Viksit Bharat by 2047? — India to be a 26 trillion economy?? — fact checked.

When the PM makes a statement, the entire media house is gung-ho on that and carries that headline without really dissecting the facts. We are going to base today’s discussion on the report by the famous PWC that said “Twenty-five years from now, India could exceed a per capita income of USD 26,000 — almost 13 times the current level — by unlocking some key areas that demand both investments and policy interventions.”

https://www.pwc.in/research-and-insights-hub/immersive-outlook/india-at-2047.html

If you do not have the time or patience to read that article, let me summarize what it conveys.

- India will be a USD 26.97 trillion economy by 2047.

- India is scheduled to grow at 12% every year.

- INR to USD depreciation will be 2% per year.

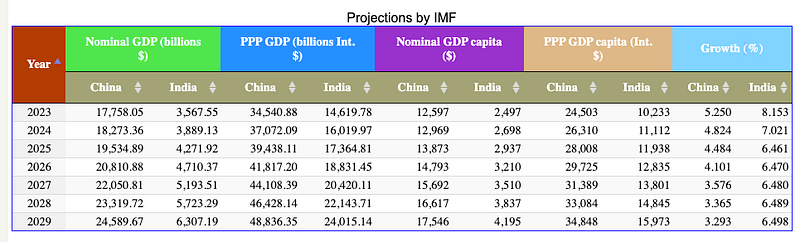

To make this report exciting, let me add the growth profile of India vs China till 2029, i.e. 5 years from when the report was published.

https://www.pwc.in/research-and-insights-hub/immersive-outlook/india-at-2047.html

Honestly, the IMF does not think India could grow at 12% every year. The best they forecast is 7.021% for the current year i.e. 2024–25. The paradox is that RBI revised the growth rate downwards to 6.6% for the current year. source.

A growth rate variance of 1 to 2% is understandable as we Indians prefer to add a bit of spice to everything. But a variance of 81% is too tough to tolerate. Tell me the last time, you saw Indian GDP grow at 12%? By that standards, IMF has done better modelling to keep the growth rate between 6 to 7% for the next 5 years.

Secondly, by 2029, China will hit a GDP of USD 24.58 trillion, so by 2030 or 2031, its economy will hit the $26 T mark. So as per the report from PWC, India will grow to a size in 2047 to what China will be in 2031.

Let me ask a question to the upper-middle class strata of the population. Is it not better to migrate to a country that will hit the “viksit” status by 2031, i.e. approximately 16 years earlier than India? Honestly, is that not the reason why we have a brain drain currently and people are migrating to a developed economy?

The people here are in cloud9 when our leader says India will be viksit by 2047 (meaning we will be a developed nation). Yeah, it’s fine to have a positive outlook and upward-looking aspirations, but the numbers are simply not adding up.

The third assumption done by PWC is to estimate that the currency devaluation of the rupee is going to be 2% per year till 2025 and then it would appreciate against the dollar.

History is not kind to the supreme leader in this regard too, our currency has been devalued by 62.88% in the last 12 years, approximately 5.24% every year.

If the data on foreign exchange is confusing you, let me get straight to the point. If the home market currency (India) is getting devalued (rupee), we need to grow faster to hit the $26T economy status.

To get the context, 1 USD = 86.557 INR. If the exchange rates were 1 USD = 1 INR, we would be a $258T economy already.

PWC’s report that the currency will start to appreciate from 2026 onwards makes no sense with the current direction set by the Govt. of India. The deficit is widening, borrowings are increasing and consumption is slowing.

I personally would want our currency to appreciate and dream of the day when INR will attain the global reserve currency, but the current direction in which we have set sail — looks like it will just end up as a dream.

The other discussed point is the deceleration of the human population by 0.01% per 5 years. I am not giving that much weightage to this fact as with the size of the current size a 0.01% variance will not create a meaningful impact on GDP. If they had published a report on how to bring down unemployment, I sure would have read it.

As an Indian, I would not belittle the growth rate or the prosperity rate our country can generate, but as a student of macroeconomics — I would like to see some data and evidence.

Govt. publishing the report of a higher GST collection MoM is not the data we need to watch for. A higher tax collection means nothing if the business shifted from the roadside vendors to the formal economy.

When the nation prospers, it usually starts with the prosperity of the people who are on the lowest rung of the economic ladder. A simple bottoms-up approach could generate a butterfly-effect and pull the entire nation back to its glory.

References:

https://www.pwc.in/research-and-insights-hub/immersive-outlook/india-at-2047.htmlhttps://www.pwc.in/research-and-insights-hub/immersive-outlook/india-at-2047.htmlhttps://www.pwc.in/research-and-insights-hub/immersive-outlook/india-at-2047.htmlhttps://www.pwc.in/research-and-insights-hub/immersive-outlook/india-at-2047.htmlhttps://www.pwc.in/research-and-insights-hub/immersive-outlook/india-at-2047.html