Nifty & BankNifty Analysis — 04 Apr 2024 — The first candle today came as a shocker -PostMortem…

Nifty Analysis — Stance Bullish ⬆️

Absolutely crazy price action today, we fell a whopping 315 points ~ 1.4% after hitting new all-time highs of 22619. The fall was too furious that it would have taken out all the stop losses of Nifty expiry traders. If that did not, then I am very sure the price action from 10.55 to 13.31 would have. That is because we retraced 276 points ~ 1.24% to go above the swing highs of yesterday. A classic V-shaped pattern, something that is rare on an index like Nifty. If you trade BankNifty, you might have gotten used to it already.

Now take a look at the 63mts chart, and see where the reversal came from ~ 22295 levels. That is the main reason why we said a stance change is required only if 22295 is broken and since we did not do that, we continue to remain bullish. But deep down it got me thinking, what is the reason we had a BIG RED candle in the opening 1 hour? No way it was related to technical analysis. It should be a news or macro economic event-related, maybe we will get to know in the RBI Governor MPC address tomorrow.

BankNifty Analysis — Stance Bullish ⬆️

The beauty of BankNifty today was that its fall did not go below yesterday’s close. Yes, the fall was intense, but the recovery was more elegant — a steady rise showing immense Bull strength.

And if you read today’s report along with what we wrote yesterday, you might have become a true fan of the Bulls. A true jump above the 47465 support shows the index is really gearing up for its breakout. Just take a look at HDFC Bank’s chart, the recovery from the recent lows has been really amazing. And when the Elephant is in the mood to run, there is nothing the smaller animals can really do.

We wish to start the day tomorrow on the bullish side. The RBI MPC meeting will be closely watched and I would really like to know why we had a strong opening RED hourly candle. There might be something that they know that we dont, let us find that out tomorrow.

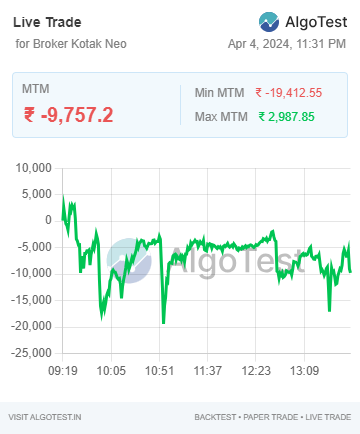

Algo Trading

Our algo trades ended today with losses of Rs9757. I had to manually override and square off the trades to limit the losses. In Hindsight, that proved like a good decision.

Webhooks automation run via TradingView on Dhan

Book a free consultation — Get your mutual fund holdings audited based on your risk profile — https://learn.viswaram.com/knowmore