30 Jan ’24 — Nifty Gets a Downgrade after Yesterday’s Upgrade — Nifty & BankNifty PostMortem…

Nifty Analysis — Stance Neutral ➡️

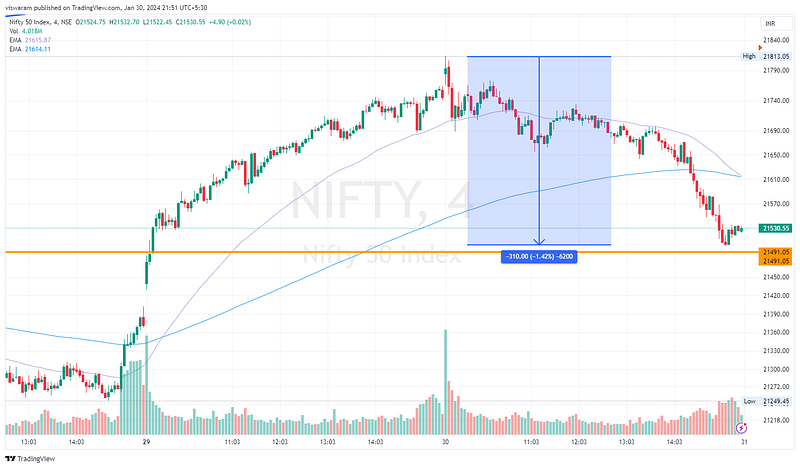

It is too early to say if the move today was due to the News impact that said “The US would give a fitting reply to the actions of Iran”. For us, it looked like a technical cool-off. We made the mistake of upgrading Nifty from neutral to bullish yesterday despite getting all 6 green candles. Today, we lost in a similar fashion 5 out of 6 63mts candles in RED. Most importantly we are back at the support level of 21491 where Nifty paused. Interestingly BankNifty did not fall that much, and neither did the NiftyIT — the pain was mostly for RELIANCE, Bajaj Finance, Titan, and ITC.

We are back at square 1, the same support/resistance level of 21491 which we hit on 15th Dec 2023. In the last 1.5 months — we have gone nowhere. Seems like the Foreign Institutional Investors and DIIs took us for a roller coaster ride — and most of the retail traders are throwing up after the ride. After the meltdown today, we are changing the stance from bullish to neutral. Gap-down open is the best way to take out the support. If we break the next target to watch out for will be 21292 followed by 21199.

BankNifty Analysis — Stance Neutral ➡️

Strange-looking 1st and 2nd candles and then a flat price action all through the day. It is quite commendable that Nifty’s bearish ghosts did not haunt BankNifty today. Even though we closed just below the SR zone of 45399 — the price action did not give a clear clue if it was bearish or bullish.

Maybe BankNifty was in a wait-and-watch mode, allowing Nifty to decide on the direction first and then follow suit. For the straddlers, it was a field day today as the flat price action would have given most of them good gains.

BankNifty cannot stay flat like this tomorrow and the day after. We have the expiry tomorrow and the Budget announcement on 1st February. Most likely Nifty will pick a direction soon and 99/100 BankNifty will align itself with the broader trend. Our neutral stance continues for tomorrow, but we are quite excited to see the option premium spikes during closing minutes today. The first thing BN has to ensure tomorrow is to reject the 45399 resistance and then hope the Bears score their goal.

Our BankNifty algo trades ended today with a profit of 1617 per lot