30 Aug ’23 Post Mortem on Nifty & BankNifty | Still wondering why we fell 111pts in the last 2…

Nifty Analysis

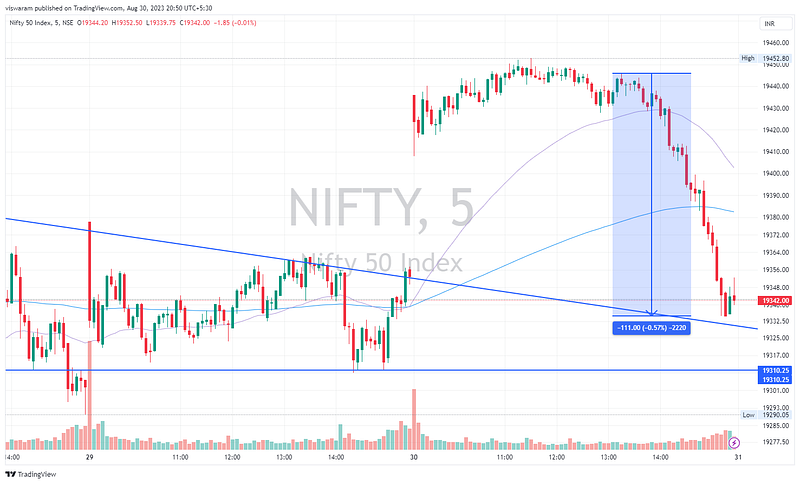

This is what I wrote yesterday — “For tomorrow, I have a 60% neutral and 40% bullish view as we are right at the upper channel and above the support.”. Never did I believe we could have a neutral closing today after the big gap-up open. Even till 13.15 there was no sign of weakness and Nifty was looking & staying strong.

Luckily Nifty is a notch above the bearish descending channel. Still giving hopes to the bulls. I still have not figured out the reason why we fell 111pts after that. Was it the China news of stimulating the economy, cutting taxes on stock markets, a warning of distress or the German CPI or the US GDP expectations? I still dont think the Rs200 cut on LPG cylinder by the Oil Minister & then the comments that it will come as Govt. Subsidy and not from OMC’s margin would have triggered this fall.

This move has opened up multiple possibilities for the monthly expiry tomorrow. Let us discuss them.

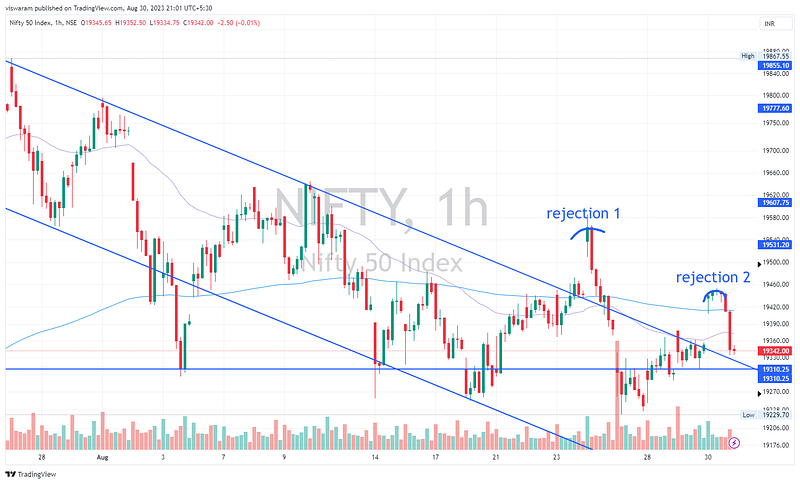

On the hourly TF we now have 2 rejections when Nifty tried to breakout from the bearish channel. Both of them had strong selling momentum which indicates the Big-Bear is still alive & kicking. If we take out the descending channel — the chart pattern will appear like a lower high and lower low in which the lower low is not that intense.

For tomorrow I wish to keep a neutral view till 19310 is not taken out and if it does — would wait for the swing low of 19229.7 to be taken out to go short. When going short, I would expect a new lower low to be formed. Meanwhile if Nifty stays strong and respects the support — I will still keep my fingers crossed for a breakout momentum.

If you are enjoying this free content, consider subscribing to my free newsletter — click here

BankNifty Analysis

The intensity of the fall was much more profound on BankNifty rather than Nifty. Right from the gap-up open the CE options premiums were commanding more premium than usual indicating a strong directional move. As soon as banknifty started falling this elevated premiums went away further indicating that the trader’s expectations were not matching.

I would like to see the move as more of a long unwinding rather than fresh shorting due to this observation. We had a total intraday fall of 1.39% ~ 623pts. When the banks started falling, I thought it might be some news related to Jio Financials. With the funding and tie-ups they could even start a lending business along with the insurance. Since they have the Blackrock tie-up, starting a broking service is also quite feasible.

On the 1hr TF, banknifty has just made a M pattern (double top) with a common support point. This makes the directional move probability for tomorrow quite lit up. I wish to stay neutral as long as the 44068 support is held, below which I would like to go short. To go long 44800 has to be broken again.