3rd Nov ’23 — The gap-up gave the trend change indication — PostMortem on Nifty & BankNifty

Nifty Analysis

The gap-up took out my resistance of 19226 and was forced to go long. I was eagerly waiting for the 19310 to get broken so that the bullish momentum was done and cemented. This did not happen as Nifty was out of steam by 11.00.

The 14.30 to 14.50 price action looked scary though, assuming the FIIs would have offloaded their selling positions in this window.

On the 1hr TF, Nifty has made an odd-looking W pattern, technically its a bullish sign but we need confirmation of the same by taking out the 19310 resistance soon. These bullish price moves could be highly shortlived as well because its just a reaction of market participants to the FED’s announcement yesterday.

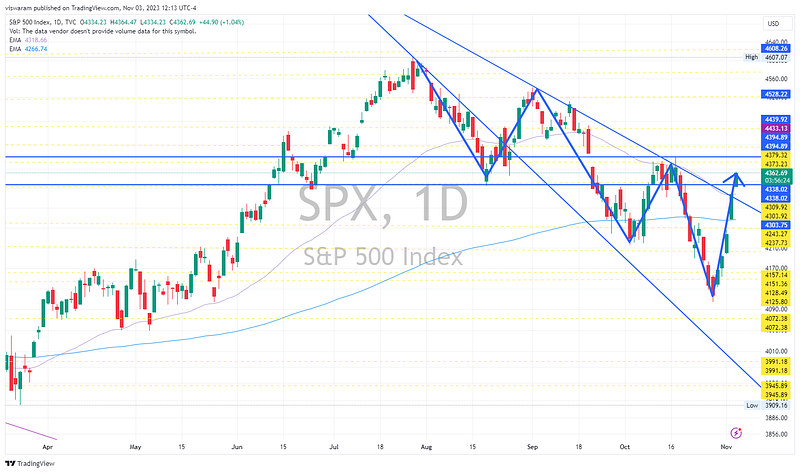

Just for reference, I have pasted the SPX chart herewith. Could this relief rally be just another lower high in the making? When the global macros are that bad and the earnings are weak, there is every possibility for the bear run to continue. So if you are a bull, enjoy till it lasts.

BankNifty Analysis

We had a gap-up open of 291pts ~ 0.68% followed by a range bound trade till close. It was a support/resistance play all along. See the blue encircled regions. BankNifty took support from the 43253 regions between 09.15 to 09.50 and was rejected at the resistance of 43404 at 10.55.

We made another attempt at 14.25 to take out the 43404 level, but that too failed. I can say with some confidence that the reason Nifty50 did not take out the 19310 was due to the inability of BankNifty to break out from 43404 levels.

A 15-minute TF will explain that better. The next major resistance comes at 44063 which is 600+ points away. So if BankNifty has to go there, then the breakout from 43404 has to be super strong. It is pretty difficult to generate that level of momentum during trading hours, especially with the implosion of volatility. The best option is to jump via gap-ups.

The W pattern is quite evident for BankNifty also, which is again a bullish indicator. I am changing my stance to bullish and hoping that we take out the 43404 levels by forenoon Monday.