15 Mar ’24 — Nifty falls below the support again, goes bearish — Nifty & BankNifty PostMortem…

Nifty Analysis — Stance Bearish⬇️

Recap from yesterday: “If you look at the higher time frame, today’s price moves might be between 38.2 to 50% Fibonacci retracement levels and what might have formed could be a lower high.”

Nifty was not able to sustain the gains yesterday, within the opening 15 minutes itself it breached the support level of 22051 and stayed below that for the entire day. Since we broke the SR level, we had to change the stance from neutral to bearish today. Even though we went down, it was not accompanied by a huge momentum or an avalanche build-up. The reason is, the next support level of 21913 was not tested today.

The only reason we pushed through the resistance yesterday was because of NiftyIT. And today NiftyIT started with cuts of -0.9%. Do you agree with me now that the main villain is NiftyIT which is preventing Nifty50 for a smooth directional trend?

On the higher timeframe, looks like the lower high is formed perfectly. It has to be complemented with a new lower low. And when that happens the support of 21913 will have to give away and we might even have to retest the 21491 levels. After reading the “electoral bonds scam” and “small and mid cap stress tests” news, I strongly feel we might have uncertain times ahead, at least for a short while.

BankNifty Analysis — Stance Neutral ➡️

BankNifty fell 195 points today ~ -0.42%, but that would end up not being sufficient to push it into Bear territory. We might need roughly 400+ points fall to slip into the bearish channel following which both N50 and BN will have the same direction. Over the last 2.5 months rarely did both the indices align in the same direction for at least 3 to 4 days consecutively. NiftyIT always interrupted a smooth directional buildup happening between these two indices and often confused N50 with false triggers.

The lower high formation and the start of the 2nd leg are more beautiful on BN rather than N50. We expect the IV to go up once BN enters the bearish channel.45788 was the approximate level from which BN had 11 consecutive 63mts GREEN candles. A similar feat with the RED candles would be equally exciting to watch. Somehow the news about the stress tests, redemption pressure, and freeze of new lumpsum investments into small-cap funds, etc may have a spill over effect on the large caps as well. I am still not sure if the markets have priced in the “panic” factor.

Algo Trading

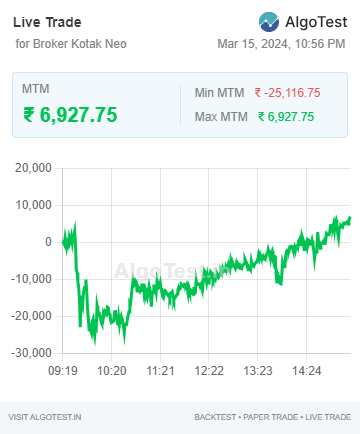

Our algo trades ended today with a gain of Rs6927. The recovery from minus 25116 was indeed good to watch.

Intraday Algos run via AlgoTest on Kotak

Webhooks automation run via TradingView on Dhan