28 Sep ’23 Post Mortem on Nifty & BankNifty — Quarterly, Monthly, Weekly & Daily Expiry Report

Nifty Quarterly Report

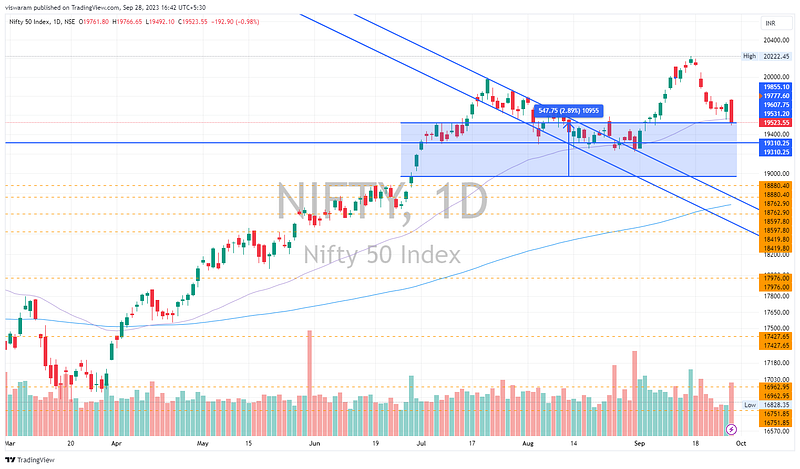

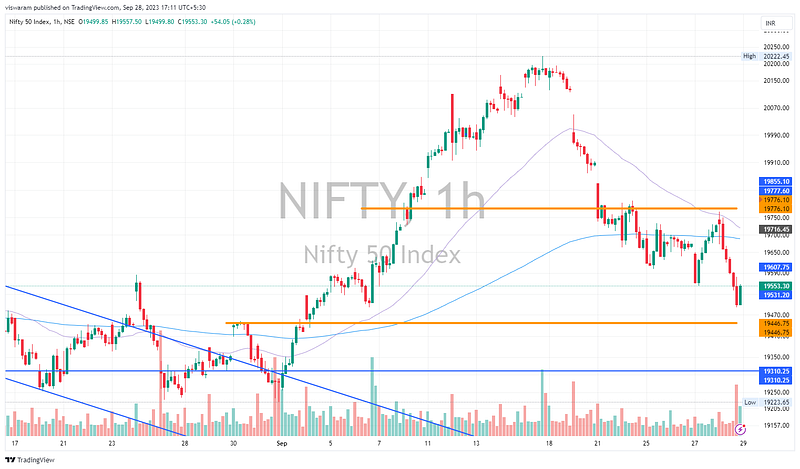

Today’s expiry marks the end of Q2 FY2023–24. Between 28th Jun 2023 to 28th Sep 2023 — Nifty has gained 2.89% ~ 547pts. June 28 was special as Nifty had hit a new ATH that day. It crossed the crucial resistance of 18880 then.

The rally that started on 28th June ended on 20th Jul wherein Nifty hit a new ATH of 19991.85. From 21st Jul to 31st Aug Nifty was in a bearish descending channel. Sep 1st the I-CRR (incremental cash reserve ratio of 10%) withdrawal news hit the markets and then we started another round of rally. We broke the previous ATH and the new high became 20222.45 as on 15th Sep.

