9th Oct ’23 — War breaks out in Middle-East, Sharp change in Global Macro — PostMortem on Nifty &…

Nifty Analysis

Nifty opened mega gap-down due to the shocking developments over the weekend. Israel declared it is in a state of war after Hamas fired rockets and took hostage Israeli citizens — source. No one was expecting this sharp reversal in global macro. In fact, US markets closed last Friday pretty strong.

Since I am not a Geo-political expert — I have no comments on what will happen, but the financial markets usually do not like uncertainty. The greatest risk right now is crude oil as the war is in the Middle East. If other countries join this battle — the risk of further escalation cannot be ruled out and the biggest victim could be the developing countries that import OIL.

Even though the chart may confuse you, we only fell 0.86% ~ 168pts in the opening 10mts and that was the low for the day. The recovery was sharp and decent and we made it up to the 61.8% retracement level. From there we started falling but gradually. There again the low set in the initial 10mts still untouched. I had to go short today — not just because the chart told me, but because I thought fundamentally the perceived risk could be much higher. Already our markets have outperformed the global peers — and this risk-on should have prompted the FIIs to pull out more money. We might have to wait for a few days for more clarity to emerge, so I thought to take some risks with some long PUT options.

The 1hr chart does not show a direction yet. If 19446 was taken out today — it would have shown bearishness — but it is neutral. For true bearishness 19350 or the recent swing low has to be taken out tomorrow. Well, I have a bearish bias because of the LONG PUT option — but the charts are not showing anything so far. If we bounce back from the 19446 level tomorrow also — I may be forced to close out the position at a loss. For tomorrow I would like to go with a 50% neutral and 50% bearish option. Nifty is not technically weak — it is the global macro that is weak. In the battle for technical analysis versus fundamental analysis — fundamental always wins especially when accompanied by strong news-flow.

BankNifty Analysis

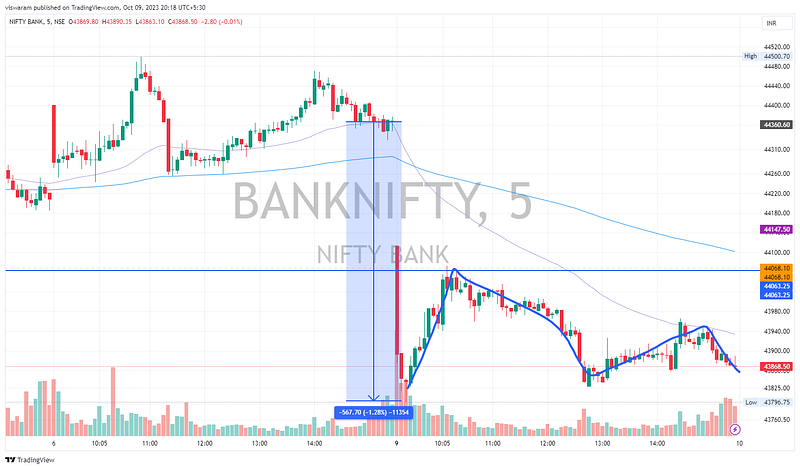

On Friday I changed my stance from bearish to neutral since we had a strong performance. We pushed through the 44068 resistance and maintained those levels. But today we dropped below that and even closed lower.

Notice we took out the 44068 level in the opening 5mts candle itself. From there we hit a new swing low of 43796 and then recovered all the way up to 44068 before falling again. Sometimes the best technical indicator that is available is the support/resistance line. If BankNifty was really having good bullish strength — it would have cut through the resistance. A fall really shows weakness.

On the 1hr TF BankNifty came from a double top formation and then made an isolated down day. Followed by 2 isolated up-days. Today we have another isolated down day that tested a new swing low. 43755 and 43603 levels are beneath — but not sure if we could stop there if the fall is mainly due to global macros. Since we have broken the support today, my stance will be bearish for tomorrow.

Just think — why are the banks falling? No way they would have sanctioned loans to the firms in Israel right? My wildest guess is that there could be many firms that have strong business relationships with Israel, and those companies may have a higher debt:equity ratio. I am quite sure the details of exposure will come out within the next week. Are the risks evenly balanced — I guess not.