Mutual Funds Day 29: Short, Medium and Long-Term Bonds

Bonds are the heartbeat of debt funds. The AMCs rely on Bonds to provide a stable supply of Fixed Income to its investors. To get a fair idea, we would need to explain how a Bond works.

Earlier you learned that by issuing shares, the companies dilute their ownership. When you buy those shares, you become a part owner. If the company makes profits, you will be rewarded based on the number of shares you hold. Either you get a dividend or the company reinvests the capital for further growth. The price of a share will increase if the revenue, sales, and market share of the company keep increasing.

Some companies do not prefer to dilute their ownership. These firms still need money to finance their operations. They raise capital by issuing Bonds. At the time of issue, the firm will provide the following information:-

- The Yield (How much returns you get)

- The Tenure (How long you have to hold)

Suppose you buy Bonds worth 1,00,000 rupees. If the firm says the yield is 10% and the tenure is 10 years, what that means is they will payout 10% of 1,00,000 per year as interest income and they will keep doing this for the next 10 years. After 10 years they will repay your principal 1,00,000 safely.

Central Government, State Government, Municipalities, Listed companies, and Unlisted companies issue bonds. A credit agency evaluates the credit rating of a bond, a higher rating means lower chances of default. Naturally, the bonds with lower ratings will have to provide a higher yield to entice an investor.

Government bonds have sovereign guarantees and the chances of default are lower, so usually the credit rating will be the highest. The bonds of unlisted companies may have a lower credit rating.

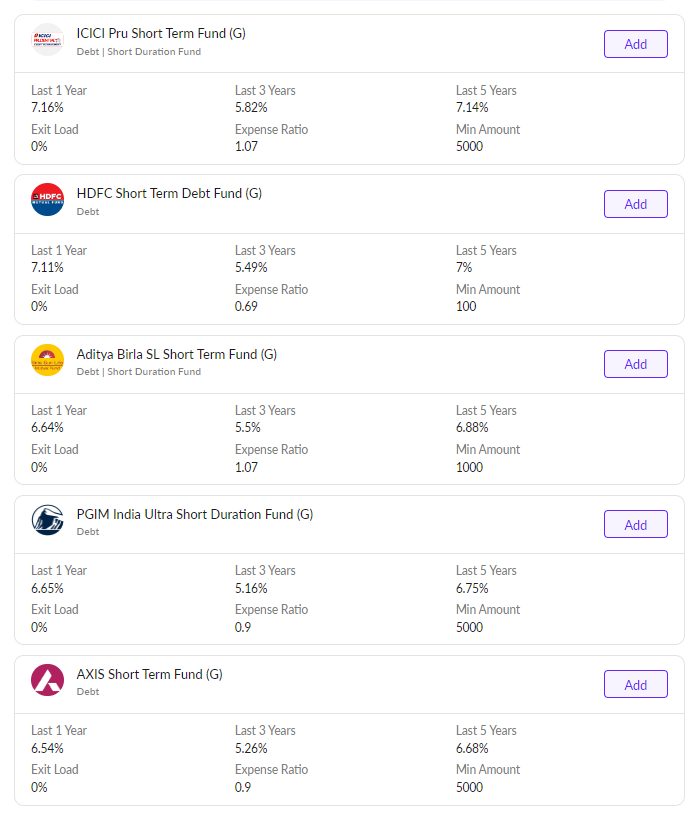

Short, medium, and long term bonds are categories that invest in these bonds based on their duration

- Short Term — Duration 1 to 3 years

- Medium Term — 3 to 7 years

- Long Term — Above 7 years

The fund manager will be willing to invest in lower credit rated bonds if the tenure chosen is higher. Similarly, for short-term bonds, he would only invest in higher rated bonds. The assumption is that long term bonds mutual funds will outperform short term bond MFs. Well, this is not guaranteed per se, as the long-term funds could invest in a company with a lower credit rating and they could default.

Investments in bonds are very crucial in providing a level of assured income to their investors. In India, the debt category is not as exciting as equity as people buy into the narrative that India’s growth story is intact. In developed countries, investments in bonds are crucial to maintaining a healthy balance of fixed-income.

https://viswaram.com/mutual-funds-day-30-gilt-funds-411adae2e3b6

If you liked this content, consider sharing it with your friends & relatives..

Book a free consultation — Get your mutual fund holdings audited based on your risk profile — https://learn.viswaram.com/knowmore