29 Aug ’23 Post Mortem on Nifty & BankNifty + Weekly Expiry Analysis on FinNifty

Nifty Analysis

Yesterday we had a neutral call on Nifty “Most importantly the 19310 support/resistance stands in between. A break in support may cause Nifty to follow the bearish channel. Whereas a breach in resistance will give Nifty breakout momentum as it exits the falling wedge. I wish to go with a neutral stance for tomorrow till we get some clarity.” You may not believe it, but today’s price action was between the 19310 horizontal support and the descending trend line.

The momentum was just not there to break the support nor break the trend line. We had 3 attempts each and all three of them failed. The open was gapup right at the trend line and we fell to the support by 10.25. From there we had a steady rise till 13.30 where we retested the trendline again but faced rejections.

The 2nd fall to the support came at 14.20 which was quick but lacking force. At 14.55, I seriously thought the support would get breached — instead we shot up to the trendline to close exactly on it.

On the 1hr TF, it seems like Nifty is coming under immense pressure to pick a direction. All clues are hinting at a bullish breakout as the support is too strong to be broken. The only reason the breakout is not happening may be because the big-bears have still not given up or booked profits. If new bears are not taking fresh shorts, then the existing short-sellers may have to run for cover as the market has a natural tendency to move up if it stays like this.

For tomorrow, I have a 60% neutral and 40% bullish view as we are right at the upper channel and above the support. If Nifty is unable to exit the channel in the first 90mts, I will look for neutral positions only. And if the lower channel is tested — I would like to convert my current positions to bearish ones.

If you are enjoying this free content, consider subscribing to my free newsletter — click here

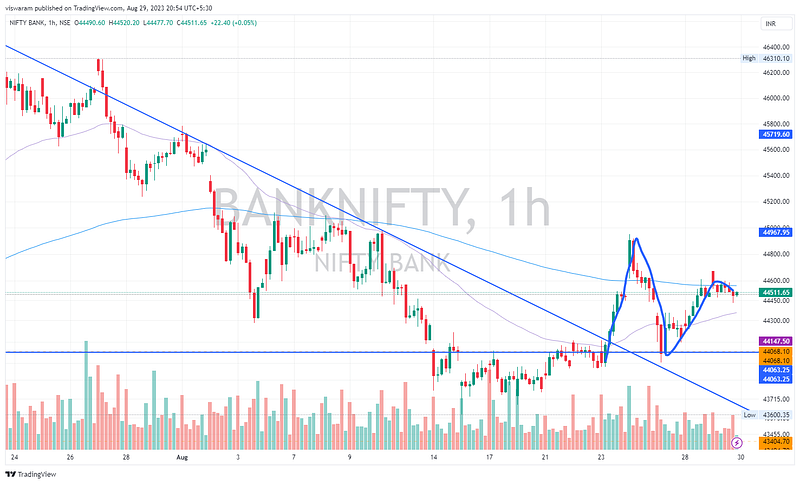

BankNifty Analysis

Yesterday I had a bullish call for banknifty, but we ended up the day flat. Although the bulls got the gap-up above the swing high of yesterday — they were unable to capitalize on it.

Since there was that gap up, the slow but falling price action ensured that the index is not closing in red. Intraday we had a fall of 239pts ~ 0.54% which is nothing compared to the usual strength of banknifty.

I was joking in our trading discord group that, today being the ONAM festival (regional festival of Kerala), the big-boys would have gone for the mega feast (sadhya) that they preferred not to swing the markets that hard.

If we look at the 1hr chart, the bullish momentum should come soon. Firstly because the support is still strong and secondly we are out of the falling wedge. Today might have been a resting day probably — I am personally expecting some serious movements either tomorrow or by 31st Aug.

I wish to maintain my bullish stance for tomorrow and would prefer to remain a bull till the support is not taken out.

If you are enjoying this free content, consider subscribing to my free newsletter — click here

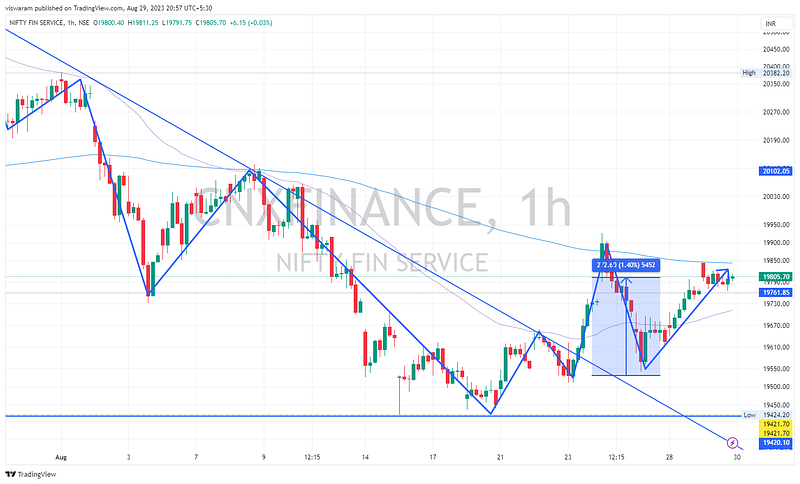

FinNifty Weekly Analysis

Between the last expiry and today, FinNifty has moved up 1.4% ~ 272pts in what looked like a show of strength by the bulls. Since this came right from the trend line, the scales are now weighing for a bull run.

We have broken the falling wedge pattern and the support of 19424 looks quite impenetrable. Today was a flat day for FinNifty but the inability to drive down the prices will give some added boost to the bulls by tomorrow & 31st Aug. Already FinNifty and BankNifty have given enough clues to Nifty on a possible trend change from bearish to bullish on the 1hr and 1D time frames. Slowly but surely Nifty should follow the financial sectors to outperform unless the NiftyIT has some stories to tell. I wish to maintain a bullish stance on FinNifty till the support of 19424 holds.