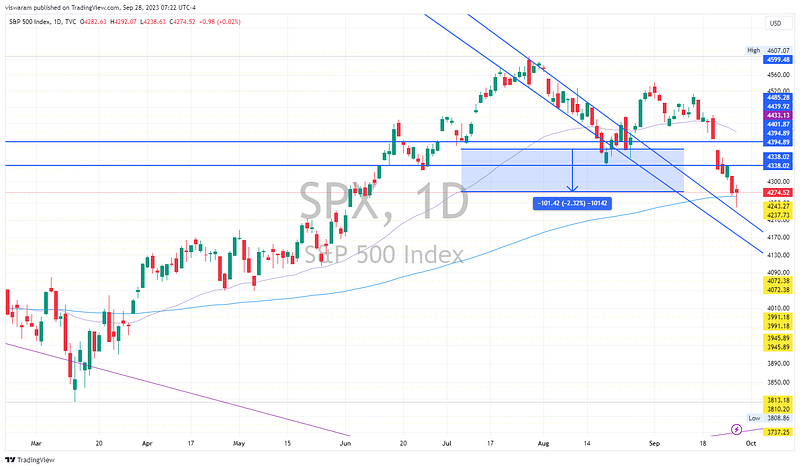

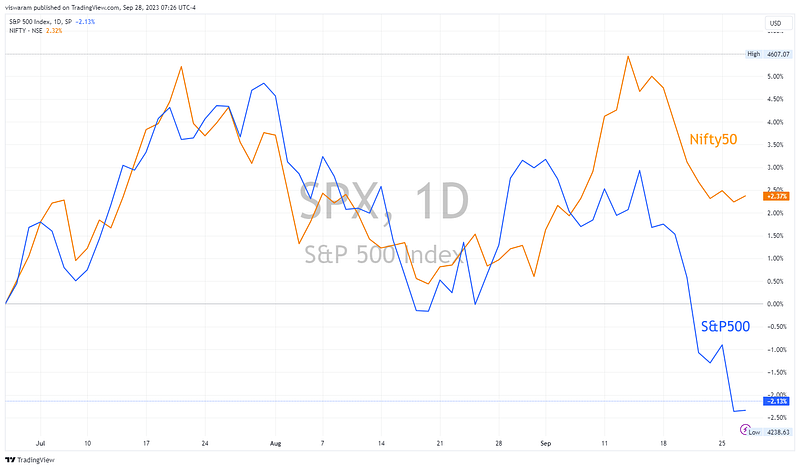

If we compare Nifty50 with S&P500 (SPX), it was down by 2.32% ~ 101.42 pts. A divergence of 5.21% exist when Nifty(INR) vs SPX(USD) is considered and the divergence reduces to 4.5% when both of them are compared in USD currency. Our markets showing great outperformance yet again.

Nifty Monthly Report

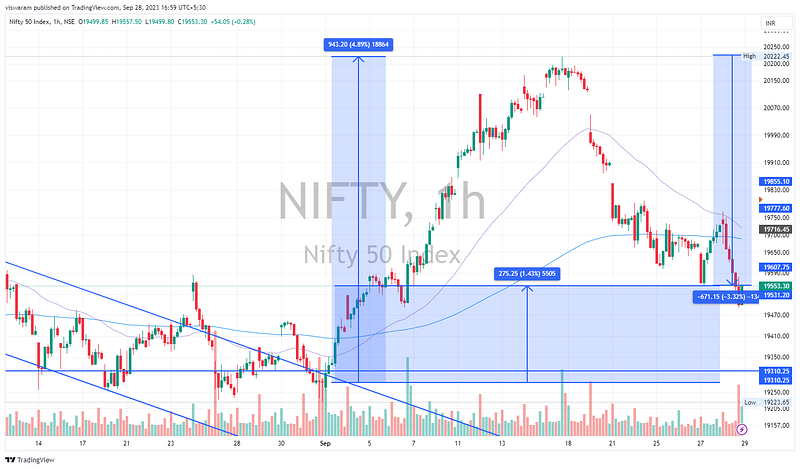

In the month of September, Nifty gained 1.43% ~ 275pts at a headline level. The low-to-high rally was a humongous 943pts ~ 4.89% long which helped Nifty record new all-time highs. From 20th Sep we lost 671pts ~ 3.32%.

Nifty Weekly Report

Between the last expiry and today, Nifty has shed 358pts ~ 1.80% to close at 19553.

Nifty Daily Report

Recap from yesterday: “I am still not changing my stance from neutral as we are still between 19777 and 19562. If we break above 19777 I wish to go long tomorrow, whereas if we break 19562 — I’d prefer to go short.”.

Remember that massive bounce yesterday from 10:30 AM? That got undone in today’s price action. We broke the swing low of 19554 to a new low of 19492. Intraday we fell 275pts ~ 1.39%. From last week I was hoping we would break the 19310 levels in this week’s expiry, but yesterday’s blip shattered that plan.

On the 1hr TF, Nifty is still looking weak. The next target should be 19446 followed by 19310 if are continuing the downward move. In case we reverse and move up, the first level to watch will be 19776. I wish to change my stance from neutral to bearish for tomorrow.

