3rd Oct ’23 — The opening 5mts candle has a story to tell — PostMortem on Nifty & BankNifty

Nifty Analysis

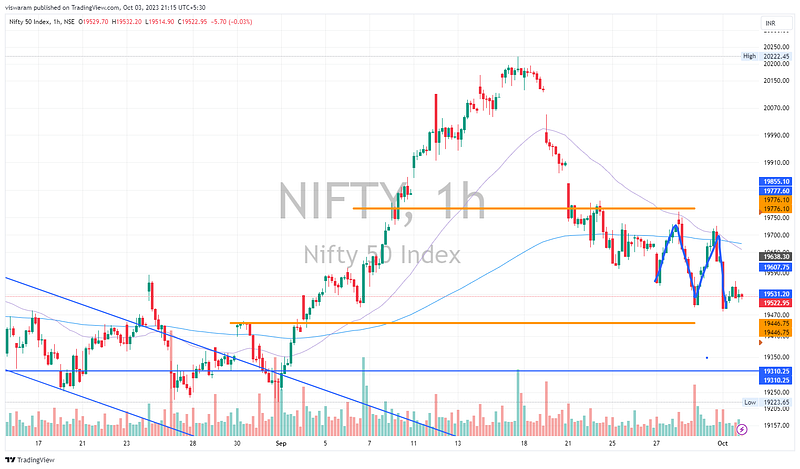

Recap from yesterday: “My stance still remains bearish with the first downside target of 19446. The moment we break 19776 on the upside — I wish to exit the short stance and go long.”

The first target of 19446 was not today even though we dropped 103pts in the opening 5mts. The low of today was 19479 breaking the recent swing low of 19492. Two surprising things happened today

- The strength of the opening candle — unbelievable and unexpected.

- The reluctance to fall after that — shows true ruggedness.

Usually, strong candles like that play out when there is strong news/event flow. I dont remember reading anything in particular before the trading session. Secondly, the character of the market to remain calm after such an opening is again unbelievable.

As I write this article SPX is down -1.47%, NDQ -1.7%. Remember most markets had a RED September — so comparatively we are still the top most performing market. My point is — if a global fall is getting underway, our markets will have more points to lose in absolute terms.

The orange support and resistance lines remain the same, the bottom one is @ 19446, top one at 19776. We just completed an M pattern (double top) on the 1hr TF. For tomorrow I continue to remain bearish with the support getting broken in the opening 1hr. Ideally, we should retest the 19310 support if not break it.

BankNifty Analysis

For today I had a neutral stance instead of a bearish one — mainly because we made a double bottom pattern in the last session. But the opening 5mts candle simply negated that in one go.

Still, Banknifty was staying relatively strong versus Nifty. Both of them did break the swing low — but BankNifty’s recovery was more convincing. Bulls should not take it as a good sign — because the fall and the recovery look like an inverted flag. Since it’s on 5mts TF — it may not have that much significance yet.

On the 1hr TF — the W pattern stands negated. We now have an M pattern. If the preceding peaks are considered with a bearish tint — we have a double M pattern or a quadruple top. The only relief for the bulls is that the index is not making a lower low. For tomorrow I wish to change my stance from neutral to bearish and hope that the 44068 gets taken out.

FinNifty Weekly Expiry

Between the last expiry and today, Finnifty has lost only 80pts ~ 0.4%. The options premium was staying pretty low today also, one of the reasons could be the 4-day expiry as we had a holiday yesterday.

Strangely FinNifty is not looking as bearish as BankNifty — I am still inclined to go neutral on the 1hr chart. Also, the first support of 19421 looks pretty far away. In case FinNifty outperforms BankNifty — then the stocks to watch out would be the Bajaj Twins