ~ 1.11%. This highly volatile price movement is largely attributed to the year-end rebalancing by the mutual funds both DIIs and FIIs.

What a fantastic financial year it has been for the investors. Nifty is up 32% ie 5415 points in the current financial year. If you look back and assess objectively, it is way above the average returns made by intraday traders. I can vouch for that as my personal returns are not more than 14 to 16% in this period.

Just imagine that, a normal investor who either did the SIP or lumpsum beat an active intraday trader. The former would have gone for a regular job or business and got an additional income whereas the latter would have spent every day (blood, sweat, and tears) in front of the trading terminal and end up underperforming.

These numbers are more than enough to drive away the traders — why take the pain if investing is giving above-average returns?

One thing is 100% sure, things will not remain like this forever. Benchmarks cannot give 30%+ returns every year if you are counting on that — it is a recipe for disaster.

Nifty almost took out the All-time highs today and ended up falling 10pts short. The inverse head and shoulders pattern played out and gave good results. My personal trades today were a total disaster. I was short 22400 CE, rolled up to 22450 CE, and then rolled over to the next weekly as the market was aggressively moving against me. Had to book back-to-back losses. After exiting the 22400 CE by stop loss, it went up another 2244% — totally crazy. And just check what happened in the last 45 minutes — we gave away 250 points. Meanwhile, I decided not to run the Algo’s today and stick with manual trades. If I had gone with the Algos, my entire March month earnings would have been washed out. In the end, made peace with whatever happened during the day. When we start trading on 1st April, we will start with a bullish stance.

BankNifty Analysis — Stance Neutral ➡️

BankNifty made its run today, but nothing as dramatic as Nifty50. We went up 590pts ~ 1.26% and then gave up 443pts ~ 0.93% in the last 45mts. The stance on BN is still neutral. If we had broken the 47465 resistance today and closed above, we would have changed the status to bullish. At one point, breaking 47465 was looking almost certain.

If you look at the higher time frame, you would quickly agree with my view. BN has a bullish edge but is still neutral. For a strong bullish move, the resistance has to be broken, and if we do that we might create a new higher high from the bottom made on 24th Jan. When we resume trading on 1st April, we wish to start with a neutral bias, and go long if we breach 47465.

Algo Trading

Expecting choppiness today, did not run the Algo trades today. In hindsight, that proved to be the right decision. Otherwise, the entire month’s gain would have been wiped out.

Webhooks automation run via TradingView on Dhan