5th Oct ’23 — Gap-up takes out my stoploss — PostMortem on Nifty & BankNifty

Nifty Expiry Analysis

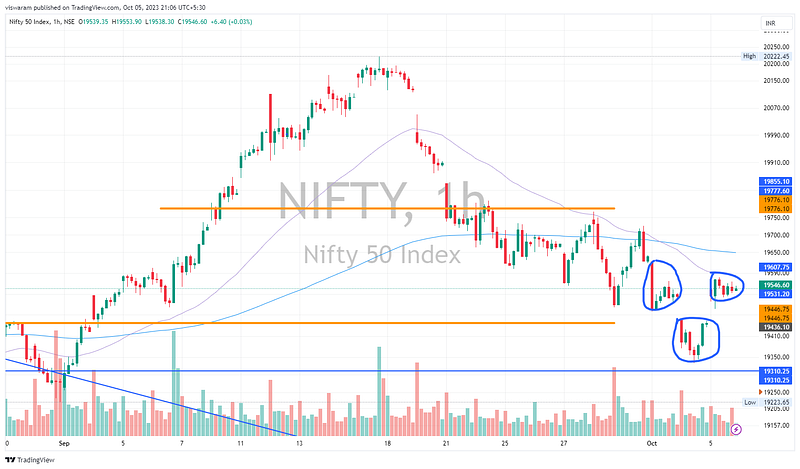

Between the last expiry and today, Nifty has only lost 6pts. Quite a rarity to see a flat close especially when we had some strong preceding moves. The recovery today gave Nifty a strong character change as well. It was looking a lot negative yesterday and further fall was looking obvious.

Nifty Daily Analysis

Recap from yesterday: “The next support level of 19310 fell short by just 0.1%. If the current momentum holds — then it should be tested and taken out by tomorrow.”. I must say — it did not go as per this plan. We not only did not break the support — but we went back and broke the resistance. Today’s move took out my stop loss and also messed around with the expiry trade.

The gap-up opening of 0.5% ~ 97pts was a true show of strength. Although I am not quite sure what changed fundamentally overnight. We did not close the gap today even though we had a slight fall towards 19486 levels. Then the 2nd leg of the boost came at 10.45 which took Nifty up by 89pts ~ 0.46%. From there we almost went sideways and closed with no further drama.

On the 1hr TF we have 3 distinct formations. A strong red candle on 3rd, a gap-down hammer on 4th, and then a doji today. If we had a full green body candle today — it would have been a morning star formation.

A morning star formation is usually a strong bullish signal that forms at the end of a bear run. Although we had a good green day today — the body of the candle was not good enough. So I am not changing my stance from bearish to bullish instead, I am going with a neutral stance for tomorrow. The support and resistance levels of 19446 and 19776 still stay as it is — a break on either side will shift my stance in that direction.

BankNifty Analysis

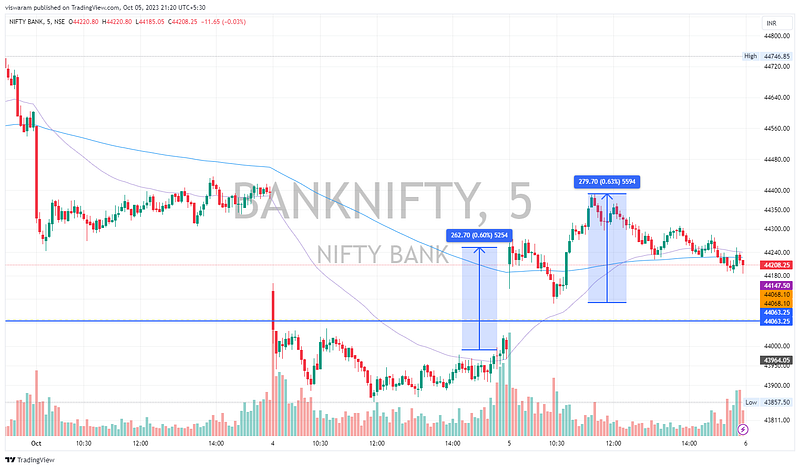

BankNifty had a similar chart pattern as that of Nifty. An opening gap-up of 272pts ~ 0.6% and then a 2nd leg of rally from 10.30 of 279pts ~ 0.63%. The only difference I saw was that after the day’s high was hit — BankNifty started falling gradually whereas Nifty went flat.

Tomorrow’s RBI MPC outcome at 10.00 might be interesting. We would like to see how RBI governor is planning to suck the liquidity out. The I-CRR implementation and then its withdrawal created a ruckus last time. Markets fell first and then recovered equally. If the liquidity is left unchecked — the costs of goods & services will keep getting inflated. Unlike other developed countries — we do not want to hurt the growth and the growth in inflation is not hurting us.

I do not wish to change my bearish stance on BankNifty despite an up day today. The M pattern at 44650 levels are looking quite strong for me and until BankNifty takes them out — I do not even plan to go neutral as well. The biggest enemy of the bears is the implied volatility — the options premiums are not expecting a massive move this week even though we have an RBI event. Option sellers are having a tough time these days — I still think it’s much better not to trade than sell strikes cheaply.