05 Mar ’24 — Nifty breaks Support, BN breaks Resistance — Nifty & BankNifty PostMortem Analysis

Nifty Analysis — Stance Bullish ⬆️

Recap from yesterday: “Our stance continues to be bullish and the first support level would be 22295. It is a shallow support and not quite relevant for a stance change, but the momentum is what really matters.”

For a brief period, Nifty traded below the support level of 22295. Even on the lower timeframe we did not have a close below that level due to which a stance change is not required. Nifty managed to pull up and close above 22358 which is not a bad thing at all, but what was worrying is how NiftyIT traded today. Even from the start, the weakness in the IT sector was evident. NiftyIT ended the day -1.59% ~ 594 points. The major reason Nifty fell today was attributed to this weakness. There is something the IT sector knows that we don’t. Look at how SPX (-0.89%), NDQ (-1.78%) are trading, a selected few people knew this in advance and started selling the tech sectors.

On the higher timeframe, the 3 red candles till the support level stands out. Even though the buying came today, it may not prove useful if we gap down tomorrow. It all depends on how the US market closes today. Primarily, I need to spend some time to understand why the tech sectors are cooling off. News aside, the charts still show no change in the bullish stance, however, if we open gap down tomorrow and that too below the 22295 levels we will immediately change the stance to neutral. And if it breaks 22199, we would love to go short.

BankNifty Analysis — Stance Bullish ⬆️

BankNifty gets a status change today to bullish. Look at the 12.47 candle that took out the resistance of 47465. Even the next candle formed was strongly bullish. We are now at a stage where BankNifty is strongly bullish and Nifty is showing some weakness due to the tech sector. If Nifty starts falling, there is no way BankNifty can remain in green, although it has happened many times in the past. Over the last many months, the IT sector has gained more weightage on Nifty50, I started noticing this after the inclusion of LTIM in the index.

On the higher timeframe, BankNifty managed to get 2 63mts candles above the resistance line. Our stance change came right after the 12.24 candle as the signs were pretty clear. On a normal day, a resistance break usually signifies a much more powerful breakout rally. We are quite not sure whether we will get that tomorrow as US markets are trading in deep RED.

If BN falls below 47465 or opens gap-down below this support level we will revert back to neutral stance. And since it is the weekly expiry tomorrow — we expect the premiums to pick up if that happens. As it stands the premiums of the OTM are not good enough for some serious speculation.

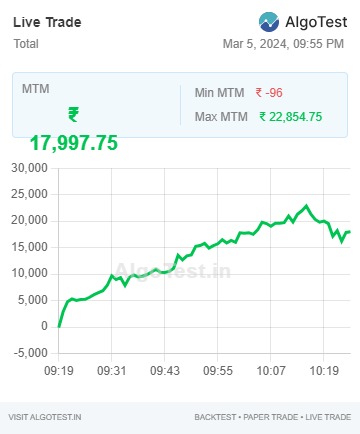

Algo Trading

Our algo trades ended today with a gain of 17997 rupees. Again pulled the plug early today i.e. at 10.24. As per my backtests the max possible gain intraday is Rs36000 and since we hit 50% of that in the opening hour — decided to exit prematurely.

Webhooks automation run via TradingView on Dhan