6th Oct ’23 — Show of Strength, Change in Sentiment — PostMortem on Nifty & BankNifty + RBI…

Nifty Analysis

Recap from yesterday: “Although we had a good green day today — the body of the candle was not good enough. So I am not changing my stance from bearish to bullish instead, I am going with a neutral stance for tomorrow.”

Everything went in the bull’s way today. The opening was gap-up followed by a steady upward-looking rally. Even though we had the RBI MPC meeting today(we will discuss in detail in the BankNifty postmortem below) — it had nothing for the bears. As it stands Nifty has managed to come out from the bear’s grip.

On the 1hr TF Nifty is still between 19446 and 19776 support/resistance levels. But the gap-up formation on consecutive days and the island formation have really shifted the sentiment from bearish to bullish. We have to take out the 19710 and 19776 levels too for a strong bullish momentum to pick-up. Mainly because we had some strong red candles at those zones.

Look at the US VIX (blue) vs India VIX (orange). Global markets are at extreme fear whereas Indian markets are at extreme greed. Need to know how long this decoupling lasts. For Monday, I wish to continue my neutral stance but keep my options open for bullish moves. The moment 19776 is tested and broken — we can expect further participation to take Nifty much ahead. For the bears to make a comeback — the US markets have to close in DEEP RED today.

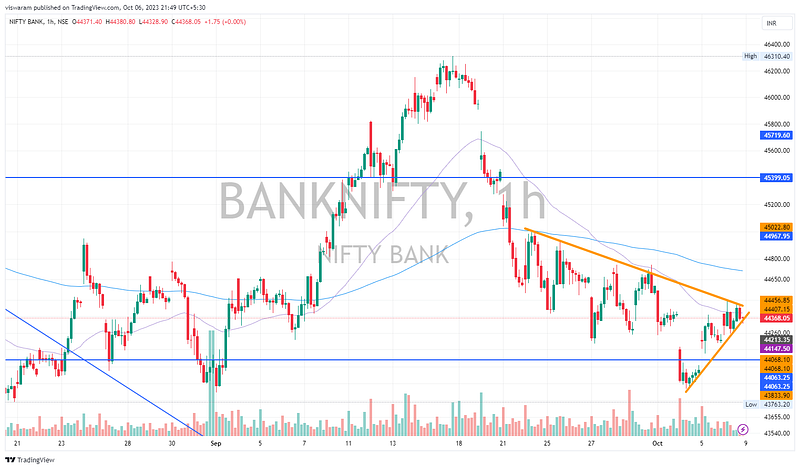

BankNifty Analysis

I had a bearish view for today, but it played out as a bad day for the bears. The RBI MPC meeting at 10 am did not move the needle that much. Usually, the RBI Governor’s speech drives up the volatility and we have some adverse moves.

There was one strong move of 250pt from 10.50 to 11.20 where we pulled back from 44500 levels. Even then the options data did not get excited — and we knew that the fall was not going to last. Rightly so, Banknifty recovered quite decently and ended the day with good gains.

Let us look at some points discussed by RBI Governer today — source

- Keep the repo rate unchanged at 6.5%

- Continuing the withdrawal of accommodative stance

- GDP growth is projected at 6.5%

- Inflation is projected at 5.4%

The US Fed rate is 5.5% and ours is still at 6.5%, keeping the rates lower is not good for a country that needs to attract foreign investments. Although he started talking about the USDINR — that conversation did not last long. If the US decides to hold these rates for a longer tenure — a major chunk of emerging market investors could flee back and invest in dollars.

An accommodative stance is usually provided to stimulate growth in the economy. RBI is just withdrawing the accommodation. Its fight is not removing liquidity with full intensity, as it may impact growth. If removing liquidity was a top priority — the stance should have been more hawkish.

GDP growth at 6.5% is very good — no comments on this.

Inflation at 5.4% is still bad. In his speech, he said he is very particular that inflation returns to the 4% band and then he forecasted the next FY inflation around 5.2%. By Shaving off 0.2% a year — how long will it take to reach back at 4%?

He also said about removing liquidity by selling Government Bonds — I am not sure how that will work. Will have to burn my midnight oil to dig deeper into it.

I am changing my stance from bearish to neutral as we have managed to break the 44068 resistance. Today’s price action imparts some stability to the current levels. The next levels to watch for will be 44702 if we are going up and 44136 if we are falling.