BankNifty Quarterly Report

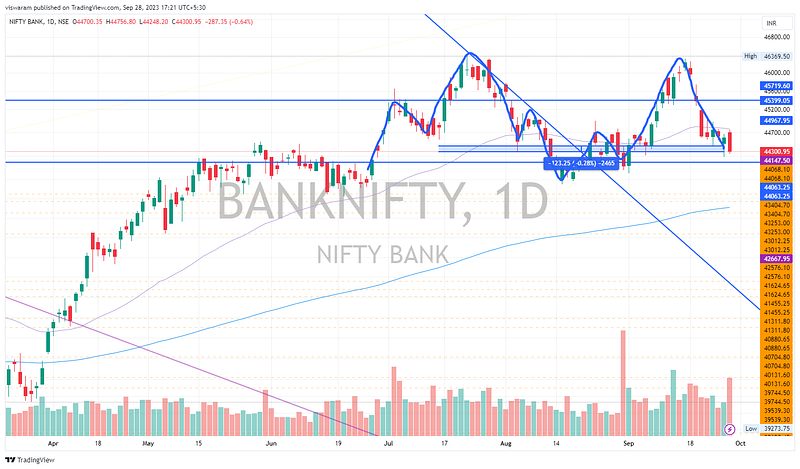

Banknifty is down -123pts ~ 0.28% in this quarter i.e between 28th Jun 2023 to 28th Sep 2023. It had formed a head and shoulders pattern till 16th Aug — but there was no followthrough. A second H&S pattern is underway as the first shoulder formed on 24 Aug and the head by 15th Sep. If you look at the heads of both H&S together — it resembles a double top formation as well. BN has bucked the trend this quarter and closed in loss vs nifty which went up by 2.89%. During this period we hit a new ATH of 46369 on 21st July which is still untested.

BankNifty Monthly Report

In the current month i.e between 31st Aug to 28th Sep 2023, BankNifty is up 214pts ~ 0.49%. The driver of the rally being the I-CRR news which helped BN overcome a falling wedge formation.

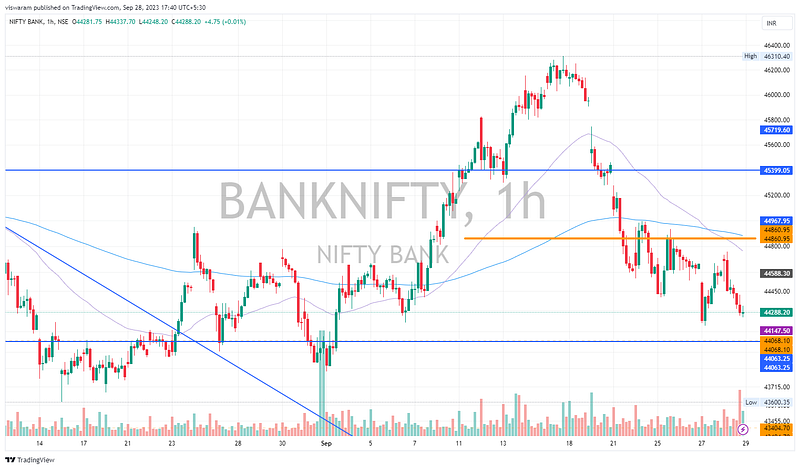

BankNifty Daily Report

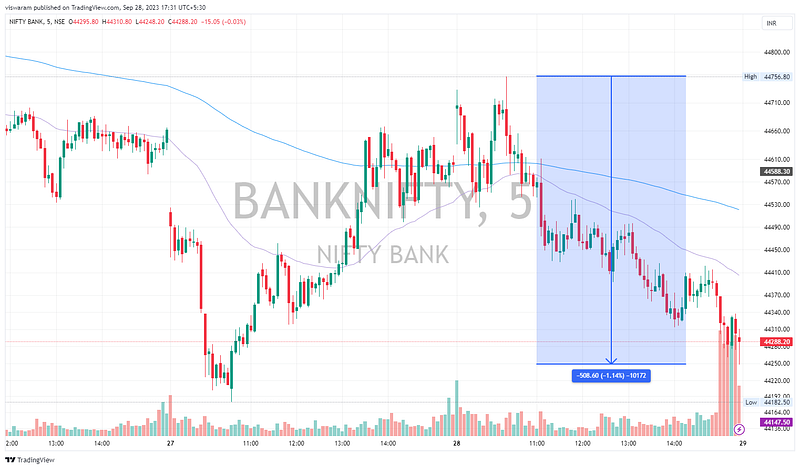

Going today with a bearish view looked totally stupid till 10.20 after which the play went according to the script. Yesterday’s up move might have prompted many analysts to change their view from bearish to bullish. I was not convinced with the move yesterday — in fact, I was totally frustrated as could not find a genuine reason why we rallied. After seeing the fall today — I feel quite relieved.

Intraday we fell 1.14% ~ 508pts — but we did not break yesterday’s swing low of 44182. Also the closing was only 0.64 ~ 287pts down compared to Nifty which closed with losses of 0.98%. I must say Banknifty held its ground quite strong today. Even though the India VIX went up 10.68% today — the implied volatility on BN was far lesser. A look at the PE option prices reveals the story — none of the traders were expecting more than 500pts fall today.

On the 1hr chart I am still bearish with the first target of 44068. The stop and reverse level will be 44860 above which I will be forced to change the stance to neutral. If BN manages to break 44068 tomorrow the next level in play will be 43600 which is also the swing low of 16th Aug.